by Grow Up Conference | Jun 3, 2024 | Cannabis Prospect Magazine, Media Partners

Indiva Limited, the leading Canadian producer of cannabis edibles, is pleased to provide an update to the information contained in its press release dated April 2, 2024. As discussed in the prior press release, the Company: (i) entered into an amendment (the “Amending Agreement“) to the second amended and restated promissory note (the “Promissory Note“) between, among others, the Company and SNDL Inc. (“SNDL“), whereby, among other things, the Company agreed to reduce certain current liabilities; and (ii) retained SSC Advisors (the “Advisor“), as its financial advisor, to assist the Company in the evaluation of potential strategic alternatives intended to maximize shareholder value (the “Strategic Review”).

The Company is continuing these efforts, and as such, the date by which the Company is required to have satisfied certain current liabilities under the Amending Agreement has been extended to June 13, 2024. The Strategic Review is ongoing and the Company continues to review strategic alternatives. This is not an indication that any decision has been, or is likely to be, made relating to any strategic alternatives. There can be no assurance that the Strategic Review will result in any binding offer, financing or transaction.

About Indiva

Indiva is proud to be Canada’s #1 producer of cannabis edibles. We set the gold standard for quality and innovation with our award-winning products, across a wide range of brands including Pearls by Grön, Bhang Chocolate, Indiva Doppio Sandwich Cookies, Indiva 1432 Chocolate, and No Future Gummies and Vapes, as well as other Indiva branded extracts. Indiva manufactures its top-quality products in its state-of-the-art facility in London, Ontario, and has a corporate workforce remotely distributed across Canada. Click here to connect with Indiva on LinkedIn, Instagram, and here to find more information on the Company and its products.

by Grow Up Conference | Jun 3, 2024 | Garden Culture Magazine, Media Partners

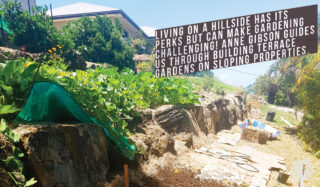

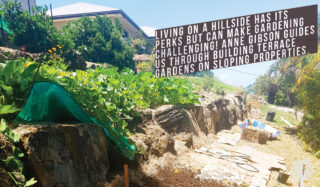

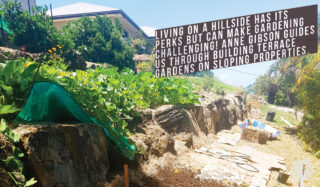

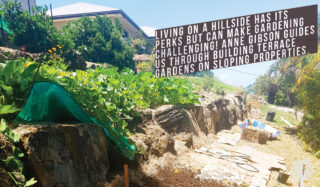

Hitting the Slopes

When we saw the views before buying our house, we didn’t anticipate all the gardening challenges on a steep slope. The property ticked many sustainable living boxes: water tanks, solar panels, a shed, flat areas around the house, and an established orchard on the slope below. However, as we started to design the kitchen garden and work with the site, it became apparent that a sloping block can present MANY challenges!

We are working with the positives of a sloping property, like incredible views, sunlight all year, cooling breezes, multiple microclimates, and the opportunity to harvest water and free energy. The two biggest issues we have had to face are access and watering. The soil is clay on a rock base. So, while it is minerally rich and holds moisture well, digging is a nightmare! We have flat pads where the house and shed are, so lawn areas have trees, shrubs, and hedges.

We are using several strategies to tackle the access, create more flat functional zones for gardens and recreation, get water where needed, and prevent soil erosion. We aim to make the property easier to navigate and enhance its visual appeal by adding value and functionality.

Strategies for Sloping Blocks

- Create terraces and retaining walls to increase flat usable areas.

- Add steps for easy access.

- Build raised garden beds into terraces or narrow, awkward areas.

- Use swales to grow on contour, harvest water passively, and reduce erosion.

- Use hay bales as temporary barriers to stop fruit from rolling down the hill while capturing moisture. They can also double as strawbale gardens.

- Excavate and infill to create more usable space.

- Consider mulching or an automatic mower if mowing is impractical or too dangerous.

How I Tackled My Terrace Garden for My Dream Space

Kitchen Garden Zone

Behind the shed, we inherited a flat area and a timber sleeper raised bed, our starting point for growing food. Adding more raised garden beds made sense as we couldn’t dig down. We opted for 2m x 1m DIY kits that were economical and took five minutes to assemble. They are aesthetically pleasing and narrow enough to fit in a tight space. I squeezed in a block of four and designed minimum-width paths so I could still access either side with a wheelbarrow for maintenance. This bought us an extra 8m2 of growing space. I also added a tiered stand with shelves and self-watering rectangular planters to take advantage of vertical space. These suit shallow-rooted salad greens, herbs, and flowers.

Meanwhile, I have a huge temporary container garden with plants that need new homes! I have set up a mini nursery at the base of the rock retaining wall between the house and the shed. It has easy access to water and provides shade relief during our long, hot summer. I will gradually transplant these ‘renters’ to permanent accommodation on the terraces below.

Top Terrace Perennial Garden Zone

Two narrow, weedy terraces were below the shed with rock retaining walls. I used two strategies to turn the weedy grass into a garden. Firstly, hand digging (call me crazy) all the worst weeds and grass out of the top terrace after rain. I got a great workout, and it was my first opportunity to work with the native clay soil. It was heavy, so I decided to sheet mulch most of the terrace to make the next stage of establishing healthy soil easier. Since we’d recently moved here, I had plenty of cardboard boxes to lay over the grass and smother it. I covered this with composted manure, minerals, and a thick layer of mulch. All the rain helped activate the cardboard breakdown into carbon. So, within a few months, I could establish a food garden quickly with fruit trees, support species, perennials, fruiting crops like tomatoes, eggplant, capsicum, and lots of herbs and flowers.

Perennial Top Garden Access

On this terrace, I only had room for a narrow pathway. I planted on both sides, limited by the upper and lower rock walls. I had no steps, so I had to access it via a slope at one end. We have since built the steps and will be installing them soon. While steps remove some of the planting areas, access takes priority.

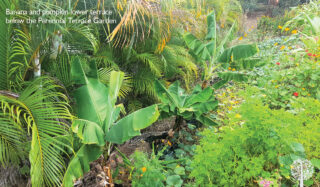

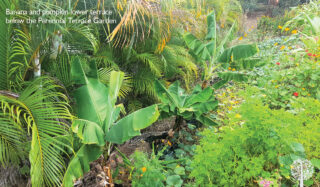

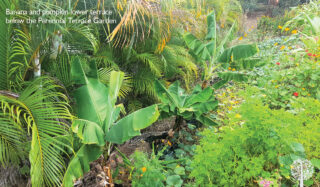

Food Forest and Banana Terrace Zones

Next up, I started work on the terrace below the Perennial Terrace and shed. It is relatively flat but slopes towards our water tanks with no retaining wall. My initial plan was to work on the soil. I sheet-mulched this area and planted pumpkins and sweet potatoes. At one end, I planted my three dwarf banana cultivars into giant grow bags, an experiment to see if they could produce fruit in ‘pots.’ So far, they have all thrived in 100L bags, but I’d use 200L next time. I planted potatoes into grow bags and let them sit in this area.

As it’s turned out, pumpkins are like naughty teenagers looking for any opportunity to escape! They scrambled UP the rock wall into my Perennial Terrace Garden and down around the water tanks. Despite their antics, I’ve let them have some additional space since we’ve harvested well over 100kg of pumpkins from this small, narrow bed. I will add more compost and thick mulch to build up the soil; eventually, we will retain it. Meanwhile, it will remain the spot for our ‘wild child’ crops to come and go seasonally.

Lower Terrace Gardens

Food Forest, Pickleball Court, and Raised Planters

On this same level, below the house, we had multiple issues. There was no retaining wall, just an irregular battered slope with weeds and rocks. It was challenging to whipper-snip and maintain. There was a flat pad below this slope, but it was a weedy nightmare and unattractive. The lower side had bush rock, and the area wasn’t wide enough to be functional. However, it had great potential.

The bluestone rocks here are like icebergs with a small cap showing on the surface but a titanic-sized ton of rock submerged. My husband took on the challenge and got heavy equipment to excavate. We created a wider flat pad and new retaining walls. He poured a concrete pickleball court with planters and garden beds by extending the pad just above our sloping orchard.

We used 1.2-ton concrete blocks to create the main retaining walls and smaller besser blocks for the low retaining walls and planter boxes. The concrete blocks do have an industrial look, but sandstone was hideously expensive and hard to build with as they are not even. We couldn’t dig holes for steel posts into the rock, so for the most part, sleeper retaining walls were not an option. We had to think creatively.

Raised Walls for Gardens

We’ve installed steps at either end so I can quickly and easily access my new Food Forest, the court, and the orchard. Drip irrigation systems are being installed next.

The result? We’ve redesigned an unsightly area, created a new terrace for my food forest and a pickleball court for exercise, and removed the need for weeding or high maintenance. The raised planter near the water tanks has steel posts and horizontal wires for my passionfruit to grow as a living screen for this utility area. The trellis will eventually wrap around to the Banana Terrace, and I’ll plant a colorful garden. We will paint the concrete blocks used for the retaining walls to soften the hardscapes and complement the court colors. The capping provides ample seating for watching the game or enjoying the view.

The rock walls are made from rocks originally excavated when the house was built. To soften these and deter snakes from using them as habitat, I have stuck cuttings of Dogbane (Plectranthus caninus) into the clay soil between them. This drought-hardy plant fills in the gaps, adding pops of seasonal color. It survives on rain and dew.

Lower Sloped Orchard Zone

The steepest part of the property is our fruit tree mini orchard and ornamental tree zone. It isn’t easy to walk around. However, we still need to maintain and harvest from our fruit trees. The clay soil can become incredibly hard and dry during summer and drought. After the rain, though, the weeds sprout up! Covering it with mulch around the fruit trees has been a priority to lock in moisture, prevent weeds, and protect the soil from erosion. Trees have also benefited from the organic matter and the microbial communities helping feed them.

Unfortunately, much of the ripe fruit rolls down the hill to our bottom fence! The mulch is slowing it down, and hay bales have been a temporary measure to put the brakes on and prevent erosion and nutrient loss.

Watering this zone is challenging as it’s too steep to safely access with big equipment. So, we plan to install a couple of IBC 1000L plastic tanks to take the rainwater overflow from our main tanks. We’ll use this to water and liquid fertilize our fruit trees. Hopefully, we’ll enjoy a bigger harvest in years to come.

AuTOMatic Mower

Finally, our block is on a corner at the top of a very steep hill. Our verges were one of my husband’s first challenges when working out how he would mow safely. His genius solution was a Husqvarna robotic mower! We affectionately named him ‘Tom’ as he not only solved our dilemma by navigating the steep slope but works day and night in any weather. This has been brilliant in summer when the grass seems to grow overnight. We plan to get another model for the lower-sloping orchard once we create barriers.

While sloping blocks have their challenges, they also offer incredible potential for landscaping to optimize garden spaces, attractive views, and spaces to enjoy. Besides, it keeps us fit, and hills are cheaper than gym fees!

by Grow Up Conference | Jun 3, 2024 | Cannabis Prospect Magazine, Media Partners

Village Farms International, Inc. announces it has amended and extended the credit agreement for its C$10 million revolving line with a Canadian chartered bank (the “Operating Loan”), effective May 24, 2024. The maturity date for the Operating Loan has been extended from May 24, 2024 to May 24, 2027.

Amendments include expansion of the Company’s borrowing options under the Operating Loan to provide additional financial flexibility. The new borrowing options provide for advances on the Operating Loan based on the Canadian Prime Rate, Base Rate, US Prime Rate and the Canadian Overnight Repo Rate (CORRA) in addition to the Secured Overnight Financial Rate (SOFR), which was already available to the Company. Other amendments reflect the considerable expansion and growth of Village Farms’ business since entering into the original 2013 credit agreement. Other material terms for the Operating Loan are unchanged.

About Village Farms International

Village Farms leverages decades of experience as a large-scale, Controlled Environment Agriculture-based, vertically integrated supplier for high-value, high-growth plant-based Consumer Packaged Goods opportunities, with a strong foundation as a leading fresh produce supplier to grocery and large-format retailers throughout the US and Canada, and new high-growth opportunities in the cannabis and CBD categories in North America, the Netherlands and selected markets internationally.

In Canada, the Company’s wholly-owned Canadian subsidiary, Pure Sunfarms, is one of the single largest cannabis operations in the world, the lowest-cost greenhouse producer and one of Canada’s best-selling brands. The Company also owns 80% of Québec-based, Rose LifeScience, a leading third-party cannabis products commercialization expert in the Province of Québec.

by Grow Up Conference | Jun 3, 2024 | Cannabis News Wire, Media Partners

The CWCBExpo is an essential B2B expo on the East Coast, being held at the Javits Convention Center in New York City. This year the Expo will be held from June 5-6, 2024, for two days of networking and engaging educational sessions.

The event schedule is meticulously planned as follows:

- June 4, 2024 – The exhibitors set up their booths, the pre-workshops are conducted on cultivation and operating a dispensary, and attendees can connect with industry colleagues at the rooftop bash that night.

- June 5, 2024 – After the registration and the media and press preview, the expo commences with a ribbon-cutting event. The expo floor opens and conference programs are conducted.

- June 6, 2024 – The attendees can participate in the conference programs and visit the expo on both the days. Along with business and networking, the participants can unwind, enjoy, and connect with industry influencers and peers at the luncheons, and after parties hosted by CWCBExpo on both the days.

Prominent members of the cannabis industry will share important insights, including:

- Industry icon Josh Kesselman, Founder and CEO, of HBI International / RAW Rolling Papers, who will preside over the fireside chat/keynote speaker session.

- Cy Scott, Co-Founder, CEO, of Headset, who will offer his insightful industry update on why New York is the next big cannabis market to watch out for and provide an update on rescheduling.

A special luncheon focusing on women in the cannabis business will be held on June 5, 2024. CWCBExpo is a leading B2B marketplace for networking within the cannabis community. Become a part of the interactive educational sessions, see unique product displays, participate in panel discussions, and seek the phenomenal opportunities offered by the CWCBExpo platform.

To learn more please visit https://cnw.fm/kVPAd & https://cnw.fm/O42wb.

About CannabisNewsWire

CannabisNewsWire (“CNW”) is a specialized communications platform with a focus on cannabis news and the cannabis sector. It is one of 60+ brands within the Dynamic Brand Portfolio @ IBN that delivers: (1) access to a vast network of wire solutions via InvestorWire to efficiently and effectively reach a myriad of target markets, demographics and diverse industries; (2) article and editorial syndication to 5,000+ outlets; (3) enhanced press release enhancement to ensure maximum impact; (4) social media distribution via IBN to millions of social media followers; and (5) a full array of tailored corporate communications solutions. With broad reach and a seasoned team of contributing journalists and writers, CNW is uniquely positioned to best serve private and public companies that want to reach a wide audience of investors, influencers, consumers, journalists and the general public. By cutting through the overload of information in today’s market, CNW brings its clients unparalleled recognition and brand awareness. CNW is where breaking news, insightful content and actionable information converge.

To receive SMS alerts from CNW, text CANNABIS to 888-902-4192 (U.S. Mobile Phones Only)

For more information, please visit https://www.CannabisNewsWire.com

Please see full terms of use and disclaimers on the CannabisNewsWire website applicable to all content provided by CNW, wherever published or re-published: https://www.CannabisNewsWire.com/Disclaimer

CannabisNewsWire

Denver, CO

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.com

CannabisNewsWire is powered by IBN

by Grow Up Conference | Jun 3, 2024 | Cannabis News Wire, Media Partners

The U.S. Department of Justice (DOJ) is set to begin accepting comments on a rule that would move marijuana to a lower drug classification. This historic move comes after the U.S. Department of Health and Human Services recommended that the drug be rescheduled following a directive issued by President Biden in 2022 to review the drug’s current classification.

At the moment, marijuana is classified as a Schedule I drug under the Controlled Substances Act. Drugs under this classification are said to have no accepted use in the medical world and a high potential for abuse. The drugs include heroin, LSD, peyote, raw opium, methaqualone and ecstasy.

A proposal announced last month would allow marijuana to be moved to Schedule III, where drugs with moderate-low potential for dependence and accepted medical uses are classified. This includes drugs such as ketamine and Tylenol with codeine.

The change would lift restrictions on marijuana research while also reducing the tax burden of some marijuana businesses. However, marijuana would still be illegal at the federal level.

The resolution recognized the medical uses of marijuana and acknowledges that it has less potential for abuse in comparison to other drugs. The justice department will be open to comments on this change until July 22, 2024. As of May 27, 2024, the department had already received more than 6,300 comments, all of which are public record and can be seen by others.

One commenter stated that the change was good legislation, noting that the time had come to stop treating the use of marijuana, which had many medicinal uses, as a criminal offense. They added that this was good for the country. Another commenter stated that the change was a bad idea and that marijuana needed to remain in Schedule I because it was a gateway drug that ruined the lives of its users.

From the above, one can see that the comments vary and come from opposite sides of the spectrum. Individuals who would like to read comments submitted or those who would like to submit a comment themselves can do so at https://www.regulations.gov/document/DEA-2024-0059-0001.

The DOJ is also accepting physical submissions, as long as they are postmarked by or on July 22. All physical submissions should be addressed to the Drug Enforcement Administration’s address on Morrissette Drive, state of Virginia.

It is expected that since the proposed rule has a lengthy regulatory process ahead, the situation may not be concluded until after the upcoming presidential election.

In the meantime, cannabis companies such as Software Effective Solutions Corp. (d/b/a MedCana) (OTC: SFWJ) will probably monitor the comments submitted to see what possible result will come out of the rulemaking process triggering cannabis rescheduling by the DEA.

NOTE TO INVESTORS: The latest news and updates relating to Software Effective Solutions Corp. (d/b/a MedCana) (OTC: SFWJ) are available in the company’s newsroom at https://cnw.fm/SFWJ

About CannabisNewsWire

CannabisNewsWire (“CNW”) is a specialized communications platform with a focus on cannabis news and the cannabis sector. It is one of 60+ brands within the Dynamic Brand Portfolio @ IBN that delivers: (1) access to a vast network of wire solutions via InvestorWire to efficiently and effectively reach a myriad of target markets, demographics and diverse industries; (2) article and editorial syndication to 5,000+ outlets; (3) enhanced press release enhancement to ensure maximum impact; (4) social media distribution via IBN to millions of social media followers; and (5) a full array of tailored corporate communications solutions. With broad reach and a seasoned team of contributing journalists and writers, CNW is uniquely positioned to best serve private and public companies that want to reach a wide audience of investors, influencers, consumers, journalists and the general public. By cutting through the overload of information in today’s market, CNW brings its clients unparalleled recognition and brand awareness. CNW is where breaking news, insightful content and actionable information converge.

To receive SMS alerts from CNW, text CANNABIS to 888-902-4192 (U.S. Mobile Phones Only)

For more information, please visit https://www.CannabisNewsWire.com

Please see full terms of use and disclaimers on the CannabisNewsWire website applicable to all content provided by CNW, wherever published or re-published: https://www.CannabisNewsWire.com/Disclaimer

CannabisNewsWire

Denver, CO

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.com

CannabisNewsWire is powered by IBN

by Grow Up Conference | Jun 3, 2024 | Grow Opportunity, Media Partners

High Tide Inc., the high-impact, retail-forward enterprise built to deliver real-world value across every component of cannabis, announced today that its Canna Cabana retail cannabis store located at 17 Hanes Road, Huntsville, Ontario will begin selling recreational cannabis products and consumption accessories for adult use on Thursday, June 6, 2024. This opening will mark High Tide’s 172nd Canna Cabana branded retail cannabis location in Canada, the 63rd in the province of Ontario and the first store in Huntsville.

Huntsville is in the Muskoka region of Ontario, the heart of Canada’s cottage country. Millions of international tourists and Canadians alike flock to Muskoka year-round to vacation in one of Canada’s most picturesque landscapes. This brand-new Canna Cabana is situated beside a major home improvement retailer and a beer store. It is also a short drive from a major discount grocery retailer and the Huntsville Place Mall, the primary shopping node for the area. This busy and rapidly expanding shopping plaza is well situated to serve the residents of Huntsville, the surrounding rural and the cottage country visitors who need to stop at a shopping centre to gather groceries and other essentials before heading out into the remote properties surrounding it.

“I am thrilled to announce the opening of our first store in Huntsville. This brand-new Canna Cabana builds upon the success of our existing cottage country stores in Bracebridge and is a key addition to our retail portfolio. The Muskoka region welcomes 3.2 million seasonal travelers annually and communities like Huntsville serve as anchors for the surrounding cottage country as visitors need to stop in to gather groceries and other goods before spending time at the lake,” said Raj Grover, founder and CEO of High Tide.

“Our team has been working hard through the first half of the calendar year, adding outstanding Canna Cabana locations like Huntsville to our store network. I remain excited about our strong free cash flow profile, which is fueling the renewed acceleration of our growth in Ontario and other Canadian provinces where we operate,” added Mr. Grover.

by Grow Up Conference | Jun 3, 2024 | Cannabis News Wire, Media Partners

- Company calls rescheduling a “monumental decision” that signifies a significant shift in U.S. drug policy

- MedCana CEO notes rescheduling “opens the door to further research, innovation and accessibility, signaling a new era of acceptance and understanding”

- SFWJ remains committed to advancing the dialogue around cannabis policy and supporting initiatives that promote responsible access and use

Software Effective Solutions (d/b/a MedCana) (OTC: SFWJ) has noted a “historic milestone” as the U.S. Drug Enforcement Administration (“DEA”) moves to reclassify cannabis from Schedule I to Schedule III under the Controlled Substances Act (https://cnw.fm/yNude). The company released an announcement from CEO Jose Gabriel Diaz and observed that the “monumental decision,” based on recommendations from the U.S. Department of Health and Human Services, signifies a significant shift in U.S. drug policy.

“The DEA’s decision to reclassify cannabis is a watershed moment in our nation’s drug policy,” said Diaz. “It opens the door to further research, innovation and accessibility, signaling a new era of acceptance and understanding. MedCana is proud to be part of an industry that advocates for sensible cannabis regulation and equitable access to this vital medicine.”

MedCana joined many companies in responding to the proposed reclassification. “Many applauded the move to Schedule III from Schedule I, which the Associated Press first reported and was later confirmed by a Department of Justice spokesperson in a statement to Cannabis Business Times,” reported the Cannabis Business Times (https://cnw.fm/wW1WX). “Executives from plant-touching companies noted its significance as a historic step toward federal cannabis reform, destigmatization, fairer tax policies for businesses and more research into cannabis’s medical benefits.

“However, many also tempered the celebratory tone and said that there was much more work to be done,” the article continued. “Leaders from industry nonprofit organizations and some lawmakers emphasized their call for the federal government to deschedule cannabis altogether, something they urged after news circulated that the U.S. Department of Health and Human Services (‘HHS’) recommended that the DEA reschedule cannabis in August 2023.”

While there may be work left to do, the initial rescheduling is certainly noteworthy. The announcement from MedCana noted that cannabis has been unjustly categorized as a Schedule I substance alongside heroin and LSD for more than four decades. This was despite the fact that the substance has recognized medical benefits and low potential for abuse. The DEA’s move to reschedule cannabis — a move that will now undergo a period of public comment — is a clear indication of its therapeutic value and aligns with evolving attitudes toward cannabis policy.

In its announcement, MedCana stated that it remains committed to advancing the dialogue around cannabis policy and supporting initiatives that promote responsible use and access to quality cannabis products.

Operating under Software Effective Solutions Corp., MedCana is a pioneer in the integration of technology and agriculture, focusing on the cannabis market and emerging technologies in agriculture. With a vision to revolutionize the industry through innovation, MedCana is dedicated to acquiring and partnering with companies that align with its mission of promoting sustainable and technologically advanced agricultural practices.

For more information, visit the company’s website at www.MedCana.net.

NOTE TO INVESTORS: The latest news and updates relating to SFWJ are available in the company’s newsroom at https://cnw.fm/SFWJ

About CannabisNewsWire

CannabisNewsWire (“CNW”) is a specialized communications platform with a focus on cannabis news and the cannabis sector. It is one of 60+ brands within the Dynamic Brand Portfolio @ IBN that delivers: (1) access to a vast network of wire solutions via InvestorWire to efficiently and effectively reach a myriad of target markets, demographics and diverse industries; (2) article and editorial syndication to 5,000+ outlets; (3) enhanced press release enhancement to ensure maximum impact; (4) social media distribution via IBN to millions of social media followers; and (5) a full array of tailored corporate communications solutions. With broad reach and a seasoned team of contributing journalists and writers, CNW is uniquely positioned to best serve private and public companies that want to reach a wide audience of investors, influencers, consumers, journalists and the general public. By cutting through the overload of information in today’s market, CNW brings its clients unparalleled recognition and brand awareness. CNW is where breaking news, insightful content and actionable information converge.

To receive SMS alerts from CNW, text CANNABIS to 888-902-4192 (U.S. Mobile Phones Only)

For more information, please visit https://www.CannabisNewsWire.com

Please see full terms of use and disclaimers on the CannabisNewsWire website applicable to all content provided by CNW, wherever published or re-published: https://www.CannabisNewsWire.com/Disclaimer

CannabisNewsWire

Denver, CO

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.com

CannabisNewsWire is powered by IBN

by Grow Up Conference | Jun 3, 2024 | Media Partners, Stratcann

Want to work in Canada’s cannabis industry? There are always many different positions available, from entry-level to executive, from cultivation to labs, from budtending to brand reps; there’s a plethora of pot jobs available at any given time.

Check out our June 2024 cannabis jobs roundup below for a small snapshot of the numerous positions available in Canada’s cannabis industry.

In BC, Inspired Cannabis in Vancouver is looking for an Assistant Manager, and Canadian Clinical Cannabinoids is hiring a Territory Manager, also in Vancouver. Green Mile Original, a micro cultivator processor in Coquitlam, is looking to hire a QAP. A Little Bud in White Rock is looking to fill a Customer Service Flex Role.

Alberta’s Plantlife Cannabis is hiring for several positions and multiple locations in the province. Battle River Pharmaceuticals Inc. is hiring a Production Worker/Housekeeper in Ponoka. Hybrid Infusions is hiring a Cannabis Processing Team Member in Edmonton. Stigma Grow is looking for Seasonal Summer Student Production Workers in Red Deer.

COST Cannabis is seeking applicants for the role of Retail Store Associate in Lloydminster, Saskatchewan. 5 Buds is hiring a Cannabis Supervisor in North Battleford. Valiant Distribution Inc. in Regina is hiring a Territory Sales Representative. The Joint Cannabis is hiring at several of its locations in Saskatchewan and Manitoba.

Tokyo Smoke is looking for a Store Manager in Portage la Prairie, Manitoba. Delta 9 is hiring for two positions in Manitoba, a Processing Associate and a Category Assistant. Fiddler’s Green in Winnipeg is looking for a Bud Ambassador for Friday and Saturday Nights. UP IN SMOKE CANNABIS in Winnipeg is looking for a retail store supervisor.

Ontario’s Motif Labs is seeking a Junior Project Manager for their facility in Aylmer. The OCS is hiring a Senior Software Engineer in North York, Ontario. This position currently offers a fully remote work schedule. Pop’s Cannabis Co. is looking for a Supervisor for its store in New Liskeard. Sessions Cannabis is hiring a Key Lead/Delivery Driver in Kincardine. Medical Saints is hiring a Senior Post-Harvest Technician in Lincoln.

Quebec’s EXKA Inc. is seeking an Administrative Technician. Rose LifeScience is hiring a Packaging/Processing Team Lead in Huntingdon, QC and several other positions. Turning Point Brands Canada is looking to hire a full-time Sales Coordinator in Laval, QC.

Tilray is seeking a Superviseur Emballage/Packaging Supervisor in Masson-Angers, QC and many other positions across Canada. Cannabis retail chain Canna Cabana is hiring for numerous positions in Manitoba, Ontario, Alberta, BC, and Saskatchewan. Aurora Cannabis is looking for a Total Rewards Specialist in Alberta, Ontario, or Quebec (remote opportunity) along with several other positions available here.

Sana’a Cannabis in Miramichi, New Brunswick, is hiring a Post Harvest Technician. Cannabis NB is looking to hire a Bilingual Customer Experience Representative (occasional) in Tracadie.

AtlantiCann is hiring a Cultivation Technician in Lower Sackville, Nova Scotia. Cannabis TEC Cannabis Services has a position for Trimming and Packaging in Liverpool, NS.

Garden in PEI is hiring a Procurement Manager in Charlottetown.

Toko Smoke is looking to hire a Budtender in Happy Valley-Goose Bay, Newfoundland. A Circle K in Deer Lake, NL is hiring a Budtender and a Part-Time Budtender in Paradise, NL.

The Herbery in Whitehorse, Yukon, is looking to hire a Budtender.

Keep checking back with StratCann for more monthly job listings. Want to be included in our next monthly update? Message us here!

by Grow Up Conference | Jun 3, 2024 | Extraction Magazine, Media Partners

Hexahydrocannabinol (HHC) represents a pivotal advancement in the cannabis extraction industry, heralding new frontiers in cannabinoid product development and market expansion. For extractors and cannabis companies, understanding the intricacies of HHC and its production processes is not just about tapping into a novel cannabinoid offering. It’s about innovating in a space that’s increasingly competitive and highly regulated. The allure of HHC lies in its unique chemical structure, offering effects that resonate with both recreational and medicinal consumers, thereby broadening consumer appeal and potentially enhancing therapeutic profiles.

Even some experts wonder, “How do they make HHC?”. This curiosity has evolved into a critical question for cannabis product manufacturers that shows the importance of technological innovation and safety standards in cannabinoid extraction processes. For industry stakeholders, mastering HHC extraction is similar to pioneering a new frontier in cannabinoid science. It may promise to unlock new product formulations and improve the efficacy and safety of cannabis and hemp products, establishing a benchmark for product excellence and compliance.

What is HHC?

HHC is the abbreviation for hexahydrocannabinol. It marks a significant development in cannabinoid science as the first semi-synthetic cannabinoid introduced in the European Union. [1] It emerged through a complex chemical transformation involving the cyclization and hydrogenation of cannabidiol (CBD), leading to a novel compound with unique structural and pharmacological characteristics.

Despite its growing presence in the cannabis market, HHC remains somewhat enigmatic, with comprehensive studies on its pharmacological properties and effects still in the nascent stages. This knowledge gap creates a critical area of research, as the understanding of HHC’s interaction with the body’s endocannabinoid system, its potential therapeutic benefits, and its safety profile requires further exploration. The creation of HHC is a step towards diversifying the range of available for medical and recreational use, potentially promising new avenues for product innovation and therapeutic applications.

When was HHC Discovered?

While the concept of hexahydrocannabinol might seem like a novel advancement in cannabis extraction, its origins trace back to the 1940s, debunking the notion that HHC is a new discovery. Roger Adams, a pioneering chemist, first elucidated the process of creating HHC, which he detailed in his 1947 patent. [2] This historic method for how to make HHC involves exposing concentrated THC to high pressure in the presence of hydrogen atoms and utilizing inert materials such as iridium, palladium, rhodium, nickel, ruthenium, platinum, or rhenium as catalysts.

This high-pressure environment facilitates the breaking of THC’s double bonds, leading to a destabilized structure and the formation of HHC. Adams’ innovative work laid the foundational understanding of HHC production, illustrating the compound’s longstanding history and its recent resurgence in interest within the cannabis community and industry.

The Differences between HHC and THC

HHC and tetrahydrocannabinol (THC) share a close relationship in their molecular structures, yet exhibit distinct differences that influence their pharmacological effects. Both compounds interact with the body’s endocannabinoid system but differ in their psychotropic activities due to variances in molecular configuration.

HHC’s structure is characterized by the absence of double bonds present in THC, a modification that results from the hydrogenation process. This alteration yields two epimers of HHC, 9R, and 9S, with the 9R epimer demonstrating cannabimimetic activity, whereas the 9S epimer exhibits either negligible or less pronounced psychotropic effects. [1]

The difference in activity between these epimers was highlighted in in-vivo studies, such as the research conducted by Raphael Mechoulam on rhesus monkeys, which noted behavioral and somatic changes post-administration of HHC epimers. This structural difference underscores the importance of precise extraction and synthesis techniques, as extractors have learned how to make HHC from CBD, optimizing for the more active R epimer. [1]

Is HHC Legal?

The legality of HHC exists in a complex regulatory system, directly influenced by interpretations of the 2018 Farm Bill. This legislation federally legalized hemp and its derivatives, provided they contain less than 0.3% THC. Since HHC is often synthesized from hemp-derived THC or CBD, it occupies a legal gray area at the federal level, not explicitly mentioned in the bill.

However, the situation becomes more black-and-white at the state level. HHC has been banned or restricted in some states that have taken a proactive stance to regulate or limit the sale and distribution of novel psychoactive substances derived from hemp. These varying state laws create a patchwork of legality across the U.S., making it imperative for consumers and businesses to stay informed about specific local regulations regarding HHC’s legal status.

Does HHC Show up in Drug Tests?

The interaction between HHC and drug testing is a topic of significant interest, especially for individuals undergoing pre-employment drug screening or other forms of drug tests. Due to the structural similarities between HHC and THC, there is a prevailing concern about the potential for HHC to trigger positive results in drug tests.

The current understanding suggests that standard drug tests primarily detect metabolites of THC, not HHC directly. Given that HHC metabolizes differently in the body compared to THC, it is theoretically less likely to be detected by traditional THC-focused drug screenings. Nonetheless, the lack of comprehensive research and variability in drug testing methodologies means there’s still an element of uncertainty. Individuals should exercise caution and consider the potential risks of consuming HHC if subject to drug testing, as the differences in metabolism may not fully exempt them from testing positive.

How is HHC Made?

To grasp the intricacies of how HHC is made, a foundational understanding of hydrogenation is essential. This chemical process is central to transforming other cannabinoids into HHC, serving as the bridge between common cannabis compounds and this semi-synthetic cannabinoid.

Hydrogenation involves the addition of hydrogen atoms to a molecule, fundamentally altering its structure and, consequently, its pharmacological properties. For those intrigued by the creation of HHC, recognizing the role of hydrogenation offers insight into the sophisticated chemistry that enables the conversion of cannabinoids like CBD or THC into HHC. It’s a pivotal first step that not only demystifies the HHC production process but also illuminates the scientific precision required to engineer cannabinoids with specific characteristics.

What is Hydrogenation?

Hydrogenation is a chemical reaction that involves the direct addition of molecular hydrogen to another element or compound, usually in the presence of a catalyst. This process can lead to hydrogen simply adding to double or triple bonds within a molecule’s structure, or it might cause the molecule to break apart, a reaction known as hydrogenolysis or destructive hydrogenation.

A hallmark of hydrogenation is its versatility. It can be applied to nearly all organic compounds featuring multiple bonds between two atoms, which is why it was applied to cannabinoids. This reaction has monumental industrial significance, evidenced by its use in creating ammonia from hydrogen and nitrogen, methanol or hydrocarbons from hydrogen and carbon monoxide, transforming liquid oils into edible fats, and in petroleum refining for gasoline and petrochemical production.

The discovery by Paul Sabatier in 1897, highlighting nickel as an effective catalyst, marked a pivotal moment in harnessing hydrogenation for industrial applications. Common catalysts include nickel, platinum, palladium, copper chromite, and nickel supported on kieselguhr for high-pressure scenarios. Today, these processes have been ingeniously applied to cannabinoids, opening new avenues in cannabinoid science and product development. [3]

How to Make HHC at Home

Creating HHC involves complex chemical processes, including hydrogenation, which are best left to the professionals. The synthesis of HHC not only requires specialized knowledge of chemistry and access to specific laboratory equipment but also entails handling potentially dangerous chemicals under controlled conditions. The precise manipulation of cannabinoids to produce HHC or its epimers demands a high degree of scientific expertise and adherence to safety protocols, which are typically beyond the scope of home experimentation.

It is important to emphasize that attempting to produce HHC at home poses significant risks, including the potential for chemical accidents and legal consequences. Given these factors, individuals interested in exploring the benefits of HHC should opt for products manufactured by reputable companies within regulated industries. For safety, legality, and quality assurance, do not try this at home.

What are the Effects of HHC?

The effects of HHC have been a subject of scientific exploration, with pivotal studies, such as the one by Raphael Mechoulam in 1980, offering insight. This research highlighted the psychotropic potency of HHC epimers in rhesus monkeys. The (R)-HHC epimer, characterized by an equatorial methyl substituent, was found to induce severe stupor, ataxia, immobility, and other signs of high potency, even at low doses. Conversely, the (S)-HHC epimer, with an axial methyl group, prompted drowsiness and reduced motor activity at higher doses. These findings, albeit from a study using a non-pure compound, show a significant variance in the effects based on the specific epimer present. [1]

The influence of each epimer’s abundance in HHC-containing cannabis products on their potency further underlines the need for detailed analysis and understanding of these compounds. High-performance liquid chromatography and behavioral assays, like the tetrad test on mice, are crucial in evaluating the psychoactive impacts comparable to those of Delta 9-THC, reinforcing the somewhat unpredictable nature of HHC’s effects.

Can HHC Get You High?

Yes, HHC can induce psychoactive effects similar to THC, leading to a high in consumers. HHC is a hydrogenated form of THC, and its psychotropic potency varies based on the specific epimers present. As mentioned, the (R)-HHC epimer, in particular, has been found to exhibit significant psychotropic activity, including symptoms of stupor and immobility in animal studies, even at low doses. These effects are indicative of a high potency that can influence perception, mood, and consciousness, comparable to the experiences associated with THC, the primary psychoactive component in cannabis.

However, the intensity and nature of the high from HHC can differ due to its molecular structure and the presence of different epimers. Consumers should note that the psychoactive outcomes depend on the abundance of one epimer over the other. Consequently, while HHC can get you high, the experience may vary, highlighting the importance of understanding the effects of hexahydrocannabinol, THC, and other cannabinoids.

Is Consuming HHC Safe?

When considering the safety of consuming HHC, it’s vital to err on the side of caution. Research into HHC and its effects is still in the early stages, with limited studies available on its long-term health implications. Though HHC is structurally similar to THC and offers psychoactive properties, the specific health risks or benefits associated with its use remain under-researched.

Consumer safety is paramount, and without comprehensive, peer-reviewed research assessing the safety profile of HHC, individuals should approach its use with caution. Potential consumers are advised to consider legal aspects, and personal health conditions, and consult healthcare professionals before trying HHC products. Additionally, the quality and purity of HHC products can vary significantly, further complicating safety assessments. In summary, due to the current lack of extensive scientific data on HHC, consumers should proceed with caution and prioritize informed decision-making when considering its use.

The Future of Hexahydrocannabinol

The exploration of hexahydrocannabinol represents a growing field within cannabinoid research, indicating both promising applications and the need for extensive scientific research. Current studies, including works dating back to the 1980s, have begun to unveil the psychotropic potential and unique properties of HHC and its epimers. These insights have laid groundwork suggesting that HHC could offer distinct therapeutic and recreational benefits that are similar yet differentiated from those of THC.

At the same time, the scientific community agrees that more research is needed to fully understand HHC’s safety profile, efficacy, and long-term effects. The preliminary observations highlight the importance of rigorous, peer-reviewed research to ascertain the pharmacological properties and health implications of consuming HHC.

Looking forward, the trajectory of HHC reflects a broader trend in cannabinoid science. The continued discovery and study of novel cannabinoids are set to expand our pharmacopeia, offering new opportunities for medical treatments and understanding human biochemistry. The future of HHC, and cannabinoids at large, rests on advancing research methodologies and fostering a regulatory environment conducive to exploring these compounds’ full spectrum of effects.

References:

- Russo, F et al., The semisynthetic cannabinoid Hexahydrocannabinol (HHC). Scientific Reports. 2023. 13, Article number: 11061. https://www.researchgate.net/publication/369781701_The_semisynthetic_cannabinoid_Hexahydrocannabinol_HHC [Times Cited = 1] [Journal Impact Factor = 4.6]

- US2419937A https://worldwide.espacenet.com/patent/search/family/024105324/publication/US2419937A?q=pn=US2419937

- Hydrogenation. Encyclopedia Britannica. https://www.britannica.com/science/hydrogenation

by Grow Up Conference | Jun 2, 2024 | Media Partners, The New Agora

Obituary of Michael Ellis Gibbons

Michael Ellis Gibbons was born in Sacramento, California. His Parents were Marion Ellis Gibbons and Carolyn Dianne Gibbons. Michael was the first of 3 children, and was the one who shared his father’s initials…M.E.G. Michael was raised in El Dorado Hills, CA and attended all his years of school in El Dorado County: Jackson Elementary School, Rescue Jr High School, and graduated from Ponderosa High School in 1976. Growing up he was a Boy Scout, played Little League, and was on the wrestling team. After He graduated, he had many occupations and life learning skills as he was finding his true self, including being a Volunteer Fireman, coach to a women’s rugby team, a tow truck driver, and joined the Air Force. Years later after returning home, Mike was a semi truck Owner Operator and most knew him in later years as having a local Coffee Internet Ice Cream Cafe in Burkes Junction, years before internet and coffee were a thing. Locals used to enjoy having a chat with Mike and having ice cream in his shop, and the local police approved of the positive environment he provided for youth in the area.

His younger brother, Tim, lovingly remembers Mike as one who was always sticking up for the Under Dog and defending others as they grew up. Mike, who also became known as QuietBear after years of shamanic training in the wilderness of Colorado, was always available for a talk, sometimes a joyful conversation, other times there was a life-learning moment that left us amazed at his knowledge. Michael/Quiet Bear had a unique ability to always stay positive and was always reaching for something new and different to learn and do, ever changing and evolving, and if he envisioned it, he was never afraid to try to grasp it. Even when Cancer came into the way…. QuietBear fought harder than anyone has and at one point was even applauded by the whole nurse’s station at the hospital. It will be a memory forever that there was always a smile and amazing deep down true belly laugh from him when time was spent together. Michael has continued his legacy by leaving his 3 children, Michael Brian Gibbons, Matthew Gibbons and Marissa Gibbons, as well as 4 grandchildren. Michael married and leaves behind his true soulmate and final Love of his Life, Marcela Cruz-Gibbons and their 2 dogs who loved him so, Ranger and Girlie.

Michael Gibbons, under his shamanic name, Quietbear, has for years offered powerful spiritual guidance and work with others in various parts of the world who reached out to him, and has been a blessing to humanity, in whose service he dedicated his life. He died four times in his life, and each time was asked by The Christ to return and complete his work, and did. Friends around the world now share their own loving acknowledgment of who Michael Gibbons/QuietBear will always be, and the work he did, and I as his wife had the profound privilege to participate in, and these I share below:

Bear has finally returned home – and can rest – maybe for the first time in decades. His onward soul and mind journey is now in the care of the Divine: what a beautiful thing!

My sincere heartfelt condolences. Bear has left a legacy and so many memories for so many people. Bears piece in this lifetime has made us better people.

May God take the precious Bear heart and give it a place in the world of spirit. In that position of strength, a kingdom where there is no loss, Bear will provide for us as no one can care for us here on our global gifted land.

I am really sad to hear about the final chapter of Bear’s life panning out this way. You are both supremely inspirational and courageous. With gratitude and hope, I wish you strength and encouragement during this extremely difficult period.

My deepest love and blessings to you Marcela. And to Quietbear who remains an absolute legend of a warrior and a being.

Deepest gratitude to you Quietbear, you amazing soul. Until we all see each other again… I will continue to hold space for miracles to come in for us all.

The man (Bear) was a spiritual giant, warrior, teacher, healer and more. You are both eternally inspiring.

.

To plant a beautiful memorial tree in memory of Michael Gibbons, please visit our Tree Store

A Memorial Tree was planted for Michael

We are deeply sorry for your loss ~ the staff at Family-Funeral & Cremation-FW

Services for Michael Gibbons

There are no events scheduled. You can still show your support by planting a tree in memory of Michael Gibbons.

Plant a tree in memory of Michael

Recent Comments