by Grow Up Conference | May 29, 2024 | Media Partners, Stratcann

Decibel Cannabis Company Inc. reported declining revenue and increased losses in its first three months of 2024 due to increased competition and lower exports.

The fourth largest licensed producer in Canada by market share, Decibel brought in $32.3 million in gross sales in the Canadian non-medical market in the three months ending March 31, 2024, and $355,000 in international sales for gross revenue of $32.7 million before expenses. This compares to $40.5 million in gross revenue in the same period in 2023.

Net revenue for Decibel in the first quarter of 2024 was just under $21 million, down from nearly $30 million in the first quarter of 2023. Adjusted EBITDA in Q1 2024 was $3.6 million, down from $6.6 million in Q1 2023. Adjusted net loss in Q1 2024 was $3.5 million, compared to adjusted net income of $3.3 million in Q1 2023.

Of the $32.3 million in gross national sales, Decibel paid $11.7 million in federal excise taxes, 32% of its gross Canadian adult-use (non-medical) sales.

Net revenue for the company has declined for three consecutive quarters, with four consecutive quarters of adjusted net loss.

“Despite the drop in revenue, we remain one of Canada’s top brands by market share,” said Decibel’s Chief Executive Officer Benjamin Sze. “With a focused effort on our strategy, we expect an improved Q2 and more importantly a continued path to sustainable growth and profitability. I am currently undergoing a comprehensive business review, and I look forward to sharing the initiatives undertaken before July 15th.”

Decibel operates two federally licensed cannabis cultivation facilities, one in British Columbia and one in Saskatchewan, a processing and manufacturing facility in Calgary, and has supply agreements for cannabis flower products in Alberta, Ontario, British Columbia, and Manitoba, and has also agreed to supply cannabis products to the Prince Edward Island Cannabis Management Corporation and Cannabis New Brunswick. It is also registered as a cannabis supplier in Saskatchewan.

Decibel has four dried cannabis brands: two premium brands, Qwest and Qwest Reserve, and two core-segment and value-segment brands, Blendcraft by Qwest and General Admission.

The company previously owned six Prairie Records cannabis retail stores in Saskatchewan and Alberta. In April, after the close of the most recent quarter, the company sold these locations to Fire and Flower Inc., a wholly owned subsidiary of 2759054 Ontario Inc. d.b.a. FIKA, for $3 million.

In the most recent quarter, Decibel says it signed a supply agreement with a new company in Israel, projecting an annual commitment by the company to purchase 1,000 kg of cannabis, and completed its first export to Australia.

In this same period, a different Israeli company defaulted on its payments required under a cannabis supply agreement with Decibel, leading to a provision of $1.6 million of such receivable.

Decibel took formal legal action to collect on the payment, and the Israeli company subsequently filed an insolvency motion. Decibel joined these proceedings, filing its claim with the trustee, believing there is 300kg of inventory related to this provisioned receivable that is currently accessible, and that a portion of the receivable may be recoverable through a resale agreement of this inventory with the trustee and another Israeli company.

In January, the Israeli government opened an “anti-dumping” investigation into cannabis imports from Canada, which included Decibel. The company’s first export to Israel occurred in Q4 2022.

Because of continued losses, the company says its future is “dependent on its ability to maintain profitable operations and maintain compliance with covenants relating to its lending agreements, generate sufficient funds from operations, continue receiving financial support from its lenders and obtain new financing,” something it cannot promise investors.

In April, Decibel filed a notice of civil claim in a BC Supreme Court for $834,901, arguing that BC-based Seven Elk Shipping’s actions resulted in the seizure of their product by US border officials.

by Grow Up Conference | May 29, 2024 | Media Partners, Stratcann

Cannabis processor Nextleaf Solutions reported revenue of $4.6 million but a loss of just over $1 million in the first three months of 2024.

The figures, part of the company’s Q2 2024 results, show a notable increase in revenue, nearly doubling compared to the same period in 2023. However, the comprehensive loss also saw a significant increase, with accumulated losses almost four times higher than in the first three months of 2023. Adjusted EBITDA was $232,682.

Nextleaf sells its branded cannabis vapes, oils, and softgels in British Columbia, Ontario, Nova Scotia, Manitoba, and Saskatchewan, as well as through medical cannabis platforms that distribute nationally under brands like Glacial Gold and High Plains.

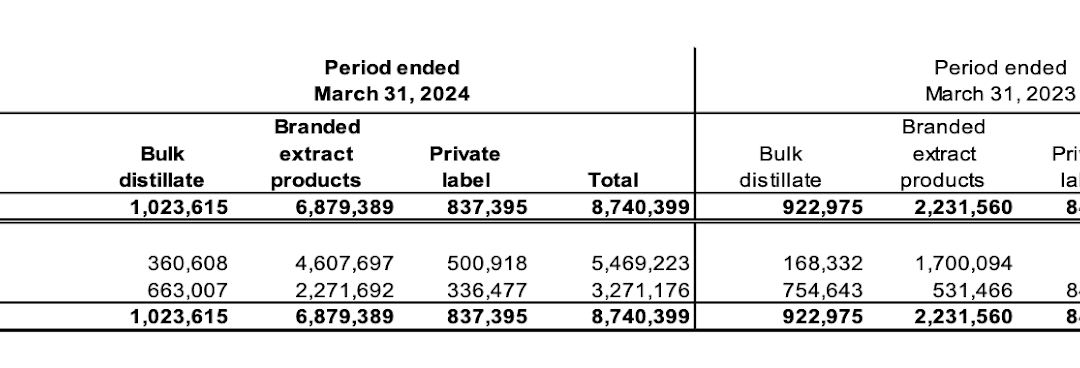

Much of the company’s sales have been in the BC market. For the six months ending March 31, 2024, Nextleaf brought in $8.7 million in revenue. Just over $1 million was from bulk distillate sales, $6.9 million was from sales of its branded extract products, and $837,395 through private label sales.

Of those sales, $360,608 of the bulk distillate sales were in BC, $4.6 million in branded product sales, and $500,918 in private label sales for a total of $5.5 million. Nextleaf currently produces more than 80 different products across four categories for white-label clients and house brands.

Before this quarter’s $1 million loss, Nextleaf Solutions reported a total of $940,336 income in the previous three quarters. As of March 31, 2024, Nextleaf held about $832,000 in cash, a net decrease of approximately $67,000 for the six months ended. The company’s working capital stood at approximately $1,355,000 as of March 31, 2024, an increase of about $323,000 over the Q1 2024, ended December 31, 2023.

The company launched nine new products in the most recent quarter, which include soft gels, oils, infused pre-rolls, and vapes.

Related Articles

by Grow Up Conference | May 29, 2024 | Media Partners, The New Agora

5 Ways to Make Something

Extraordinary Happen

By Gary Z. McGee

“I was waiting for something extraordinary to happen but as the years wasted on nothing ever did unless I caused it.” ~Charles Bukowski

Don’t let the years waste on. Life is short. Grab the bull of the present by the horns and force it into a force to be reckoned with in the future. Here are five ways to do that…

1.) Get out of your own way:

“It had long since come to my attention that people of accomplishment rarely sat back and let things happen to them. They went out and happened to things.” ~Leonardo da Vinci

Don’t rest on your laurels. Go out and happen to things. But before you can happen to things, you must happen to yourself. You must be able to get out of your own way.

Getting out of your own way means outmaneuvering your cultural conditioning. It means burning off the dross by humiliating your religious self, your political self, and even your notion of the Self.

The only way to do this is by realizing that your conditioning is an outdated skin that must be shed. Then you must shed it. Which will likely hurt like hell. It will be akin to ripping off a comforting band aide from an unhealable wound. But nothing is more important than revealing your own vulnerability despite the faux invulnerability of your cultural conditioning.

When the mollycoddling, placating, pseudo-invulnerable cultural conditioning is ripped away, all your left with is raw vulnerability, death anxiety, and existential pain. Relish it. It is your truest aspect.

2.) Seek pain, not comfort:

“Humor is the instinct for taking pain playfully.” ~Max Eastman

Pain should not be avoided at the expense of adventure. Adventure should be embraced at the risk of pain.

Take that existential pain and raw vulnerability and transform it into humorous curiosity. Use it like a sponge. Soak up the knowledge you’ll need to challenge an indifferent universe. Use it to discover the hidden passageways out of your comfort zone. Use it to transform boundaries into horizons.

As Hobbes said, “Hell is truth seen too late.” Don’t allow Hell to descend upon you. Get ahead of the curve. Challenge yourself. Take the pain of your knowledge and blitzkrieg the bliss of your ignorance. No fear. Crash like thunder, strike like lightning. Don’t let up until your comfort zone becomes a thing you can take with you into the wild, into solitude, into adventure.

Nothing extraordinary can happen if you’re curled up in a ball in the corner of your comfort zone. Tear down the ramparts. Upend the fences. Flatten all the boxes you’ve been forced to believe in. Seek the healing pain of solitude before the deadly comfort of complacent domesticity lays you low.

As Atticus said, “Loneliness is a fire I hold close to my skin, to see how much pain I can stand before running to the water.”

3.) Seek questions, not answers:

“Proceed on the hypothesis that everything you are is a lie and everything you know is wrong and try to disprove it.” ~Jed McKenna

Don’t take anything for granted. The so-called answers you’ve been spoon-fed all your life are not really answers. They are kneejerk reactions to the fear of the unknown. They are biased opinions based on the nothingness we’ve vainly tried to force into somethingness. They are faux lyrics set to a makeshift song and dance set to distract us from the fact that none of us has a damn clue what it’s all about.

As Richard Feynman said, “We are never definitely right; we can only be sure we are wrong.”

Thinking you are right is smoke and mirrors at best and delusional belief at worst. Best to outflank “rightness” and get down to brass tacks. Assume you are wrong about a great many things. Question what you think you know by remaining curious about what you do not. Always leave yourself outs. Keep curiosity ahead of certainty.

As Anthony Bourdain said, “Life is complicated. It’s filled with nuance. If I believe in anything, it is doubt. The root cause of all life’s problems is looking for a simple fucking answer.”

Don’t look for simple answers. Seek out difficult questions. Use the question mark like a sword. Cut through delusion. Cut through “truth.” Cut through “rightness.” Cut through answers. Use it as the tip of the spear that will spearhead your own Truth Quest.

4.) Force yourself to take the Hero’s Journey:

“Turn your life into a line of poetry written with a splash of blood.” ~Yukio Mishima

The Hero’s Journey is a whetstone. It’s a way of sharpening your character. It’s a way of testing your mettle against the crucible of a life well-lived. It’s a way of strengthening the muscle of your soul.

As Joseph Campbell wisely surmised, “The modern hero must not wait for his community to cast off its slough of pride, fear, rationalized avarice, and sanctified misunderstanding. ‘Live,’ Nietzsche says, ‘as though the day were here.’”

You must not wait to overcome your own threshold guardians, shadows, and dragons. You should live as though the day were here. You should pluck the strings of destiny, discover the magic elixir of competence, and then bring it back to the “tribe.”

Life is too short to remain a victim. And there are too many victims in need of a hero who can lead by example. The hero’s journey is that example. It’s a mighty beacon in the dark. It’s a beacon of darkness in the blinding light. It’s a psychosocial symbol for next-level transformation, individuation, self-actualization, and enlightenment. It’s soul craft in its purest form.

5.) Live dangerously, not obsequiously:

“People with courage and character always seem sinister to the rest.” ~Hermann Hesse

Don’t be afraid to seem sinister to others. Have the courage to be Fire. Burn all the moths if you must. Those who are also fire will see how your fire is a boon to all. And although those who are moths may get burned, they may also discover the Phoenix within them.

Rebirth is necessary for those who are living half-dead lives. Don’t be afraid to be the one who awakens them from pretending to be asleep. Live on purpose, with purpose. If your purpose should upset the masses, then so be it. Let them quibble. Let them fall all over themselves in whiney, woe-is-me, status-quo-junky despair. Let them melt all over the place in tear-filled snowflake misery. You have work to do.

You have courage to set afire like a beacon of hope in a hopeless world. You have your unconquerable character to set up as a psychosocial symbol of audacity and honor. You have extraordinary moments to fish out of the maw of the ordinary. You have gods to dethrone.

As Hermann Hesse also said, “Those who are too lazy and comfortable to think for themselves and be their own judges obey the laws. Others sense their own laws within them.”

Sense your own law within you. Elevate yourself above the battlefield. Discover your own conscience as pure law. Become the personification of checks and balances. Dare yourself to become more courageous than the mollycoddled culture you grew up in. Become a more valuable human.

As Niels Bohr said, “Every valuable human being must be a radical and a rebel, for what he must aim at is to make things better than they are.”

Image source:By Viajeros Cósmicos

About the Author:

Gary Z McGee, a former Navy Intelligence Specialist turned philosopher, is the author of Birthday Suit of God and The Looking Glass Man. His works are inspired by the great philosophers of the ages and his wide-awake view of the modern world.

This article (5 Ways to Make Something Extraordinary Happen) was originally created and published by Self-inflicted Philosophy and is printed here under a Creative Commons license with attribution to Gary Z McGee and self-inflictedphilosophy.com. It may be re-posted freely with proper attribution, author bio, and this statement of copyright.

by Grow Up Conference | May 29, 2024 | Cannabis News Wire, Media Partners

Leading cannabis companies are urging a federal court to permit the public to attend a hearing virtually in a lawsuit where the companies are requesting protection for in-state marijuana activities from federal interference. The U.S. Department of Justice has stated it holds “no stance” on this request.

The hearing will take place before the United States District Court for the Western Division of the District of Massachusetts. The plaintiffs’ attorneys highlighted in a motion that the disagreement raises issues of public interest. They reported receiving a lot of requests from the media to watch the hearing online, as most can’t be present in person.

Further, they argue that permitting remote access to the hearing will not prejudice any parties involved. They suggest that access by phone or video conference would be adequate. They also mentioned that they consulted with the defendant’s counsel, who confirmed that the defendant has no stance on the motion.

The lawsuit, titled Canna Provisions vs. Garland, is spearheaded by Verano Holdings Corp., a multistate cannabis operator, alongside Massachusetts-based marijuana companies Wiseacre Farm and Canna Provisions as well as Gyasi Sellers, the CEO of Treevit.

Leading the lawsuit is David Boies, who has previously represented clients such as former vice president Al Gore, the DOJ and plaintiffs in the lawsuit that resulted in the repeal of California’s same-sex marriage statute.

In their lawsuit, the companies argue that the federal prohibition of cannabis lacks justification, especially given the widespread legalization of cannabis in states and the federal government’s generally noninterventionist stance on the matter.

Last month, the plaintiffs requested oral arguments, a request granted by Judge Mark G. Mastroianni, an appointee of President Barak Obama. In response, the DOJ maintained its neutral position.

Central to the case is whether in-state marijuana activity impacts interstate commerce. The federal government contends that marijuana legalization draws tourists from other states, thereby affecting interstate commerce. In a recent filing, the DOJ contended that it makes sense to conclude that Massachusetts’s legal cannabis market stimulates marijuana tourism, a distinct type of cannabis-related interstate commerce.

The DOJ’s brief referenced a Supreme Court decision from decades ago, affirming Congress’s jurisdiction to regulate establishments attracting out-of-state tourists, even if the transactions occur entirely within the state. Conversely, the plaintiffs argue that the Commerce Clause of the Constitution should not allow the DOJ to interfere in activities legal within state borders, as the state itself regulates these.

The recent motion follows an announcement by President Joseph Biden that his administration is formally reclassifying cannabis. A proposal to place marijuana in Schedule III is set to be published in the Federal Register soon.

The planned regulation change was approved by Attorney General Merrick Garland, one of the main defendants in this case. However, rescheduling marijuana would not equate to federal legalization, and it appears unlikely that this rulemaking will impact the DOJ’s stance in the ongoing court case.

Cannabis industry actors such as Software Effective Solutions Corp. (d/b/a MedCana) (OTC: SFWJ) await the completion of the rulemaking process so that they can map out their future plans accordingly.

NOTE TO INVESTORS: The latest news and updates relating to Software Effective Solutions Corp. (d/b/a MedCana) (OTC: SFWJ) are available in the company’s newsroom at https://cnw.fm/SFWJ

About CNW420

CNW420 spotlights the latest developments in the rapidly evolving cannabis industry through the release of an article each business day at 4:20 p.m. Eastern – a tribute to the time synonymous with cannabis culture. The concise, informative content serves as a gateway for investors interested in the legalized cannabis sector and provides updates on how regulatory developments may impact financial markets. If marijuana and the burgeoning industry surrounding it are on your radar, CNW420 is for you! Check back daily to stay up-to-date on the latest milestones in the fast -changing world of cannabis.

To receive SMS alerts from CNW, text CANNABIS to 888-902-4192 (U.S. Mobile Phones Only)

For more information, please visit https://www.CannabisNewsWire.com

Please see full terms of use and disclaimers on the CannabisNewsWire website applicable to all content provided by CNW, wherever published or re-published: https://www.CannabisNewsWire.com/Disclaimer

CannabisNewsWire

Denver, CO

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.com

CannabisNewsWire is powered by IBN

by Grow Up Conference | May 29, 2024 | Cannabis Prospect Magazine, Media Partners

Shiny Health & Wellness Corp. reports that its wholly-owned subsidiary, Shiny Bud Inc., with the authorization and approval of its board of directors (the “Board”), has filed a Notice of Intention to Make a Proposal (“NOI”) pursuant to the provisions of the Bankruptcy and Insolvency Act (Canada) (“BIA”). The principal purpose of the NOI filing is to create a stabilized environment for the Company and its financial advisors to run an orderly and flexible sale, investment and solicitation process (“SISP”) with the goal of identifying one or more interested parties that wish to acquire or make an investment in the Company’s business or all or some of its assets.

B Riley Farber Inc. has been appointed as the trustee under the NOI (the “Proposal Trustee”). The Company is working closely with the Proposal Trustee and its legal advisors on the SISP to best protect the Shiny Bud brand and its 20 licensee stores whose ability to continue to use the Shiny Bud brand in accordance with the license agreements is not impacted by the NOI.

In connection with the filing of the NOI, the Company has entered into an agreement with its existing senior creditor, Evergreen Gap Debt GP Inc, as Agent for and on behalf of Evergreen Gap Debt LP and Gap Debt III LP (the “DIP Lender”), pursuant to which the DIP lender will advance a debtor-in-possession (“DIP”) loan to the Company in the amount of up to $580,000 to generally fund working capital needs and expenses related to the NOI proceedings. The DIP Loan is conditional on, among other things, approval from the Ontario Superior Court of Justice (the “Court”).

The Company intends to seek an order from the Court approving the terms of the SISP and DIP loan. The Company’s objective is to complete the SISP by the end of July 2024. It is important to note that the Company is not bankrupt. If the DIP agreement is approved, the Company believes it has sufficient resources to fund its operations during the SISP and its stores will remain open for business during that time, subject to any restructuring steps that the Company may take during the process. Pursuant to the BIA, upon filing the NOI, there is an automatic stay of proceedings in respect of all creditor claims and actions against the Company that will protect the Company and its assets from the claims of creditors and others during the pendency of the proposal proceedings.

Anyone interested in obtaining more information about the SISP should contact the Proposal Trustee at: Nerina Jahja – njahja@brileyfin.com.

ShinyHealth also announces that its wholly-owned subsidiary, mihi Health and Wellness Inc. (“mihi”), has received, in connection with a guarantee provided by mihi in favour of its wholly-owned subsidiary that owns the Cotton Mill Pharmacy, a demand from the lender to such subsidiary for immediate payment of unpaid loan amounts. The Cotton Mill Pharmacy is currently temporarily closed. ShinyHealth is reviewing the merits of this demand and financial circumstances of mihi.

As a result of the NOI and financial resource constraints, ShinyHealth also announces that it is expecting not to file its annual financial statements and accompanying management’s discussion and analysis for the fiscal year ended January 31, 2024 by the prescribed deadline of May 30, 2024. ShinyHeath’s ability to complete the audit and filing of its annual financial statements and related management’s discussion and analysis will be dependent upon the results of the NOI process.

As a result of the prior resignations of Meris Kott and Jonathan Hemi, the remaining directors of ShinyHealth are Brad Kipp (non-independent) and Lyn Christensen (independent), and the remaining officers are Brad Kipp (Interim CEO) and Dominic Lavallée (Interim CFO). As a result of ShinyHealth currently having only two directors, it does not currently meet the minimum number of directors required under applicable law as a reporting issuer or pursuant to the policies of the TSX Venture Exchange (“TSXV”). In light of this, ShinyHealth has been advised by the TSXV that trading of its shares will remain halted and failure to remedy the deficiency within 10 business days will result in a suspension in trading of the ShinyHealth shares. ShinyHealth confirms that its transfer agent, Computershare, continues to act as its transfer agent.

by Grow Up Conference | May 29, 2024 | Cannabis Prospect Magazine, Media Partners

Nextleaf Solutions Ltd., a leading life science firm and licensed cannabis processor, is pleased to release its financial results for their second quarter ended March 31st, 2024. The Company achieved sequential revenue growth, a record $3.4 million net revenue, and an adjusted EBITDA[1] of $232,682.

Highlights

- Achieved gross margins of 28% in Q2 FY2024, up from 20% in Q2 FY2023.

- Net revenue grew by 7% to $3.4 million compared to the previous quarter and by 57% compared to Q2 FY2023. Revenue growth attributed to steady product innovation with 9 product launches in this quarter.

- The reported Loss of $1.01M for the quarter was primarily attributed to a non-cash charge related to a Share-Based Compensation expense.

- For the six months ended Q2-2024, the Company achieved an Adjusted EBITDA[2] of $554,638, marking a significant improvement compared to a loss of $201,951 in the same period of the previous year.

- Further strengthened its balance sheet by reducing its CRA liability by $740,000.

- Strong performance across all cannabis softgel and THC Oil SKUs with 21% and 32% growth rates respectively.

- Successful first shipment of white label vapes for a new commercial partner.

- The Company issued shares and stock options as part of an employee retention and incentivization initiative, with employees voluntarily electing to receive share payments instead of cash – demonstrating strong corporate alignment and dedication.

- New category launch of Glacial Gold MAX THC Infused Pre-rolls into major markets including BC, Alberta, and Ontario.

- 9 new product launches this quarter:

- Glacial Gold Balanced 10:10 Softgels 100-pack

- Glacial Gold CBD 50 Softgels 100-pack

- Glacial Gold MAX THC Grape Escape Double D Infused Pre-rolls 3×0.7g

- Glacial Gold MAX THC Cherry K.O. Double D Infused Pre-rolls 3×0.7g

- Glacial Gold MAX THC Blueberry Dream Hybrid Vape 1.2g

- Glacial Gold MAX THC Kush Mintz Hybrid Vape 1.2g

- Glacial Gold HIGH THC Berry Blotto Vape 1g

- High Plains 1000mg Indica THC Oil Drops 35ml

- High Plains 2000mg Balanced Oil Drops 35ml

“We have been diligently focused on executing our commercialization roadmap and product pipeline throughout this past quarter. We’ve made strategic investments into building up our inventory to strengthen our position, boost commercialization efforts, and expand territory sales,” shares Emma Andrews, Interim CEO. “We’re excited about the growth we’re seeing across our key categories, and we are motivated to continue setting the standard for unparalleled value.”

2024 Outlook

The Company will prioritize the following strategic initiatives throughout the third and fourth quarters FY2024:

- Brand Building & Marketing: Implementing strategic marketing campaigns and activations to elevate brand awareness and recognition among Canadian consumers.

- Increasing Points of Distribution: Expanding the number of distribution points within core markets and strengthening retailer relationships.

- Commercialization & Product Development: 12 new SKUs nationally.

- Inventory Building: Continued investment into building up inventory, including biomass procurement, through to finished products.

- Operational Efficiency: Improving operational efficiency through the integration of an ERP system.

- Commercial Partners Program Expansion: achieved through ingredient supply, white labeling, contract manufacturing, and toll processing activities for new and recurring clients.

About Nextleaf Solutions Ltd.

Nextleaf® is an innovative cannabis processor with a portfolio of federally regulated emerging consumer brands, market validated cannabis derivative products, and high-potency bulk ingredients. Nextleaf’s multi-patented, highly automated, closed loop extraction, and distillation technology sets the global standard for processing cannabis at scale.i

by Grow Up Conference | May 29, 2024 | Cannabis Prospect Magazine, Media Partners

Cronos Group Inc. has terminated its agreement (the “Sale Agreement”) with Future Farmco Canada Inc. (the “Buyer”), for the sale and leaseback of its property located at 4491 Concession 12 Sunnidale Road, Stayner, Ontario, Canada, L0M 1S0 (the “Peace Naturals Campus”). The Buyer did not satisfy or waive its due diligence and financing condition by the May 27, 2024 deadline, as set forth in the Sale Agreement. All amounts paid by the Buyer as part of a security deposit that were previously held in trust have been returned, in accordance with the Sale Agreement. The Company is continuing to evaluate its strategic options for the Peace Naturals Campus, which may include continuing and expanding operations at the facility.

About Cronos Group Inc.

Cronos is an innovative global cannabinoid company committed to building disruptive intellectual property by advancing cannabis research, technology and product development. With a passion to responsibly elevate the consumer experience, Cronos is building an iconic brand portfolio. Cronos’ diverse international brand portfolio includes Spinach®, PEACE NATURALS® and Lord Jones®. For more information about Cronos and its brands, please visit: thecronosgroup.com.

by Grow Up Conference | May 29, 2024 | Cannabis Prospect Magazine, Media Partners

Decibel Cannabis Company Inc., a market leader in premium cannabis and extract manufactured products, is pleased to announce its unaudited interim financial results for the three month period ending March 31, 2024.

“Despite the drop in revenue, we remain one of Canada’s top brands by market share. With a focused effort on our strategy, we expect an improved Q2 and more importantly a continued path to sustainable growth and profitability. I am currently undergoing a comprehensive business review and I look forward to sharing the initiatives undertaken before July 15th.” said Benjamin Sze, Decibel’s Chief Executive Officer.

First Quarter Highlights

- National Market Share(1) of 6.0% in Q1 2024, which placed Decibel as the 4th largest licensed producer in Canada by market share.

- Net Revenue was $21.0 million in the first quarter of 2024, with year over year decrease of 16%. Net revenue decrease driven by increased competition in the infused pre-roll segment, vape consumers switching towards large format 510 cartridges and disposables and the halting of exports to Israel as the Company transitioned to a new distribution partner. Subsequent to quarter end, Decibel has launched large format 510 cartridges and disposables.

- Gross Margin Before Fair Value Adjustments was 48% in the first quarter of 2024, compared to 51% in the first quarter of 2023.

- Adjusted EBITDA(2) of $3.6 million in the first quarter of 2024, with a year over year decline of 45% over the first quarter of 2023. The decrease in Adjusted EBITDA quarter over quarter was primarily driven by a decline in net Canadian recreational sales and international sales and the reclassification of retail financial contributions to discontinued operations, partially offset by a decrease in SG&A.

- Positive Free Cash Flow(2) of $375 thousand in the first quarter of 2024, with a sequential decrease of 79% over the first quarter of 2023.

- Adjusted Net Loss(2) of $3.5 million in the first quarter of 2024, with a decline of $6.8 million over the first quarter of 2023. Adjusted Net Income was negatively impacted by a $3.3 million impairment on the Prairie Record’s assets held for sale during the first quarter of 2024 and subsequently sold on April 10, 2024.

- Adjusted Earning Per Share (“Adjusted EPS”)(3) of negative $0.01, with a year over year decrease of $0.02.

About Decibel

Decibel is a consumer-focused cannabis company focused on delivering products that delight customers through a commitment to robust innovation and product quality. Leading brands General Admission, Qwest and Vox are among its portfolio sold both across Canada and beginning to extend towards new countries to create a global footprint. Decibel operates a processing and manufacturing facility in Calgary, Alberta and two cultivation facilities in Creston, British Columbia and Battleford, Saskatchewan.

by Grow Up Conference | May 29, 2024 | Cannabis News Wire, Media Partners

- MedCana subsidiary is expanding reach both domestically and internationally

- Company is strengthening support, sales operations through international partnerships

- Eko2o is at the forefront of providing innovative agricultural technology and infrastructure solutions

Eko2o S.A.S., a subsidiary of Software Effective Solutions (d/b/a MedCana) (OTC: SFWJ), is experiencing significant growth and success, as evidenced by recent news that it has become a key infrastructure supplier for some of Colombia’s largest flower producers (https://cnw.fm/PI8yO). In addition, Eko2o is strengthening its support and sales operations through international partnerships and collaborations, including with Danziger International.

“Our solutions stand out in the market, and we are delighted to witness our company’s growth as we expand our reach both domestically and internationally,” said Eko2o CEO Juan Ricardo Velez. In the announcement, the company noted that it has solidified its reputation as a leading provider of greenhouse infrastructure and agricultural technology.

Earlier this year, the company entered into a “pivotal” agreement with Danziger Colombia (https://cnw.fm/YxwtB). The agreement is projected to generate between $2.5 million and $3 million in revenue over the next three years and represents the commitment both organizations have to innovative agricultural practices. The agreement noted that Eko2o would provide greenhouse infrastructure services, irrigation products and technology and other technologies related to Danziger’s flower operations in Colombia.

That initial agreement led to Eko2o’s expanding collaboration with Danziger International, marking a significant step in Eko2o’s strategy to increase its global footprint, leveraging its expertise to support one of the flower industry’s most respected names. “This collaboration is expected to boost Eko2o’s visibility on the international stage and foster new opportunities in global markets,” the company noted in the announcement.

Eko2o’s commitment to excellence and innovation continues to attract the attention of major industry players, contributing to Colombia’s reputation as a leader in floriculture and agricultural technology. The company is at the forefront of providing innovative agricultural technology and infrastructure solutions. As a leading provider in Colombia, Eko2o is dedicated to enhancing agricultural productivity and sustainability through cutting-edge technologies and services that support farmers and agricultural businesses in achieving higher yields and operational efficiency.

MedCana, operating under Software Effective Solutions Corp., is a pioneer in the integration of technology and agriculture, focusing on the cannabis market and emerging technologies in agriculture. With a vision to revolutionize the industry through innovation, MedCana is dedicated to acquiring and partnering with companies that align with its mission of promoting sustainable and technologically advanced agricultural practices.

For more information, visit the company’s website at www.MedCana.net.

NOTE TO INVESTORS: The latest news and updates relating to SFWJ are available in the company’s newsroom at https://cnw.fm/SFWJ

About CannabisNewsWire

CannabisNewsWire (“CNW”) is a specialized communications platform with a focus on cannabis news and the cannabis sector. It is one of 60+ brands within the Dynamic Brand Portfolio @ IBN that delivers: (1) access to a vast network of wire solutions via InvestorWire to efficiently and effectively reach a myriad of target markets, demographics and diverse industries; (2) article and editorial syndication to 5,000+ outlets; (3) enhanced press release enhancement to ensure maximum impact; (4) social media distribution via IBN to millions of social media followers; and (5) a full array of tailored corporate communications solutions. With broad reach and a seasoned team of contributing journalists and writers, CNW is uniquely positioned to best serve private and public companies that want to reach a wide audience of investors, influencers, consumers, journalists and the general public. By cutting through the overload of information in today’s market, CNW brings its clients unparalleled recognition and brand awareness. CNW is where breaking news, insightful content and actionable information converge.

To receive SMS alerts from CNW, text CANNABIS to 888-902-4192 (U.S. Mobile Phones Only)

For more information, please visit https://www.CannabisNewsWire.com

Please see full terms of use and disclaimers on the CannabisNewsWire website applicable to all content provided by CNW, wherever published or re-published: https://www.CannabisNewsWire.com/Disclaimer

CannabisNewsWire

Denver, CO

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.com

CannabisNewsWire is powered by IBN

by Grow Up Conference | May 29, 2024 | Cannabis News Wire, Media Partners

- Strategic four-pillar business model provides essential piece of Lavish Entertainment’s mission to create an industry-leading entertainment business

- New model “represents a bold step forward in our journey to develop Lavish Entertainment into a staple in the entertainment industry,” states CEO

- The company plans to develop, acquire operations in each of plan’s four areas

At the core of Golden Triangle Ventures’ (OTC: GTVH) purpose of pursuing ventures in the health, entertainment and technology sectors lies its focus on vertical integration to cut costs and maximize margins. One of the company’s newest ventures — Lavish Entertainment, its entertainment division — embodies this focus, as evidenced by its recently released four-pillar business model (https://cnw.fm/jQ33l).

According to GTVH, this strategic framework provides an essential piece of Lavish Entertainment’s mission to create an industry-leading entertainment business. The company’s new model includes key foundational elements — logistics, staffing, equipment and production — that were carefully identified and organized to complement each other and ensure seamless operations across all facets of the company.

“We are thrilled to introduce our innovative four-pillar business model, which represents a bold step forward in our journey to develop Lavish Entertainment into a staple in the entertainment industry,” said Marco Antonio Moreno, president and COO at Lavish Entertainment. “We look forward to showing our shareholders how this new business model will unfold.”

With its new business model as a backdrop, Lavish Entertainment plans to develop and acquire operations in each of the four areas of the plan. Specifically, the announcement noted that “effective logistics are the backbone of any successful entertainment operation” and that “by establishing a dedicated logistics business, Lavish Entertainment can streamline its event-planning processes, ensure seamless coordination of resources and services, minimize delays, and enhance overall efficiency.”

In addition, the company’s staffing, or talent and manpower, are indispensable assets in the entertainment industry. “Whether it’s skilled technicians, event coordinators or guest services personnel, assembling the right team is essential for delivering memorable experiences,” the company stated. “Lavish Entertainment’s staffing division will focus on recruiting, training and managing a diverse array of talent to meet the demands of its multifaceted operations.”

Equipment is equally important to Lavish Entertainment’s corporate vision, which calls for cutting-edge equipment and state-of-the-art technology, both indispensable for creating an immersive entertainment experience. The company’s comprehensive strategy, the announcement noted, will “focus on acquiring, maintaining and upgrading a vast equipment inventory to support a diverse range of productions and events. Top-tier equipment will allow Lavish Entertainment to push the boundaries of creativity and innovation, deliver memorable experiences, and leave forever lasting impressions.”

Production is the final pillar in the business model. “Whether it’s designing captivating stage sets, crafting compelling narratives or executing seamless live performances, the art of production is paramount for success,” the company stated. “The level of expertise in production makes the difference between uninspired and unforgettable. It is essential for bringing creative visions to life and is a critical pillar to advance Lavish Entertainment forward.”

The company noted that this strategic business model is specifically applicable to the company’s flagship project: Destino Ranch. Strategically located to be accessible to tens of thousands of visitors a day, Destino Ranch is destined to become a modern art and music festival mecca. The one-of-a-kind location will combine the natural beauty of the Mojave Desert with an immersive, world-class art installation gallery and a large-scale music venue to become an international destination that rivals Coachella and other well-known festival sites.

Golden Triangle Ventures is a multifaceted consulting company that operates as a parent business pursuing ventures in the health, entertainment and technology sectors, along with other areas that provide synergistic value to these three core divisions. The company aims to purchase, acquire and/or joint venture with established entities within these areas of business. The goods and services represented are driven by innovators who have passion and commitment in these marketplaces. The company plans to utilize relationships and create a platform for new and existing businesses to strengthen their products and/or services. The three points of the Golden Triangle exclusively represent the three sectors the company aims to do business in.

For more information, visit the company’s website at www.GoldenTriangleInc.com.

NOTE TO INVESTORS: The latest news and updates relating to GTVH are available in the company’s newsroom at https://cnw.fm/GTVH

About CannabisNewsWire

CannabisNewsWire (“CNW”) is a specialized communications platform with a focus on cannabis news and the cannabis sector. It is one of 60+ brands within the Dynamic Brand Portfolio @ IBN that delivers: (1) access to a vast network of wire solutions via InvestorWire to efficiently and effectively reach a myriad of target markets, demographics and diverse industries; (2) article and editorial syndication to 5,000+ outlets; (3) enhanced press release enhancement to ensure maximum impact; (4) social media distribution via IBN to millions of social media followers; and (5) a full array of tailored corporate communications solutions. With broad reach and a seasoned team of contributing journalists and writers, CNW is uniquely positioned to best serve private and public companies that want to reach a wide audience of investors, influencers, consumers, journalists and the general public. By cutting through the overload of information in today’s market, CNW brings its clients unparalleled recognition and brand awareness. CNW is where breaking news, insightful content and actionable information converge.

To receive SMS alerts from CNW, text CANNABIS to 888-902-4192 (U.S. Mobile Phones Only)

For more information, please visit https://www.CannabisNewsWire.com

Please see full terms of use and disclaimers on the CannabisNewsWire website applicable to all content provided by CNW, wherever published or re-published: https://www.CannabisNewsWire.com/Disclaimer

CannabisNewsWire

Denver, CO

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.com

CannabisNewsWire is powered by IBN

Recent Comments