by Grow Up Conference | Nov 18, 2024 | Media Partners, Psychedelic News Wire

A new study has investigated how effective psychedelic-assisted therapy is in managing various treatment-resistant mental conditions. The researchers determined that these therapy sessions, particularly those that involved psilocybin or LSD, substantially improved symptoms of depression.

They also found that individuals who were relaxed during their sessions experienced noticeable effects. Prior to their study, the researchers posited that having a positive experience during one’s therapy session or feeling relaxed contributed to the therapeutic effects of psychedelic therapy.

For their study, the researchers obtained data from 2 groups; twenty-eight patients taking part in psychedelic-assisted therapy and twenty-eight healthy participants who were part of a separate trial. Individuals in the former group included those diagnosed with treatment-resistant mental health conditions like anxiety and depression who hadn’t benefitted from traditional treatments.

Prior to their therapy sessions, every patient met with their psychiatrist two times to discuss their psychiatric history, any complaints they may have had and their therapy goals. The psychiatrists also offered information on the negative and positive effects of consuming psychedelics as well as how any issues that arose could be managed.

For their psychedelic therapy session, professionals administered a dose of either psilocybin or LSD to patients in a comfortable, quiet room. Each was encouraged to relax, in addition to rating different features of their experience hourly. This included negative or positive feelings, overall intensity of effects, and relaxation levels.

After the sessions, their symptoms of depression were measured and compared to the before results, which allowed researchers to observe any changes in depressive symptoms or mood. Unlike this group, the control group wasn’t asked to rate their relaxation levels after their psychedelic therapy sessions.

In their report, the researchers explained that they recorded a decrease in symptoms of depression among patients.

The improvement was noticeable even a week after their sessions, which suggests that this therapy’s antidepressant effects may last even after the session. This offers hope to patients who’ve not benefitted from conventional treatments.

They also found the strongest forecaster of positive mental health outcomes to be relaxation, explaining that individuals who felt relaxed in their sessions demonstrated the highest reductions in their symptoms of depression. This, the researchers noted, suggests that the level of ease and comfort patients experienced as well as the quality of the therapy environment may be crucial to the treatment’s success.

In addition to this, the researchers found that this improvement wasn’t associated with the usual features of a psychedelic experience like ego dissolution or mystical insights. This, they theorize, could be because the patients experienced less intense effects due to the long-term impact of psychiatric drugs on brain function.

In their report, the researchers suggest looking into ways to increase relaxation during therapy sessions in a bid to boost the therapy’s benefits. The researchers’ findings were reported in the Journal of Psychopharmacology.

It would be interesting to learn how psychedelic drug development companies like Mind Medicine Inc. (NASDAQ: MNMD) (NEO: MMED) (DE: MMQ) think about the impact of set and setting factors like relaxation upon the effectiveness of the formulations they are working on.

About PsychedelicNewsWire

PsychedelicNewsWire (“PNW”) is a specialized communications platform with a focus on all aspects of psychedelics and the latest developments and advances in the psychedelics sector. It is one of 60+ brands within the Dynamic Brand Portfolio @ IBN that delivers: (1) access to a vast network of wire solutions via InvestorWire to efficiently and effectively reach a myriad of target markets, demographics and diverse industries; (2) article and editorial syndication to 5,000+ outlets; (3) enhanced press release enhancement to ensure maximum impact; (4) social media distribution via IBN to millions of social media followers; and (5) a full array of tailored corporate communications solutions. With broad reach and a seasoned team of contributing journalists and writers, PNW is uniquely positioned to best serve private and public companies that want to reach a wide audience of investors, influencers, consumers, journalists and the general public. By cutting through the overload of information in today’s market, PNW brings its clients unparalleled recognition and brand awareness. PNW is where breaking news, insightful content and actionable information converge.

To receive SMS alerts from PsychedelicNewsWire, text “Groovy” to 888-902-4192 (U.S. Mobile Phones Only)

For more information, please visit https://www.PsychedelicNewsWire.com

Please see full terms of use and disclaimers on the PsychedelicNewsWire website applicable to all content provided by PNW, wherever published or re-published: https://www.PsychedelicNewsWire.com/Disclaimer

PsychedelicNewsWire

San Francisco, CA

www.PsychedelicNewsWire.com

415.949.5050 Office

Editor@PsychedelicNewsWire.com

PsychedelicNewsWire is powered by IBN

by Grow Up Conference | Nov 18, 2024 | Media Partners, Stratcann

Following a strike announcement by the union representing Canada Post workers, cannabis companies in Canada say they are taking steps to ensure customers can still receive their cannabis orders.

The Canadian Union of Postal Workers (CUPW) announced on November 15 that more than 55,000 postal workers in Canada were going on strike, asking for, among other things, fair wages and a safe working environment.

Canada Post will not be processing or delivering mail, and new items will not be accepted until the strike ends.

Impact on delivery

The shutdown will affect many businesses and services in Canada, including companies and retailers that ship cannabis products across the country. In Canada, the primary way people receive cannabis for medical purposes is by ordering directly from producers or third-party distributors who often use Canada Post or Purolator to get their products to medical patients.

Many non-medical retailers, including provincially-run cannabis stores, also often rely on Canada Post to deliver orders to customers.

A spokesperson for Tilray, a medical cannabis provider in Canada, tells StratCann that the company has plans to find new shipping options for patients.

“Tilray acknowledges the ongoing Canada Post strike and its potential impact on our patients’ access to medical cannabis. We recognize that our patients depend on a reliable supply of medicine, and we are taking proactive measures to ensure their well-being is prioritized during this time.

“To minimize any potential disruptions, Tilray will be utilizing alternative shipping methods to ensure that our patients continue to receive their much-needed medication. Our team understands the importance of timely delivery, and we are committed to ensuring that our patients receive their medical cannabis orders without interruption. We want to reassure our patients that there will be no incremental cost to them for this service.”

A media representative with the SQDC in Quebec, which is the only legal non-medical online cannabis seller in the province, says most of its customers can utilize same-day delivery to avoid any delays due to the strike.

“We hope Canada Post and their workers will find a settlement that will suit them both,” the representative tells StratCann, noting that only six percent of the SQDC’s sales are made online.

“Of those transactions, 20% of our delivery won’t be covered by other delivery options, but there still may be a store nearby….SQDC already offers a 90-minutes or same-day delivery service to several areas. We encourage our customers to rely on those services or to pick up their products at their nearest stores (click and collect).”

Chester Ku-Lea, the head of marketing at Herbal Dispatch, a medical cannabis provider located in BC, says the company is in the process of taking steps to create shipping alternatives, including using FedEx.

Nationwide job action

He says they were aware the strike was a possibility, but the company was caught off guard by the nature of the strike and its immediate impact across Canada. The expectation, he says, is that Canada Post would use rolling or rotating strikes. In the event of rotating strikes, Canada Post would continue processing and delivering packages in areas where there was no strike. Today’s announcement, however, was for a full nationwide job action.

“What caught us by surprise is that when there’s a strike notice it’s usually a rolling strike so services are delayed rather than closed, so that was news to us. We expected a rolling strike.”

A notice on Aurora Cannabis’ medical cannabis portal says that all patient orders have now defaulted to Purolator for delivery due to the strike. Patients will need to ensure they have a physical address to mail to, not a PO Box.

The union representing Purolator workers has said they will not handle mail that originated with Canada Post in an act of solidarity. However, shipments can be placed through Purolator without first going through Canada Post. Purolator is a subsidiary of Canada Post.

FedEx is not involved in the strike.

by Grow Up Conference | Nov 17, 2024 | Media Partners, The New Agora

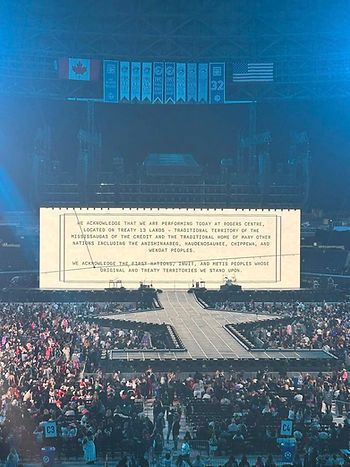

Taylor Swift’s Land Acknowledgement

By: Johnny Hawke

Silly “Indians” always fooled and mesmerized by Whitemans Tricks. This ain’t Taylors Land Acknowledgement this Statement is from Roger’s Communications Inc where it is likely included in her contract for Roger’s to express its commitment towards Truth and Reconciliation.

This is considered an “exclusive advertisement” in a lucrative “real estate space” without a doubt valued at an estimated few million where Rogers Inc will write this up as a charitable donation and donate some funds to a charity engaged with Indigenous initiatives to get a tax break.

Corporations can claim a deduction for charitable donations of up to 75% of their net income for the year. Tim Hortons does this with it’s Trauma Donut Campaign on “Orange Shirt” Day.

Truth and Reconciliation is Big Business, an Industry where Yes! the system “Gives Back” after ensuring tax breaks to recover any loss. Donations go to the Non-Profit Industrial Complex of Charitable Orgs that are also huge Corporations. Funds then go through a bureaucracy to be finally distributed to smaller community non-profit orgs. Any effective projects of actual Truth and Reconciliation only receive crumbs as funds have to be spread out also the Non-Profit Industrial Complex will only fund Canada’s “Good Little Indian.”

At the end of the day, Corps like Rogers, the Oil and DeForestation Industries although they are funding and sponsoring things like INDSPIRE Awards, Powwows and giving charitable donations are still exploiting our territories, depleting resources and removing us from our Territories.

Reconciliation is not a word that was randomly chosen to reflect this initiative of Canada’s Truth and Reconciliation Commission in 2008. “Reconciliation” is the “Sacrament of Penance” of the Roman Catholic Church. Reconciliation means “to come back under god” and penance means “voluntary self punishment”. The Sacrament of Penance is also the monetization of Sin and is the process of modern day Courts. The Roman Catholic Church claims to be the representative of God on Earth. There are many of our People prancing around in Ribbon Shirts and Ribbon Skirts employed under Truth and Reconciliation to help bring others back under God, “the crown” monetizing the sins of the Church. This is what is being accepted when Indians accept the scheme of Truth and Reconciliation.

by Grow Up Conference | Nov 17, 2024 | Media Partners, Stratcann

The BC Government is seeking to seize six properties they say are connected to the proceeds of illicit cannabis production.

Court records show that, following an investigation, the RCMP executed a search warrant at a house in Burnaby on February 1, 2024. In that search, police located several hundred cannabis plants, equipment related to growing cannabis, and more than 14 kilograms of dried cannabis, as well as product labels, packaging materials, scales, and currency.

Then, on February 9, 2024, according to court documents, the RCMP executed a search warrant at a second residential location in Burnaby, where police also discovered several hundred cannabis plants, growing equipment, more than 30 kilograms of dried cannabis, a gun, ammunition, and a bulletproof vest, as well as currency.

The provincial government alleges that no cannabis licences of any kind were associated with either property at the time. The defendants in the case are Jacky Yen Chuang and Li Hua Julie Chen.

The government argues that both properties and four others in Richmond, Abbotsford, and Burnaby are proceeds and instruments of unlawful activity. Some or all the funds used to acquire and/or maintain these properties were proceeds of the unlawful activity, continues the government’s argument, and/or tax evasion in breach of the Income Tax Act.

The allegations have yet to be proven in court.

In an unrelated case, the owners of a cannabis store, the S&M Medicinal Sweet Shoppe in Gibsons, BC, that was raided by BC Community Safety Unit Officers (CSU) in 2020 continue to challenge that raid and associated penalties.

The store owners, Michelle Sikora and Doug Sikora, filed a petition in June 2024, seeking to have the fine levied by the CSU to be retracted. In addition, in 2020, Michelle Sikora sought to have all cannabis seized from their store by the CSU be returned.

The petitioner’s argument was that, in part, the BC government’s actions violated their Charter rights. That first application was denied in 2021, with the provincial government finding that there was no evidence that Sikora had any valid licence or permit for the cannabis.

Then, in December 2021, both petitioners were each issued a Notice of Administration Penalty (AMP) for $118,919.10. This amount was based on the estimated value of seized cannabis being $54,459.55. The government calculates AMP penalties by doubling the value of seized material from a store operating without a licence from the province.

In January 2022, the couple challenged the monetary penalty by requesting an administrative hearing while again furthering their Charter argument, referencing the R v Smith case.

In June 2023, the deputy director of the CSU refined the administrative penalty, issuing the amount only to the corporate petitioner, not two each of the Sikora’s individually. The director also rejected the petitioner’s claim that the search and seizure by the CSU was in violation of sections 7, 8, and 11 of the charter.

The new monetary penalty applied to the corporate petitioner was $105,873.86 based on the estimated retail value of the seized cannabis of $52,936.98.

In June 2024, the petitioners then filed a case at the bar seeking to have the administrative penalty retracted and again sought to have the seized cannabis returned.

The provincial government’s representatives again denied the merits of these arguments, seeking to have the petition denied in a filing in October 2024.

A ruling in the case is pending.

by Grow Up Conference | Nov 16, 2024 | Media Partners, The New Agora

President Musk and Assistant Secretary Trump

– The Real Pecking Order?

By Julian Rose

Well, those with the most beef lead the herd. That sounds like the primitive form of leadership adopted before mankind grew up a bit. The era when warriors and physical prowess alone decided the pecking order.

However, over a few thousand years people progressed and the powers required for remaining king of the castle changed.

Those with the ability for intellectual reasoning overcame purely physical strength and eventually those with a commercial penchant pushed aside the intellectuals.

Only a few hundred years ago we in the West had an era of great advances in the arts and in self discovery, known as the Renaissance, in which superstition and religious dogma were eclipsed by a dynamic exploration of both the physical and psycho-spiritual worlds.

Science emerged as a discipline in search of rational explanations of what makes universal life forces behave the way they do. The same with the development of medicines and systems of governance.

The integration of all these facets of human evolution promised something better and more sophisticated than rule by baseline power and control which had started the social cycle going.

But, lo and behold, emerging out of supposedly progressive political energies of North America, are symptoms of the old brute power game once again taking centre stage.

Only now it is not individual physical strength, but individual financial strength that aims to rule the day. Hence America welcomes an era of ‘billionaire presidents of power’ to occupy the throne of domestic and globalist influence.

In this macho world of ‘he who has the money controls the politics’ it looks like Musk will come out at the top of the pyramid and Trump will slot in behind him.

We know that banks, corporations and intelligence services actually run the modern world’s daily affairs, but now we have sheer individual wealth and prestige claiming their own unique powers of intervention on the world stage.

One entrepreneurial billionaire applauds another such determined billionaire in a game of mutual back slapping. George Soros, Bill Gates and Jeff Bezos are among another clique from the same stable.

So Trump gives Musk the priviledge of intervening in the affairs of State; possibly even setting the agenda in some areas. And Musk hails triumphant Trump by pouring money into his political fighting funds.

None of this has anything to do with merit, you understand. Unless making a financial killing is considered meritorious in its own right. Something that seems to have become an integral part of ‘The American Dream’.

Musk’s Tesla electric car business is seemingly not favoured by Trump. The supposedly liberal philosophy behind the ‘X’ social media operation also does not go down well.

We don’t know what the EMF microwaving satellite spy in the sky extravaganza is thought of by Trump – nor Musk’s ‘smart’ (arsed) AI agenda. But he does not seem to have his hopes pinned on the cyborgian transhuman future which Musk has in mind for us.

However, one can be pretty sure that Trump admires Musk quite simply because he’s the richest man in the world. And that sort of admiration leads to the complete abandonment of sobriety.

Wealth is mesmerising. Extreme wealth is intoxicating. And because most of mankind is equally mesmerized by these beasts of Mammon, they find a ready audience wherever they go, whatever they do and say.

They worship themselves, each other and their deeply ingrained illusions of power; and this gives them an aura of invincibility in the eyes of billions of aspiring materialists who see grandiose pomposity as the very pinnacle of ‘success’.

The dominance of a politically motivated billionaire elite goes beyond globalism, as we know it today. It belongs to the realm of ‘self congratulating’ dictatorship and despotism.

It is a return to the age when physical strength dominated tribal life – except that now the tool of domination is not a powerful physique but vast individual wealth.

Collective attainment of such wealth has been spearheaded by transnational and multinational corporations over the past few decades. This form of wealth gathering requires a degree of team work and shared financial management.

But the individual despot likes to go it alone – and nobody, or almost nobody, tries to stop him. Because if one’s life goals are essentially materialistic, somewhere inside one harbours the same dream as the despot.

So here we are.

Many today long to see – and to feel respect for – some genuine leadership qualities in those who strut the world stage. So they imbue these actors with qualities they do not possess, because the psychological need to feel protected and cared for by some father figure is a dominant emotional condition, particularly in times of great uncertainty.

Some may argue that such elite figureheads represent resistance to a quasi governmental and corporate take over. A brake against the deep state architects of control establishing their cybernetic New World Order.

But this theory fails to hold water, since the individual despots operate entirely within the parameters of the status quo. They do not stand for a revolutionary change of attitude and redirected goal of life that constitutes the only way the broad swathe of humanity can find liberation and emancipation. They simply rearrange the deck chairs on the Titanic.

Thus, once again, we come face to face with an indisputable truth. The true values upon which to build a community, society, nation and world – are not materialistic in nature, but are spiritual.

As long as ‘leaders’ flaunt their financial vanities and pretend to offer alternatives to the blue pill Matrix, the world, and all its life forms, will continue to slide into an irrevocable state of oblivion.

As long as those in power use psychic and financial exploitation to cause others to suffer inferiority complexes and feelings of being lesser human beings – as long as this form of inequality prevails as the norm – then we cannot hope for the grand redistribution of wealth and social status that is the only way to set the world on its true path of socioeconomic and spiritual emancipation.

While the speculation and second guessing of what will next emerge along the linear pathway of political subterfuge rages on – the real work of humanity is consigned to the shadows, smothered, fractured – and barely visible amongst the superficial ebb and flow of various shades of criminality.

I prefer to view this exhibition of Muskian type megalomania as the last hurrah of a dying era. The final burst of individual two dimensional tunnel vision power compulsion.

Serious people, with their eyes set on both personal and collective transformation, recognise that the change which is most deeply longed for is is the realisation of our highest body, mind and spirit aspirations. A route that frees one from the constant tug of the ego and the seductive allure of narcissism.

This is the way of truth which stands in stark contrast with the battle of the egos that rages on the world stage.

Just because someone is in possession of a large amount of money does not mean he/she has something useful to say. In fact it generally means the opposite.

The kind of attention to overt materialism required to elevate someone into the category of billionaire is proportionate to the lack of wisdom such a person exhibits. How else could it be?

Unless and until spiritual and humanitarian values are nurtured into having a leading role in our daily lives, no genuine life improvements can take place.

Yet the majority of ‘educated’ people still strain their ears to catch every last word of purposeful deception spewed out into an already over polluted mass media market place by the Musks, Trumps and Gates’s of this world. While completely ignoring outstanding words of wisdom that bring clarity and sanity into meaningful focus.

Here’s a pearl of such wisdom to hold onto at a time when the bombastic and belligerent kings of spin crowd out the courageous purveyors of truth:

“Civilization, in the real sense of the term, consists not in the multiplication, but in the deliberate and voluntary reduction of wants” Mahatma Gandhi

Julian Rose is an early pioneer of UK organic farming, a writer, broadcaster and international activist. He is author of the acclaimed title ‘Overcoming the Robotic Mind’ and other works.

Do visit his website www.julianrose.info

by Grow Up Conference | Nov 16, 2024 | Media Partners, Stratcann

This week at StratCann, we covered the most recent report from Israel regarding allegations of “product dumping” from Canadian cannabis producers (more on this next week).

We also looked into the recent micro licence issued by the Kahnawà:ke Cannabis Control Board, the second cannabis production licence the KCCB has issued in coordination with Health Canada.

A clinical psychologist says he has concerns with a recent cannabis marketing campaign from the NSLC, and Tilray’s Aphria RX facility launched its first German-grown cannabis.

The BC Government is looking to seize two properties they say are connected to cannabis trafficking, and a law firm alleges that the SQDC broke provincial rules with its “rotating” SKU pricing.

In our profile series, we featured Todd Veri from Cedar Bug Farms in BC and his life mission to grow the most affordable cannabis in Canada.

It was another busy week in Canadian cannabis finance news, with Cronos, Rubicon Organics, Medipharm Labs, and Avicanna releasing their Q3 2024 reports and the SQDC releasing their Q2 2024 report. Also, Delta 9 has selected a bid from its SISP process, still to be approved by the court on November 15 (results pending).

In law enforcement news, police in Ajax, ON, are searching for three suspects in a cannabis store arson, while an assault with a knife led to two arrests and a raid at an unlicensed cannabis store in Nova Scotia.

Police in Calgary arrested a man who was wanted in connection with several cannabis store robberies earlier this year, while police in Kingston, Ontario raided an unlicensed store, and CBSA authorities seized 40 kg of cannabis on its way to the UK. Police in Quebec made arrests in connection to illicit cannabis.

In other cannabis news

Willow Biosciences Inc. announced that it has advanced work on its proprietary yeast strain for production of THC and plans to commercially launch in the Canadian market.

Radio Canada is reminding people to be wary of cannabis poisoning incidents with their pets, especially dags. D’ya like dags?

City News says more Canadians are aware cannabis can impair driving abilities but notes many still do it.

Dave Berry, the Executive VP at AGLC, spoke with local media about the agency’s new Forget Bad Bud campaign.

The University of Prince Edward Island profiled entrepreneur Sarra Jayasinghe, who owns Ricci Cannabis, which produces cannabis-infused and non-alcoholic wine beverages.

The Journal at Queen’s University says cannabis consumers feel like second-class citizens in a culture awash in overconsumption of booze.

Organigram CEO Beena Goldenberg has once again penned an article on the challenges the company faces with regulations and taxes.

The Honourable Lorne Kusugak is now the Minister responsible for the Nunavut Liquor and Cannabis Commission and the Minister responsible for the Nunavut Liquor and Cannabis Board.

The Kahnawá:ke Cannabis Control Board (KCCB) will be conducting in-person consultations with residents living in close proximity to recently proposed cannabis store locations.

International cannabis news

Conservatives in Germany say they would reverse legalization. “We don’t want to smoke pot, we want safety and order,” said Tino Sorge, a health policy spokesman for the German center-right CDU/CSU group, whose party has pledged to overturn the legalization of cannabis if they win power in February’s election.

Italy’s flourishing “cannabis light” (hemp) industry risks being uprooted this year when Prime Minister Giorgia Meloni intends to push a bill through parliament to ban any product deriving from the hemp flower. While cannabis production is illegal in Italy, parliament eight years ago authorized trade in hemp.

Within days of seizing 170 pounds of cannabis destined for the United Kingdom, US Customs and Border Protection officers seized 343 more pounds of UK-bound cannabis at an international shipping service facility in Delaware County, PA.

And finally, The American Journal of Public Health published a report on US state recreational and medical cannabis delivery laws.

by Grow Up Conference | Nov 15, 2024 | Media Partners, Stratcann

The Sûreté du Québec’s Cannabis Smuggling Investigation Service, in collaboration with the Québec City Police Department, conducted searches on the morning Thursday, November 14 in connection with illicit cannabis and other substances.

The operation, say police, sought to dismantle a criminal organization engaged in the production, distribution and sale of illicit cannabis and other substances in the Portneuf region between Quebec City and Trois-Rivières.

Police arrested four, two women aged 26 and 32 and two men, both aged 32 in the course of four searches of two residences located in Donnacona and Cap-Santé, a business located in Portneuf, a storage facility located in Donnacona, and a vehicle.

The operation involved around thirty police officers, including investigators, SIJ technicians and dog handlers from the Sûreté du Québec.

The ACCES Cannabis program (Actions Concertées pour Contrer les Économies Souterraines) is a provincial initiative set up in 2018 by the Ministry of Public Security, to combat illicit cannabis operations.

Earlier this month, police in Quebec arrested six and seized a large quantity of cannabis in connection with what they say was a hash processing facility.

Related Articles

by Grow Up Conference | Nov 15, 2024 | Media Partners, Stratcann

A law firm in Quebec has modified an application for a class action suit against the Société québécoise du cannabis (SQDC) relating to how the provincial cannabis retailer priced their products.

On November 15, 2024, lawyers at Groupe SGF amended an application for authorization to include what they say is a claim that the SQDC admitted they sold “rotating” SKUs at a lower price than regular SKUs, potentially violating provincial cannabis rules.

Groupe SGF first filed a class action suit against the SQDC earlier this year on behalf of the plaintiff, Gabriel Bélanger, alleging the provincial cannabis agency does not comply with the Consumer Protection Act (CPA). In that case, Bélanger argues that the SQDC forces people to make “blind purchases” of cannabis products listed on their website.

In a press release last May, the SQDC said it was taking the time to look into the issue properly but noted that its initial comment was that it disagreed with the applicant’s claims and intended to contest the application.

Lawyers at Groupe SGF say they believe that the class action is now open to all cannabis consumers who purchased so-called “Non-Rotating” products from the SQDC, whether online or in-store. Groupe SGF says this would have meant consumers paid a higher price for the same product than if it had been put in a product with a variety displayed as “in rotation”.

The lawyers for the plaintiff, Mr. Gabriel Bélanger, believe that all of this is in violation of the prohibition on providing a discount to the consumer on the price of cannabis as per Quebec’s Cannabis Regulation Act.

This amendment may still require approval by the Court, notes Bélanger’s lawyers, who believe that at this stage, such a request should be granted. If not granted, they say they will file a new class action.

The original class action includes anyone who has purchased cannabis in the “dried flower” and “pre-rolled” categories for which the strain displayed on the SQDC website has been “strain rotating” since October 17, 2018.

A media representative for SQDC tells StratCann that the agency will take the time to review those allegations.

“However, we remain confident that we comply fully with the law and that we respect our customers’ interests,” the representative added in an email.

by Grow Up Conference | Nov 15, 2024 | Media Partners, The New Agora

Shills, Liars & Freaks – The reasons why

By Sherry Swiney

In the beginning was the Word. So powerful is this statement the dark side does not want humans to recognize the power in words. Words are frequencies that come from our thoughts, feelings, and deeds. The power behind those frequencies is provoked by intention.

Please keep that in mind as you read this article about shills, liars and freaks, and the reasons why these occur in humanity.

As mentioned several times WE ARE IN A GAME. To quote from a previous blog written in 2021; “The people on the ground, aka the ground crew, are wiser and smarter than those who are at the top, leading the show. We don’t need them. They need us. This is a real problem for the leaders.”

You can find more writing about this Game here https://keyholejourney.wordpress.com//?s=Game&search=Go

Indeed we do have a predator in our midst that wants to render us docile, but far from docile are those who recognize the Game being played. How do they make you docile? You get traumatized when you first arrive on Earth. See We came in strong – what happened?

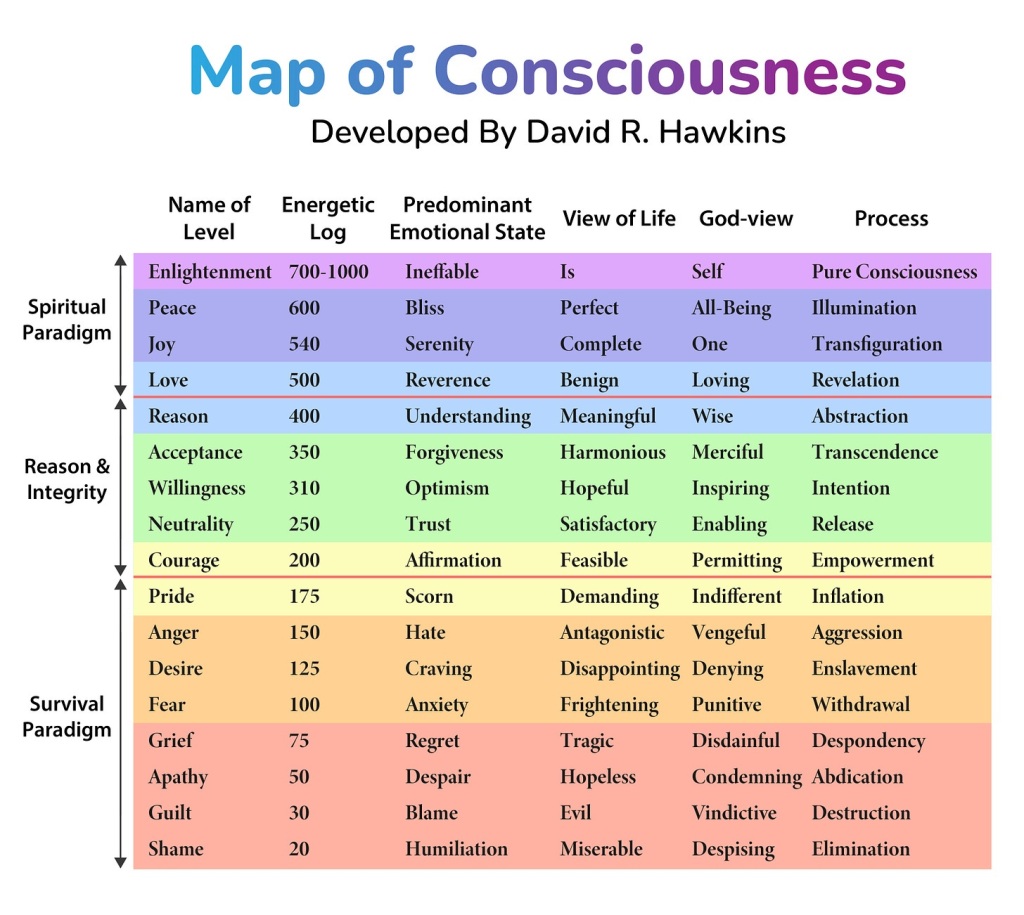

Bottom line: we were traumatized from birth. The map below shows the frequency level for each emotion. If you read across the top you will see the frequency level (energetic log), as well as other categories said frequency demonstrates itself. The goal here is for everyone to raise their frequency from Shame (20 Hz) to a minimum of Courage (200 Hz). Frequency is the number of complete waves passing per unit of time. It is measured in Hertz (Hz), the number per second.

Remember, when we call others names, good or bad, we are seeing in them something we like or do not like in ourselves. Whether we know it or not, it’s a reflection thing like a mirror. If, in your view, someone does something wrong, that’s not the time to call them names. It does not accomplish anything useful. Instead, that’s the time to sit them down and tell them what they did that you perceive as wrong. Allow them to either admit it was wrong or to explain why they did the “dirty deed”.

We never know the whole story.

This is not to say giving everyone the benefit of the doubt is always the best way especially if that will result in you becoming a door mat. Don’t do that. Becoming a door mat is a result of your own low self-esteem. You should examine that yourself or get help with such a discovery.

However, giving a person this benefit first, questioning why they did the thing may result in an explanation for which you had not considered. What if the thing turns out not to be wrong? What if the explanation brings you to a different conclusion about the thing that makes you grow in awareness? What if the explanation reveals the person is in turmoil from some kind of pain? And what if you can help them get through it?

There are many reasons people do the things they do. I would say that most of it comes from being abused and traumatized from childhood. Often we will see an adult acting like a child. I learned why that happens from my own experience as I was in the healing process from being attacked by the dark side. I learned the psyche gets stuck at the age in which the trauma happened. Since most traumatizations happen in childhood, no wonder people revert back when triggered!

Reminder: we are in a movie – a Game – that I’ve been mentioning for a long time. Readers who have been with me since the mid 1990’s may recall “The Game” mentioned several times.

The last thing I want is for people to be fooled. This is why I read, watch and listen to all sides of a coin and as Patrick often said, there are more than two sides to a coin.

Make America Healthy Again push:

Now, don’t take me wrong. I am thrilled that RFK, Jr. and team have contacted some straight up farmers, like Joel Salatin (fast forward to 1:28:56), who knows how to do regenerative farming as well as the financial side of things. I am thrilled there’s a potential for Americans to be Healthy Again. It will be wonderful IF that all happens for all Americans. Hopefully, this idea will spread across the world. When all of us are healthy, our collective minds will be sharper and we will be able to see more clearly what’s happening. We will be less-likely to be fooled any more.

Since the (s) election results, it appears the people in America have been invited to nominate people for different jobs in the Trump administration on the Make America Healthy Again campaign. If interested, check this out here: https://nominees.mahanow.org/. I learned this from a substack post by Sasha Latypova. For those who don’t know, Sasha blew the whistle on military involvement with the Covid vaccine. You may read her substack here: https://substack.com/@sashalatypova

Unfortunately, I have not found such a website for people to nominate candidates for Trump’s 2024 cabinet and other positions. If you know of one, please let everyone know in the comments.

The health of our population is very important because being healthy in body leads to being healthy in mind and soul. Such will often enough cause one to decide to look for the root cause of their uneasiness. They begin searching for remedies other than big pharma. They often search for an emotional reason which is always a great idea. In that process, they may learn how traumatized they were most of their life.

Our State of the Nation appears to be a mix of upcoming chaos by the Democrat side and progress/confusion on the Republican side.

We must stay on our toes, realizing that we need to keep both Trump and RFK, Jr. and their feet to the fire.

As Americans who want peace, freedom and good health in our world, we need to stay on our toes as well. We cannot allow the predator to render us docile again.

We are fighting a spiritual war and that is not a meaningless statement. It means the spirits on Earth and not on Earth are in a battle for survival. Some of us know how the energetics works, and some of us don’t. I would say that the non-humans know more about it than we do. In the spiritual realm, there are no places except the places created by the spirits within that realm. We do the same thing here on Earth but we mostly do it unconsciously. That’s why it is possible for humans to be played so easily. The dark side relies on its knowledge of humans being traumatized and they use it so we destroy ourselves.

Most of us have no idea who we are. It is important we heal all wounds deep within and when we do that, we return to honoring that important aspect of Self. We regain our natural powers in this Universe to heal ourselves and others from the inside out.

Else we will just get played again by more Shills, Liars & Freaks. Could we not do that this time, please? Our emotions are the turning key. Hive Mind not Allowed, okay?

Namaste,

Sherry

Please visit my website: https://www.keyholejourney.com

by Grow Up Conference | Nov 15, 2024 | Cannabis News Wire, Media Partners

With recent shifts in political power, many are questioning if a Republican-led government might better support cannabis reform than one led by Democrats. As former President Donald Trump returns to the White House and Republicans take control of the Senate, the $32 billion U.S. cannabis industry stands at a crucial point, uncertain about the future of legalization.

The recent elections delivered three defeats for state-level adult-use cannabis legalization. This shift may signal a transition from state-driven legalization efforts toward a more federal approach in Washington, D.C.

Advocates and lobbyists now face the challenge of uniting and presenting a cohesive message to persuade conservative legislators to support reform on a federal level. David Culver, director of government affairs at the U.S. Marijuana Council, noted that while the results were disappointing, there are still potential opportunities to make progress next year.

While Trump’s support for states’ cannabis legalization and Biden’s marijuana rescheduling initiative offer a glimmer of hope, obstacles remain, especially with conservative resistance.

In contrast to recreational marijuana, medical marijuana initiatives are still gaining ground in some states. For example, Nebraska voters decisively supported medical cannabis, although a pending court case may impact the final outcome.

However, the path for recreational use has not been as favorable. In Florida, voters rejected a highly-funded adult-use measure, supported by the cannabis industry, with the opposition led by GOP Governor Ron DeSantis. Similarly, voters in both North and South Dakota turned down industry-backed proposals for adult-use legalization.

These recent defeats raise critical questions about whether marijuana reform campaigns can return to these states and if the industry will be able to fund future campaigns following such costly setbacks.

The current political landscape suggests that federal reform will become the next major focus for cannabis advocates. Republicans are expected to take control of the White House and perhaps both houses of Congress by January. Marijuana policy will probably be neglected until important decisions are made, such as choosing the next U.S. Attorney General or the DEA chief.

Some cultural concerns have also complicated progress for marijuana reform. According to the co-executive director of the Coalition for Cannabis Policy, Education, and Reform co-executive, Shanita Penny, conservative lawmakers have raised issues about the widespread public use of marijuana in D.C., with some expressing frustration about cannabis smells outdoors. Florida voters also echoed similar concerns, which may have influenced their opposition to the recent ballot measure.

The division within the broader cannabis industry itself is another factor slowing down reform efforts. Disagreements between regulated cannabis businesses and hemp operators continue to muddy the industry’s message. A debate has emerged over the “Farm Bill loophole,” which some cannabis advocates wish to close to restrict certain hemp-derived THC products.

Firms like Cresco Labs Inc. (CSE: CL) (OTCQX: CRLBF) will be watching to see how the changes on Capitol Hill impact the rate at which marijuana policy changes are introduced, discussed and possibly implemented.

About CNW420

CNW420 spotlights the latest developments in the rapidly evolving cannabis industry through the release of an article each business day at 4:20 p.m. Eastern – a tribute to the time synonymous with cannabis culture. The concise, informative content serves as a gateway for investors interested in the legalized cannabis sector and provides updates on how regulatory developments may impact financial markets. If marijuana and the burgeoning industry surrounding it are on your radar, CNW420 is for you! Check back daily to stay up-to-date on the latest milestones in the fast -changing world of cannabis.

To receive SMS alerts from CNW, text CANNABIS to 888-902-4192 (U.S. Mobile Phones Only)

For more information, please visit https://www.CannabisNewsWire.com

Please see full terms of use and disclaimers on the CannabisNewsWire website applicable to all content provided by CNW, wherever published or re-published: https://www.CannabisNewsWire.com/Disclaimer

CannabisNewsWire

Denver, CO

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.com

CannabisNewsWire is powered by IBN

Recent Comments