by Grow Up Conference | Nov 15, 2024 | Media Partners, Stratcann

The Canada Border Services Agency (CBSA) found approximately 40 kilograms of cannabis concealed inside the luggage of a man scheduled to fly to London, UK, on October 21.

The man, 21-year-old Zubir Mahida, arrived at Toronto Pearson International Airport with a scheduled departure flight for the UK. An outbound baggage examination by the Canada Border Services Agency (CBSA) located the approximately 40 kilograms of cannabis concealed inside his luggage.

According to police, the approximate street value of the cannabis that was seized is $120,000, and the maximum sentence for cannabis importation in the UK is up to 14 years in prison.

Zubir Mahida appeared for a hearing and was released on an undertaking to appear in Brampton court on November 28, 2024.

“Reducing the flow of inbound and outbound cannabis is a priority of RCMP Toronto Airport Detachment. Cannabis is decriminalized in Canada but it is illegal to carry any amount of cannabis on international flights and amounts exceeding personal use on domestic flights,” said Inspector John McMath, Officer in Charge, RCMP Toronto Airport Detachment. “This case highlights the fact that if a passenger chooses to smuggle cannabis, serious criminal drug smuggling charges will apply.”

“Although cannabis has been legalized and regulated in Canada, it remains illegal to bring it into or take it out of the country,” added Lisa Janes, Regional Director General, Canada Border Services Agency, Greater Toronto Area Region. The CBSA is dedicated to stopping the illegitimate flow of cannabis into and out of Canada, and we are proud to continue working with the RCMP and other law enforcement partners supporting their efforts in criminal investigations and prosecutions.”

Such seizures are not uncommon. The CBSA reports seizing more than 23,553,038 grams of cannabis products in fiscal year 2023-2024 and 126,210 grams of hash.

Earlier this year, the Canadian Border Services Agency (CBSA) seized 140 pounds of cannabis at the Halifax Stanfield International Airport, destined for the UK. In January, the CBSA intercepted 310 kg of cannabis in a container exported from Canada to the UK at Montréal Marine and Rail Services.

In September, four Canadians were caught trying to bring cannabis into the UK.

The UK has seen a marked increase in seizures of cannabis from countries like Canada, the US, and Thailand in the last few years.

More than half of those arrested in 2023 (71) had flown in from US airports, while 24 came from Canada and another 24 from Thailand. Around half of all arrests (184) so far in 2024 related to cannabis that originated in Thailand, while 75 arrests related to cannabis originating from Canada and 47 to cannabis from the US.

Featured image from a seizure of Canadian cannabis in the UK earlier this year.

by Grow Up Conference | Nov 15, 2024 | Media Partners, Stratcann

Police in Kingston, Ontario, executed a search warrant at an unlicensed cannabis store on November 13, 2024, seizing a large quantity of cannabis products and arresting one person.

Kingston Police Special Services Unit say they first learned of an unlicensed cannabis store operating in the downtown core distributing illicit cannabis-based products in early November 2024.

A formal investigation was launched into the location near the intersection of Queen Street and Division Street. Investigators applied to a Justice of the Peace for a search warrant under the Cannabis Act, which was granted and subsequently executed on November 13, 2024.

Upon execution of the search warrant, police located numerous ‘point of sale’ devices, advertising signage, unstamped tobacco products and several cannabis-based products.

In total, investigators seized the following:

- 5254 grams of pre-rolled cannabis “Joints”

- 7582 grams of cannabis-infused edible gummies

- 4058 pre-packaged cannabis flower

- 1041 unstamped tobacco products

The total street value of the items seized is $170,000.

A 21-year-old Kingston resident was charged with Possession of cannabis for the purpose of selling it and Possession for use in production or distribution of illicit cannabis under the Cannabis Control Act. The accused is scheduled to appear in court on a later date.

by Grow Up Conference | Nov 15, 2024 | Media Partners, Stratcann

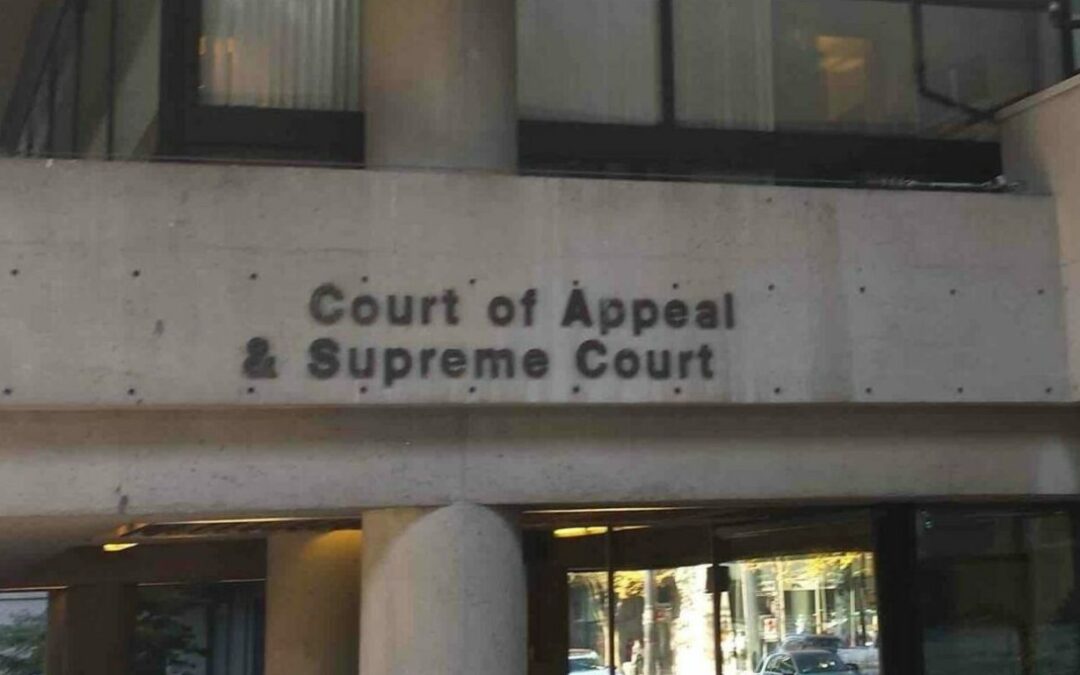

The BC Government filed a civil lawsuit in the BC Supreme Court on November 12 against a Kelowna business they say was purchased with and operating as a money laundering operation for drug trafficking, primarily cannabis.

The government is seeking to seize two properties connected to the business it says are connected to finds from illegal drug trafficking.

The province’s director of civil forfeiture says All Out Customs & Collision Ltd. in Kelowna is a front operation that does not conduct any legitimate business.

Police raided the business in December 2023, following an investigation that began in February of the same year. Police seized 8.2 kilograms of cannabis and about three kilograms of cannabis oil, as well as a smaller amount of cocaine, MDMA and psilocybin mushrooms. Police also seized $17,000 in cash. The owner of the business and the two properties the province seeks to seize, Richard Kelly Madore, was arrested at the time.

Madore has a previous cannabis-related arrest from 2012, when he was found on a logging road with $100,000 in cash and 20 kilograms of cannabis. Those charges were later downgraded to possession, a conditional sentence, and a fine, but police contend he is a “high-level” cannabis trafficker.

The BC Civil Forfeiture Office contends that one of the properties it wants to seize, Madore’s home, was purchased with the proceeds of crime, along with his All Out Customs business and property.

Last year, the BC government passed the Civil Forfeiture Amendment Act, 2023, giving it the power to begin legal proceedings against property connected to illegal cannabis grow operations. The government had pursued such cases prior to the passage of the 2023 law, as well. BC’s civil forfeiture program was created in 2006 and has come under criticism from civil liberties groups.

In December 2023, the BC Supreme Court put a pause on the province’s efforts to seize $12 million in properties connected to illegal cannabis and psilocybin dispensaries.

In May 2024, The BC Civil Forfeiture Office began civil forfeiture proceedings against two properties following investigations into the sale and distribution of illicit cannabis by a company operating in Surrey, BC.

The investigations by Surrey RCMP into the illicit sales and distribution of cannabis took place from April 2020 to February 2022. The two properties are located in Maple Ridge and Mission

The BC government filed its fourth unexplained wealth order (UWO) application in September 2024, seeking to seize $5.6 million worth of properties connected to what police say was a large, illegal cannabis production and distribution business.

h/t Castanet

by Grow Up Conference | Nov 15, 2024 | Media Partners, Stratcann

Avicanna Inc. reported net revenues of $6.3 million at the end of Q3 2024, with a comprehensive loss of $922,077, down from a loss of just over $1 million in the same period in 2023 and from a $2.8 million loss in the previous quarter.

The company is an international biopharmaceutical company focused on cannabinoid-based products and operates the medical cannabis care platform MyMedi.ca, the Medical Cannabis brand RHO Phyto, as well as focusing on R&D and clinical development.

The company acquired Medical Cannabis by Shoppers Drug Mart in 2023, which it transitioned to the MyMedi platform.

North American net revenue for the nine months ended September 30, 2024, was $17.5 million, compared to $10.4 million for the nine months ended September 30, 2023. The increase over the nine-month period was a direct result of the acquisition of Medical Cannabis by Shoppers and the introduction of MyMedi.

Of those, revenue channels in Canada for the company sold 144,756 units in the nine months ended September 30, 2024, compared to 118,265 in the same period in 2023, a 22% increase.

The company reported a $2.8 million gross margin by segment in North America in the three months ended September 30, 2024, or 51%, for a consolidated gross margin of $3.6 million including its presence in South America.

by Grow Up Conference | Nov 15, 2024 | Media Partners, Stratcann

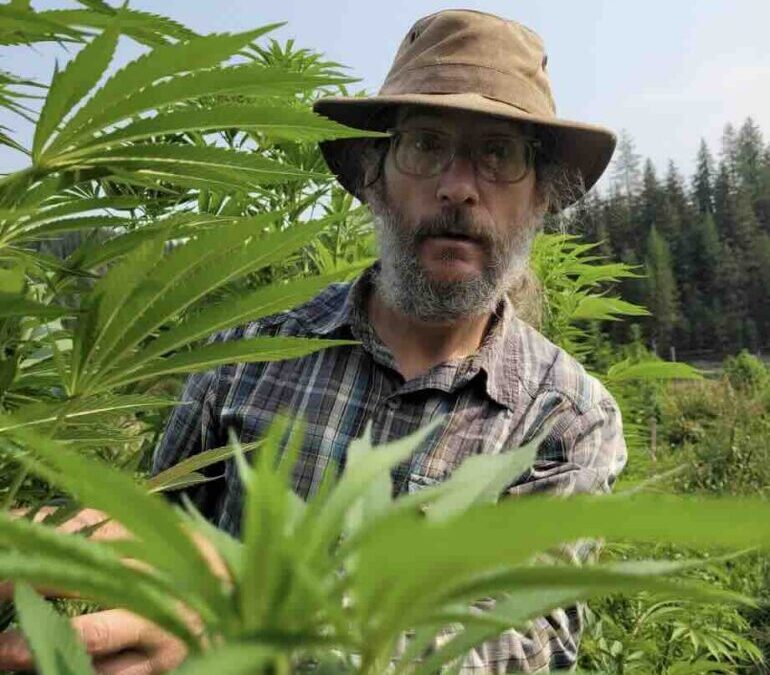

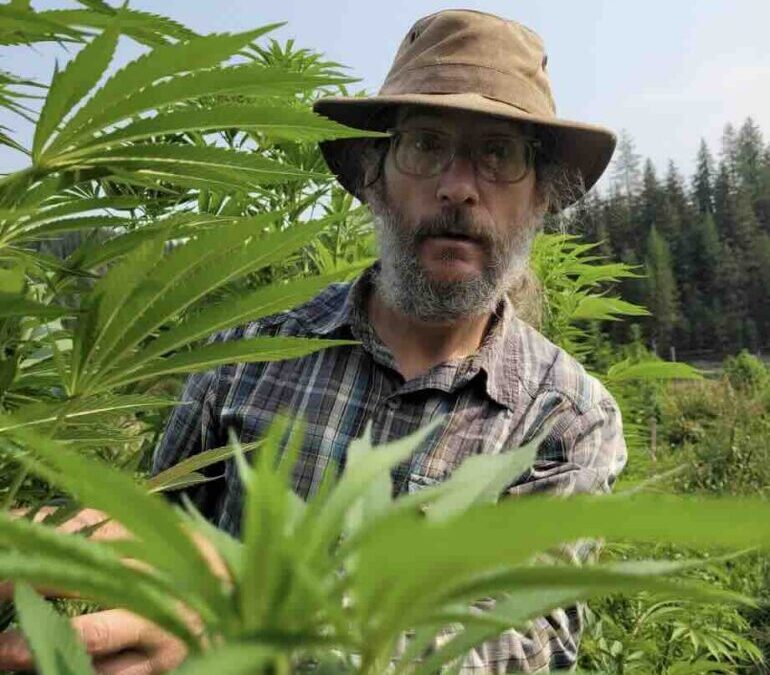

Todd Veri has been working with, and adjacent to, cannabis in BC’s Kootenay region going back decades.

When legalization lumbered its way into Canada, like many in his walk of life, he decided to take a crack at getting a federal license to grow cannabis on outdoor farms in the region.

What began as a co-op with two different farms (with plans for more) has been pared down over the years through layers of regulations and business and interpersonal challenges into a one-person operation on a small farm about one hour north of Nelson, BC.

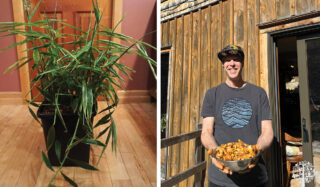

Among the goats and cows and the hay he feeds them, Todd Veri grows four acres of cannabis varieties at Cedar Bug Farms, as he’s done there for several years. Now, after more than five years of trying, learning, and adapting, Veri says he hopes this will finally be his year to bring a crop fully to market.

“This year was all about trying to put the pieces together that worked. We had a lot of challenges in previous years, but I also learned a lot along the way.”

One of those lessons was not to over-build and to see how the plants respond to being left more to their own devices. In the first few years, the farms had multiple employees working all season long to plant, weed, tend, and harvest. This year, Veri has done most of this work on his own. And that has meant learning to let a lot go.

“Weeds were a big part of it. I learned to let a lot of the wild plants just grow, which created a more beneficial micro-ecosystem that seemed to support itself, rather than spending a lot of time and money weeding and mowing.”

This move alone meant he could handle on his own what would have been handled by a team of ten in the first few years. He says that keeping costs down was always part of the plan, which is one of the reasons he chose outdoor production.

“We chose outdoor because I saw the drive to the bottom in terms of prices. The amount of overproduction was predictable. I still see outdoor as the best way to deliver something of high quality and value for people to smoke.”

Though, over the years, the entire process has taken its toll on Veri and the farm. Not only did the co-op model unravel in the first few years, but he now needs to sell the farm to cover the ongoing expenses he’s incurred to get to this point.

Despite these challenges and obstacles, Veri is one of the more optimistic people in the industry. He says he prefers to own and learn from his mistakes rather than focusing on the things he cannot change or finding external situations to blame.

“It’s been very hard. Having to sell the land I’ve been growing on is hard. But I have to stay positive, and that perspective is why I think this is still a viable business. Every year, I’ve learned what to do right and what not to do next time.

“My hope is to find someone who will buy the farm and I can continue to operate it for them, so this year’s harvest will be what I hope will prove that model.”

Veri has about one-third of his field planted this year and expects 50-80kg to be ready for sale in the coming months.

His dream has been to sell into the BC market as an outdoor, BC-grown product, but he’s also exploring other options, including the export market. Finding a market for outdoor product in Canada can be difficult, he says, but he believes that growing at a lower cost than indoor, and with a better terpene profile from the natural light, will win over consumers who may be more accustomed to indoor product.

“BC has a long history of great outdoor cannabis, especially in the Kootenays. We need a way to bring that to the legal market.”

by Grow Up Conference | Nov 15, 2024 | Cannabis News Wire, Media Partners

Earlier this week, the Missouri Court of Appeals, Eastern District, ruled that the stacking of cannabis sales taxes was unconstitutional.

The state legalized adult-use sales in 2022 when 53.1% of voters in the state approved Amendment 3, a ballot initiative that sought to legalize adult-use marijuana. The initiative also legalized the possession, purchase, consumption, manufacture, delivery and sale of cannabis for individuals aged 21 and above.

This is in addition to allowing persons with specific offenses related to cannabis to petition for release from prison or probation and parole and have their records expunged. This approval saw the state issue licenses to recreational dispensaries in February 2023, officially launching recreational cannabis sales.

Soon after this, local governments started implementing sales taxes on cannabis sales in a bid to capitalize on the new market. While imposing the 3% sales tax had been made clear, the regulation hadn’t touched on whether counties could levy an additional 3% tax stacked on the tax already imposed by a local town or city.

This loophole allowed counties like Cass and Jackson in the Kansas City area to approve a county-wide cannabis sales tax. In the St. Louis area, the St. Charles and St. Louis counties also approved county-wide cannabis sales tax.

Soon after this, Robust Missouri Dispensary 3 filed a suit disputing the additional taxes in October 2023. In the initial proceedings, the circuit court ruled that the county was allowed to impose a county-wide tax on top of any tax already imposed by a local city, town or village.

The dispensary appealed this decision in the appeals court, which issued its ruling this week. In the ruling, the 3-judge panel at the appeals court explained that only one local government was allowed to levy an additional 3% sales tax. This ruling prevents multiple governments from collecting any more retail sales taxes.

The decision was celebrated by the Missouri Cannabis Trade Association, led by Andrew Mullins, its executive director. Mullins explained that the industry could now continue contributing millions upon millions annually in sales tax revenue to local communities as well as the state.

Latest figures show that the recreational marijuana market in Missouri has reached a valuation of $1.4 billion, less than two years after its launch.

The industry group estimates that the new decision will save $3 million monthly for consumers. The Missouri Cannabis Trade Association advocates for the implementation of a safe, successful, and compliant recreational and medical use marijuana program in Missouri.

This ruling is likely to be welcomed by the wider cannabis industry, including firms like Green Thumb Industries Inc. (CSE: GTII) (OTCQX: GTBIF), since some jurisdictions have been imposing excessive taxes that end up making licensed operators non-competitive when compared to black market marijuana products.

About CannabisNewsWire

CannabisNewsWire (“CNW”) is a specialized communications platform with a focus on cannabis news and the cannabis sector. It is one of 70+ brands within the Dynamic Brand Portfolio @ IBN that delivers: (1) access to a vast network of wire solutions via InvestorWire to efficiently and effectively reach a myriad of target markets, demographics and diverse industries; (2) article and editorial syndication to 5,000+ outlets; (3) enhanced press release enhancement to ensure maximum impact; (4) social media distribution via IBN to millions of social media followers; and (5) a full array of tailored corporate communications solutions. With broad reach and a seasoned team of contributing journalists and writers, CNW is uniquely positioned to best serve private and public companies that want to reach a wide audience of investors, influencers, consumers, journalists and the general public. By cutting through the overload of information in today’s market, CNW brings its clients unparalleled recognition and brand awareness. CNW is where breaking news, insightful content and actionable information converge.

To receive SMS alerts from CNW, text CANNABIS to 888-902-4192 (U.S. Mobile Phones Only)

For more information, please visit https://www.CannabisNewsWire.com

Please see full terms of use and disclaimers on the CannabisNewsWire website applicable to all content provided by CNW, wherever published or re-published: https://www.CannabisNewsWire.com/Disclaimer

CannabisNewsWire

Denver, CO

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.com

CannabisNewsWire is powered by IBN

by Grow Up Conference | Nov 15, 2024 | Media Partners, Stratcann

Tilray Medical has launched its first commercial-grown medical cannabis flowers from its Aphria RX GmbH facility in Germany.

The product will be sold as “Grown in Germany”, explains Tilray’s chief strategy officer and head of international, Denise Faltischek.

“We are excited to launch our Made in Germany premium cannabis products, which marks a significant milestone in our mission to deliver the highest-quality medical cannabis products to patients in Germany,” adding that this helps expand the company’s brand and products in the German market.

Tilray received the first cannabis cultivation licence issued under Germany’s new Cannabis Act in July. This licence allows Aphria RX to cultivate and manufacture cannabis for medical purposes in Germany.

The American cannabis company, which operates in Canada, the United States, Europe, Australia, and Latin America, was the first to receive a cannabis production licence in the country. Canadian cannabis company Aurora and the German company Demecan are also now licensed for production in the country.

In February 2024, Germany passed the German Medical Cannabis Act, expanding the country’s medical cannabis laws.

Aphria RX has been present in the medical cannabis space in Germany since March 2019, when the company was awarded a licence for the cultivation of medical cannabis in Germany from the German Federal Institute for Drugs and Medical Devices (the “BfArM”).

Anyone who wishes to cultivate, produce, trade, import, export, dispense, sell, otherwise place on the market, obtain or acquire cannabis for medicinal purposes or cannabis for medical-scientific purposes in Germany requires a permit from the German Federal Institute for Drugs and Medical Devices.

Related Articles

by Grow Up Conference | Nov 15, 2024 | Garden Culture Magazine, Media Partners

Look no further if you are looking for superfoods that are easy to grow at home. I discovered ginger and turmeric are easy to grow and produce surprisingly large yields indoors in the Autopot system. If you are unfamiliar with Autopots, they are a gravity-fed bottom watering system. I mention them instead of growing conventionally because ginger and turmeric grow bigger and faster in this system. I tried regular pots and hand feeding, but it wasn’t the same. I have also tried to grow them outside, but they prefer the consistent tropical conditions of my grow room: 26°C and 50-60% RH.

Accidental Growing Ventures

Ginger was my first interest, and I grew it by accident. One day, I noticed an old piece of ginger on the counter sprouting a green shoot. I had been harvesting some plants that week and had my Autopots sitting without plants but still full of soil with a cut trunk. I nestled three pieces around the trunk and gave it some plain water.

Within about a week, I noticed the plant was growing. So, as I cleaned up the rest of the garden, I kept my ginger project going and planted two other pots. The plant grew and grew. Within two months, I had grown an impressive-looking plant. Ginger looks like tall grass when it grows, and knowing what prize could be lurking under the soil kept my interest piqued.

The Harvest of all Harvests

I let the plant grow for another six to eight weeks and knew it was time to harvest because all the sides of the pot were warping out under the pressure of growing roots. I had no idea what to expect with that first plant, and I was blown away! I harvested three and a half pounds of the most beautiful ginger ever. Ginger from a supermarket is brown with tough skin. But freshly harvested ginger is off-white, pale yellow, and purple when first picked. It develops the skin over a week or so when exposed to the elements.

Have you met Turmeric?

About two months into the project, I realized I needed to start more roots. I went to my local health food store because I assumed organic ginger would root better than the regular supermarket variety. I have since discovered that it all grows well, and finding ginger with little sprouts is best. Searching for the perfect ginger is how I ended up growing turmeric. It was just sitting beside the ginger, and I thought, what the hell? Turmeric grows differently than ginger; unlike the thin grass-like structure, turmeric has broad leaves similar to a palm. It takes up more room than ginger, so consider the size when planting. It takes about four to five months from root to harvest, like ginger.

Medicinal Staples

It has been seven years since my first batch of these medicinal crops. Ginger and turmeric are staples in our house and we consume them regularly. Turmeric boasts many health benefits. Curcumin, its active compound, possesses potent anti-inflammatory and antioxidant properties. These attributes make turmeric a powerful natural remedy for alleviating joint pain, reducing inflammation, and combating oxidative stress. Studies suggest it helps in managing conditions like arthritis, heart disease, and even certain cancers. Additionally, turmeric is linked to improved cognitive function and mood regulation.

Ginger, revered for centuries in traditional medicine, also offers various health benefits. Its bioactive compound, gingerol, provides the same benefits as curcumin. This root also alleviates nausea, eases digestive discomfort, and relieves muscle pain. Ginger may help lower blood sugar and cholesterol levels, contributing to heart health. Research suggests it possesses antimicrobial properties, potentially bolstering the immune system.

Whether consumed fresh, dried, or as a tea, both roots can provide a flavorful and natural boost to overall health and well-being. Plus, they are easy and fun to grow!

by Grow Up Conference | Nov 15, 2024 | Media Partners, Stratcann

Delta 9 Bio-Tech has selected a bid for the purchase of some of its assets through the SISP process that began earlier this year.

If approved by the court, the purchaser will receive 17 of Delta 9’s grow pods, along with intellectual property and some enumerated personal property, as part of the sales and investment solicitation process.

The application will be held before the court on November 15.

On July 15, 2024, Delta 9 Bio-Tech Inc. and four related entities were granted an initial order by the Court of King’s Bench of Alberta under the Companies’ Creditors Arrangement Act (Canada) (CCAA).

On July 24, 2024, the Court approved a sales and investment solicitation process (SISP) to solicit interest in, and opportunities for, a sale of, or investment in, all or part of Bio-Tech’s assets and business operations.

On September 11, 2024, the court granted an order extending Delta 9’s stay of proceedings pursuant to the Amended and Restated Initial Order (ARIO) first granted in July, up to and including November 1, 2024. That extension was to November 1 and has now been extended to January 31, 2025.

Among Delta 9 Bio-Tech’s assets is a 95,000-square-foot cannabis cultivation and processing facility located in Winnipeg, Manitoba, which contains 297 modular “grow pods”. These are retrofitted shipping containers used by some micro cultivators. The company says they are customized for flowering, trimming, cloning, research, testing, support, and storage.

Delta 9 is a vertically integrated group of companies that touches cannabis cultivation, processing, extraction, wholesale distribution, retail sales, and business-to-business sales.

Through the SISP process, Delta 9 and its Monitor selected the highest and only serious bid, the one for 17 of the grow pods along with related intellectual property. The bid price has been redacted in the monitor’s report.

Delta 9’s Monitor sought confirmation from SNDL, the first-ranking secured creditor of the purchased assets, but had not yet received a response when the monitor’s fourth report was filed on November 13.

In a press release earlier in July, Delta 9 said that the CCAA process was in the best interest of the company and its shareholders, especially in light of recent “aggressive” actions by its creditors, namely recent demand notices from SNDL Inc. on May 21 and July 12 and SNDL’s recent acquisition of all the Company’s senior secured debt for $21 million.

by Grow Up Conference | Nov 15, 2024 | Media Partners, The New Agora

awakeninthedream.com

awakeninthedream.com

By Paul Levy

Our world seems to be descending into utter chaos, as if the mass psychosis that has afflicted our species is ever-deepening, wreaking more and more havoc all over the world. I keep wondering, what can we—any of us—do? What can I do that could possibly be of help? One idea, like a recurring dream, keeps on insistently knocking at the door of my consciousness again and again. The idea is that our sleeping dreams are, both literally and symbolically, showing us night after night—if we look at them in the right way—the very solution to our myriad world crises. This is to say that our dreams themselves, though an illusion of the mind, are potentially teaching us—and revealing—the nature of reality and how we operate within it.

The problem is that we—each one of us—have a superhero power beyond our wildest imagination, but we don’t know it. Due to the fact that this power is always operating through us, we have become blind to and don’t recognize its operations. Because we are unaware of this practically magical power in our possession, our superhero power—like a boomerang—turns against us in a way that is disabling our evolutionary potential. This superhero power—which has everything to do with our innate creative genius—is on display, in ways both hidden and overt, in our dreams every night.

Our dreams are not just potentially giving us insight into our personal unresolved issues, compensating our one-sidedness and/or reflecting back our unconscious blind-spots (among many other benefits as well), but are also offering us an even greater gift. Contemplating the very process by which dreams emerge from our consciousness can help us gain a higher-order insight into how the creative nature of our consciousness actually operates. This understanding goes well beyond just receiving the gifts encoded within the particular symbolic content of any specific dream. Speaking in a symbolic language, our dreams are themselves living symbols reflecting back to us the part we play in constructing reality via the creative power of our minds. In showing us the role we play in composing them, our dreams are also revealing to us how we are actively participating—whether we know it or not—in creating our experience of life.

The way to unwrap the freely offered gifts that our dreams are lavishing on us starts with our creative imagination, which makes sense, as our creative imagination is the source of our dreams. As if making a magical elixir, there is a way of combining two of our intrinsic faculties – our unconscious dreaming/imaginative powers and the ability of our conscious mind to reflect upon these creative powers. Through self-reflecting (i.e., reflecting upon itself and its creations), the mind processes information, thereby potentially gaining insight into the internal dynamics of the mental projections that are shaping our moment-to-moment experience. This can potentially unlock a profound realization about the role we play in the arising of our experience, an insight lying dormant within us that has been yearning to be brought into the light of day.

Imagine we are in a dream, whatever it may be. Whatever point of view we are holding within the dream—which is a projection of our mind—is instantaneously, in no time at all, faster than we can think or blink, reflected back to us through the configuration of the seemingly externalized forms of the dream. The dream IS nothing other than a mirror of the very mind that is observing it. In other words, the dream is not separate from—and is, in fact, nothing other than—the psyche itself manifesting as a seemingly real solid universe.

In a dream the psyche has seemingly projected itself outside of itself and then observes and interacts with itself as if it is something other than and separate from itself, forgetting that what it is reacting to is its own creation. If the psyche becomes absorbed in this process—i.e., falls asleep to what it is creating as it is creating it—it becomes conditioned by its reactions in a way that constricts and limits its infinite creativity. In so doing, it uses its profound creative potency against itself, entrancing—and casting a binding spell—upon itself.

Our dreams are showing us that we are such incredibly powerful dreamers that we can unknowingly put ourselves under the spell—in reality a self-created ‘curse’—of an ultimately nonexistent phantom appearance that arises from the immense creativity of our own mind. Unless illumined and seen through, we have an unconscious proclivity to enchant ourselves—via the unrealized creative power of our own mind—into believing that the imaginary, illusory dreamlike apparitions that we have conjured up are more powerful than we ourselves are. The majority of problems of the human race are due to the lack of awareness of how we are participating in and engaging with our own creative process.

In essence, we have forgotten that we have immense reality-shaping powers at our disposal – we are geniuses with amnesia. As if ‘bewitched,’ we entrance ourselves, however, by our own innate, unrealized genius for co-creating reality. We have become masters of unconsciously imposing self-created limitations upon ourselves. We then struggle with trying to break out of our internal prison, forgetting that we ourselves have created what visionary William Blake calls “mind-forg’d manacles.” It is as if we are disoriented and deranged magicians who have unconsciously created a world that is destroying us, all the while thinking that we are just encountering—and being victimized by—an objective reality that we cannot change. Jung writes, “more than one sorcerer’s apprentice has been drowned in the waters called up by himself.”[i] In our case, the sorcerer’s apprentice is all of humanity, and we currently are in the process of destroying ourselves by the multiple catastrophes that we ourselves are unconsciously conjuring up.

Here’s where it gets really interesting. Whatever attitude and viewpoint we are holding in a dream is instantaneously mirrored back to us by the dream, as the dream itself is nothing other than a reflection of the very consciousness that is observing it. Our viewpoint in the dream and the way the dream appears are not two separate processes, but rather, reciprocally co-arise and mutually influence each other, both in no time at all as well as over time. Reflecting our viewpoint, the dream offers us all the evidence we need to make us think that whatever we are seeing in the dream is objectively happening, thereby confirming “the truth” of our viewpoint. Once the dream has “proven” to us that we are simply seeing “what is there,” we become more entrenched and fixed in our viewpoint, which the dream immediately reflects back by offering us evidence confirming our viewpoint, ad infinitum. This is an endlessly self-generating and self-reinforcing timeless feedback loop whose source is our own mind.

This process takes place instantaneously, atemporally—outside of time—and yet, it is experienced by us as unfolding over time, a combination which renders this creative dynamic invisible and unknown to us. Unless we develop the capacity, however, through paying careful attention to how we are playing a part in the moment-by-moment arising of our experience, this process—in which we are unconsciously participating—will remain unseen, and hence, have power over us.

When we are having a self-validating experience such as this, no one can talk us out of our conviction that we are seeing clearly—as our conclusion of seeing “reality” is based on our direct experience—we have all the data we need to convince ourselves of the rightness of our point of view. And yet, via the creative power of our mind to influence how reality manifests, we have literally hypnotized ourselves.

In taking the projections of our mind to be objectively real, we relate to an experience—whose source is within ourselves—as existing outside of ourselves, which is to split ourselves in two. We then think we are awake when we are actually caught up in, reacting to—and playing out—our unconscious. Dreams are, after all, a direct and unmediated expression and manifestation of our unconscious. This process of fooling ourselves via our intrinsic power to create our experience, combined with our insistence that our perspective is objectively true, is the underlying dynamic that is at the root of humanity’s endless conflicts and violence against itself, which is pure madness. When the overwhelming majority of seven and a half billion humans have fallen under this self-created spell, we get collective madness writ large on the industrial scale that we see today.

Our night dreams are potentially revealing to us, via the hidden, almost invisible projective dynamics by which they are constructed, what I call “our sacred power of dreaming.” This is truly a “sacred” power, in that it doesn’t come from us, but from a power beyond—and greater than—ourselves (by whatever name we choose to call it). While coming through us, this is a power that is also creating us (as well as the whole universe) in which we are—knowingly or unknowingly—participating. Our sacred power of dreaming is our intrinsic power to call forth, create and “dream the dream”—be it night or waking dream—into materialization moment by moment. This is the superhero power that we are wielding every moment of our lives – knowingly or not. Becoming aware of this power, however, and using it consciously is where our real healing creative power lies. Every night of our lives our dreams are illustrating—and revealing to us—this creative power that we all possess. This very same creative power that shapes our dreams at night is in-forming (albeit with a greater lag time) our daily lives as well.

In our sacred power of dreaming we have been granted a practically God-like creative power. This places a demand on us that we can no longer remain blind and irresponsible towards these divine creative powers that we unknowingly possess. As long as we choose to stay unconscious of the sacred inheritance that is freely bestowed upon us, however, we are fated to act out our God-given creative power in self-limiting and destructive ways, as we see so overtly demonstrated throughout our world today.

When our life is seen as a dream—and we interpret it as such—the deeper message we are continually getting is that it is imperative for us to know something about the workings of the sacred forces within us. It makes all the difference in the world whether we become conscious of how we are—all the time—interfacing and interacting with the creative power of the divine.

True creativity is a continuation of and co-participation with the on-going act of cosmic creation itself. The Creator created humanity in His/Her own image – a free being gifted with creative power. Humanity was created so that we, too, would consciously create; being creative is our divinely-sanctioned vocation. Humanity is called to actively participate in engaging our creative nature. Our dreams at night are—both literally and symbolically—revealing the dynamics underlying the profundity of our creative capabilities.

In my opinion, the future of humanity depends upon whether or not we wake up to the divinely-sponsored creative agency within us and consciously step into our innate superhero power – but maybe I’m just dreaming. As Christ himself said in the Bible, “You are Gods, you are all children of the Most High…. And Scripture cannot be broken.” It is our prophesied destiny to eventually wake up and consciously realize our God-given superhero power.

There is no better time to have this realization then the present moment. Christ himself said, “Behold, now is the acceptable time. Behold, now is the day of Salvation.”[ii] The present moment—right now—is, in fact, the only time that we ever can realize this, as it is the only time that there ever is.

Footnotes

[i] Jung, The Archetypes and the Collective Unconscious, CW 9i, para. 31.

[ii] 2 Corinthians 6:2

Copyright © 2020 Awaken in the Dream

About the Author

A pioneer in the field of spiritual emergence, Paul Levy is a wounded healer in private practice, assisting others who are also awakening to the dreamlike nature of reality. Among his books are The Quantum Revelation: A Radical Synthesis of Science and Spirituality (SelectBooks, May 2018) and Dispelling Wetiko: Breaking the Curse of Evil (North Atlantic Books, 2013). He is the founder of the “Awakening in the Dream Community” in Portland, Oregon. An artist, he is deeply steeped in the work of C. G. Jung, and has been a Tibetan Buddhist practitioner for over 35 years. He was the coordinator for the Portland PadmaSambhava Buddhist Center for over twenty years. His email is paul@awakeninthedream.com; he looks forward to your reflections.

Recent Comments