by Grow Up Conference | Nov 1, 2024 | Media Partners, Stratcann

BC’s LDB sold nearly forty thousand kilograms of legal cannabis in Q2 2024 (July, August, and September), for a wholesale total of $147.2 million, a 14% and 7% year-over-year increase, respectively.

The average price of cannabis continues to drop in the province, reaching a record low at $3.81 a gram, down from $4.05 a gram at the same time last year and down from $3.86 per gram in the previous quarter of 2024. The average price of a gram of cannabis flower dropped to $3.15.

The number of licensed cannabis stores in the province increased to 510, up from 505 in the previous quarter and 490 in the same quarter in 2023.

Overall, sales of 3.5 gram offerings were down 18.7% year-over-year in terms of volume, while 7 gram offerings were up 46.5%. Half-ounces (14 and 15 grams) were relatively level, with an 8.6% YOY increase, while 28 gram offerings were up 9%.

The total number of cannabis beverages sold in Q2 2024 was 665,801, up just 8.3% year-over-year and down from 720,053 units sold in Q1 2024. Total units of cannabis edibles sold in the most recent quarter was 2,291,851, up 19.2% YOY.

Total sales for dried flower were up 2% YOY while units sold were down by 0.5%.Total sales for inhalable extracts, which include infused pre-rolls, were $52.7 million, up 14.4% YOY and up from $50 million in the previous quarter.

Pre-roll sales were $34.4 million, up 8.6% YOY and up from $31.4 million in the previous quarter.

Disposable vape pens saw a huge year-over-year jump in Q2 2024, with $4.8 million in sales, up 144.8%, and a 67.2% increase in units sold. Sales of disposable vapes also increased from $3.1 million in Q1 2024.

Sales of infused pre-rolls were $20 million, up 20.3% YOY and up from $18.6 million in Q1 2024. Variety pack pre roll sales (non-infused) were $2.6 million, up 154.2% YOY and up from $1.9 million in Q1 2024.

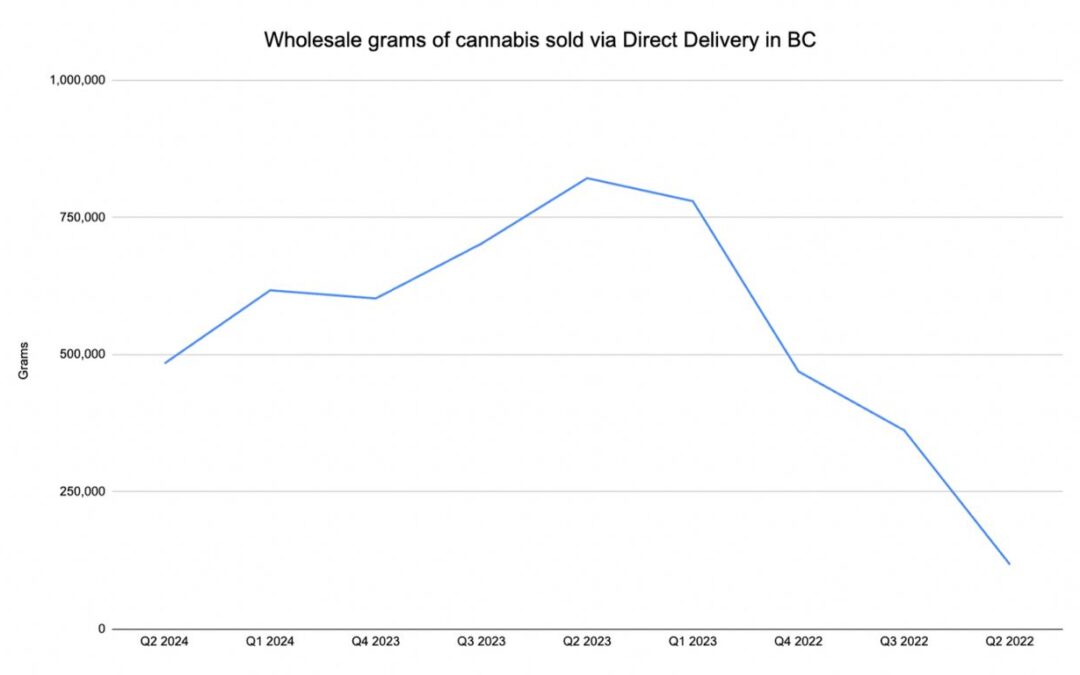

BC’s direct delivery program, which allows some small-scale BC cannabis producers to ship products directly to retailers, bypassing the LDB’s central delivery warehouse, dropped significantly in the most recent quarter.

There were 484,000 grams of cannabis sold through this program in Q2 2024, down from 821,717 grams in Q2 2023 and 617,359 in Q1 2024. This translated into $2.3 million in sales, down from $3.8 million in sales in Q2 2023 and $3 million in Q1 2024.

Despite this overall decline in direct delivery sales, edibles sales increased by 1,156.9% YOY in terms of dollars sold and 643.6% in terms of units sold. Topicals sales also saw a significant increase, with a 97% increase yoy in terms of dollars sold and a 103.5% increase in units sold. Ingestible extracts also saw an increase in sales, while every other category saw significant declines.

Related Articles

by Grow Up Conference | Nov 1, 2024 | Media Partners, Stratcann

Police in Woodstock, New Brunswick raided what they say is an illegal cannabis shop on October 22, seizing cannabis and cannabis products and arresting two people.

Earlier in October, members of the Woodstock Police Force’s Integrated Enforcement Unit (IEU) initiated the investigation into an illegal cannabis dispensary that had set up shop in Woodstock.

Following the initial investigation, members of the Woodstock IEU, Street Crime Unit, and Community Engagement Unit, along with officers from the Department of Justice and Public Safety, executed a search warrant at the dispensary, “Woodstock Medicine Chest & Trading Post”, located at 114 Queen Street, Woodstock, in a coordinated operation.

As a result, a 48-year-old woman and a 57-year-old man were taken into custody and now face charges under the Cannabis Act. Both individuals were released and are scheduled to appear in court in April 2025. The investigation remains ongoing, and additional charges may follow as authorities continue their inquiry.

Items seized during the search included over six pounds of dried cannabis, more than 500 cannabis pre-rolls, hash, shatter, edibles, and vapes.

Related Articles

by Grow Up Conference | Nov 1, 2024 | Media Partners, The New Agora

Spiritual Exercise

Sometime, step outside your home and look around the yard. Look at the

plants and the trees and the hedges and you will see something interesting

which is a spiritual lesson. You’ll see that some of the plants and some of

the flowers are green – bright green and thriving. Others are dry, frail,

colorless. Why?

This is a lesson from nature, and it will jump into your mind if you

remember the lesson; and it will help you to transfer it to the spiritual

principle inside. Why are some of the plants green and strong, tall, and

others weak? Underground water, right? Some of them have stretched out

their roots below ground and reached out for it. Others did not.

I am telling you, you will find no better simple example of why most human

beings are indeed frail and scared, have no real life at all. If you want

to change that into being a very lively type of human being, think about

the idea all the time – that the water of life is there. It is yours for

the reaching. (And by the way, another lesson. The green plants don’t have

to have anything to do with the dry ones, and neither must you, whether

that dryness is in you or someone else.)

Most everyone scorns the water of life. How many love the water of life?

Love it more, and it will be so easy to not get entangled with the dreary,

sick affairs of this world. You will indeed get up in the morning and you

will be eager in a new way not to score that business victory, not to find

some way to push away your concealed angers, but you’ll get up, and the

first thing you will think about is to know that you have your Father’s

work to do.

And why does He give us this work? Because He knows it is what we need in

order to grow in the spirit, to grow in knowledge and graciousness of what

life is truly all about. So, there is much work to be done!

Let me emphasize that point for a minute. You can’t go back to your old

ways. STOP IT! What you’ve just heard is enough pure water for you to

absorb and for you to want to know from experience, not from the

dictionary, what the word dedication means. It means you are constantly

catching yourself sound asleep mentally, emotionally, spiritually. Catch

yourself thinking something you shouldn’t at all be thinking, saying

something utterly wasteful just to prove how friendly you are, or how

concerned you are with someone else.

You catch yourself doing wrong things, and having done that, you’re going

to prove to yourself that you can indeed escape yourself. But listen to me,

you do not have…any awareness of how subtly you are deceiving yourself.

And I’ll tell you one of the worst self-deceptions of all. You’ve read the

books; you’ve heard a thousand talks; you’ve talked with other people. You

want to be able to talk to yourself, blab to yourself, lie to yourself and

say, “I know what I’m doing.” You haven’t the slightest notion of what

you’re doing. If you know that about yourself, then there’s a chance for

you. Liars shall not enter the Kingdom of Heaven.

Look, knowing how bad it is, is absolutely essential for you to know how

good it can be about spiritual and psychological matters, and all you have

is a mind filled with mechanical motions that you think is power and

spirituality, which it is not.

The only way to shatter that is for you to go out of that door determined

that during your twenty-four hours of each day, you’re going to know how

bad off you really are. And you’re bluffing it and faking it, even when you

try to convince yourself that you know what you’re doing.

God says: “Stay close to Me; that’s all you need.” And when you do that,

no one, nothing, poverty, nothing can ever be a difficulty with you,

because you see, the eternal Truth is health; it is happiness. The heavenly

ways are perfect.

Let God prove Himself to you. Let your entire inner life go. It will be

replaced with what is heavenly.

by Grow Up Conference | Nov 1, 2024 | Media Partners, Stratcann

City Staff are recommending that Surrey City Council initiate rezoning applications on behalf of the eight successful applicants at twelve locations to permit Cannabis Retail on the proposed sites.

The recommendation will be presented at a council meeting on Monday, November 4. The staff report intends to inform the council of the successful applicants to the Request for Expressions of Interest for Cannabis Retail.

Surrey City Council released a proposal for up to 12 cannabis stores in BC’s second-largest city in early 2024, approving the plan in April. The city has said it would consider up to two locations for each of its six distinct communities: Whalley/City Centre, Newton, South Surrey, Guildford, Cloverdale, and Fleetwood.

If the council approves the recommendations in the report, staff then plans to begin a site-specific rezoning application for council consideration on behalf of each of the selected applicants to permit cannabis retail use at their proposed location.

If the rezoning of a property to permit cannabis retail use is approved, prospective retailers would then need to get a business license from Surrey.

City staff screened out six applications on the basis of an incomplete submission submitted within the RFEOI period. The remaining applications were then deemed eligible for the second stage evaluation.

The results of this secondary selection process identified the following successful applications in each of the communities are:

- Whalley/City Centre

- “Dutch Love Cannabis” #201-13650 102 Avenue

- “Local Cannabis” 10449 King George Boulevard

- Newton

- “Imagine Cannabis” #502-7380 King George Boulevard

- “Surrey Cannabis Connection”

- South Surrey

- Burb Cannabis” #108-15775 Croydon Drive

- “Dutch Love Cannabis” #125-16030 24 Avenue

- Fleetwood

- “Inspired Cannabis” #103-9014 152 Street

- “Surrey Cannabis Connection” 15148 Fraser Highway

- Cloverdale

- “137 Brands” 17608 56 Avenue

- “Queensborough Cannabis” 19581 Fraser Highway

- Guildford

- “Inspired Cannabis” 10383 150 Street

- “Imagine Cannabis” #5-10330 152 Street

by Grow Up Conference | Nov 1, 2024 | Cannabis News Wire, Media Partners

A troubling tendency has surfaced in states where marijuana markets are regulated: businesses frequently offer their goods using identical or very similar trademarks. This overlap occurs because the United States Patent and Trademark Office (USPTO) prohibits federal trademark safeguarding for cannabis products, as they are illegal at the federal level.

In the absence of federal trademark safeguards, marijuana businesses are left with little choice if they want to prevent others from using identical brand names or logos in different states.

This situation has created a unique issue in the sector where customers question if a product is from Company A or Company B when packaging or branding looks nearly identical. As more states implement regulated markets, new brands arise, raising the possibility of consumer confusion and underscoring the importance of unique trademarks.

Typically, marijuana businesses select a name or logo for their product, assuming it’s unique and unused by others, often without conducting a thorough search. Regrettably, this presumption may result in expensive legal disputes. Many marijuana business owners have encountered challenges over the years after discovering that their “unique” terminology, such as Dank, Emerald, Elevated, Canna, or 420, were already commonly used or connected to cannabis culture.

Businesses in the cannabis industry must therefore negotiate a challenging environment where trademark conflicts are inevitable until laws at the federal level change and the USPTO approves trademarks for marijuana products.

Once this happens, the shift will be both advantageous and difficult. The market will become more competitive as a result of the opening of the floodgates for new trademark applications, even though businesses will now have recourse to federal courts for trademark safeguarding.

In the interim, cannabis businesses should look at alternative brand protection strategies. Federally, trademarks are accessible for goods and services that do not directly involve the cannabis plant, such as select hemp-based goods, websites, smoking accessories, retail services, and non-infused products.

Cannabis companies can pursue trademark safeguarding in states where cannabis is regulated for their in-state offerings, like retail services, edibles, or flowers. However, these protections are limited to the state of registration, unlike federal trademarks, which cover the entire U.S., creating issues for companies that operate across state lines.

To further safeguard their brand, companies should consider other forms of intellectual property protection, such as patents, copyrights, or trade secrets.

One common misconception is that if a company hasn’t faced a trademark lawsuit yet, it won’t face one in the future. However, as the industry grows, litigation around trademark issues is expected to rise, with larger companies often leveraging their resources to protect their trademarks. When enforcement happens, smaller businesses may face the difficult choice between rebranding or engaging in a legal fight.

Many companies want the trademark to represent their product, but a more effective trademark reflects the company’s unique character, values, and purpose. A unique trademark enhances a brand’s long-term standing and helps it stand out in the marketplace.

It is also easier to defend, which makes it more difficult for rivals to violate the brand and guarantees greater recognition and protection.

With the proposed reclassification of cannabis to Schedule III and the evolving legal status of cannabinoids, more entrepreneurs are likely to enter the market, leading to a wave of new brands. In this dynamic landscape, a robust trademark is not just a logo—it protects a company’s identity. Starting early on trademark safeguarding can mean the difference between a smooth path to growth and facing costly legal obstacles.

For established companies like Verano Holdings Corp. (CSE: VRNO) (OTCQX: VRNOF), protecting their brand identity is paramount since these entities have worked hard to get to where they currently are.

About CNW420

CNW420 spotlights the latest developments in the rapidly evolving cannabis industry through the release of an article each business day at 4:20 p.m. Eastern – a tribute to the time synonymous with cannabis culture. The concise, informative content serves as a gateway for investors interested in the legalized cannabis sector and provides updates on how regulatory developments may impact financial markets. If marijuana and the burgeoning industry surrounding it are on your radar, CNW420 is for you! Check back daily to stay up-to-date on the latest milestones in the fast -changing world of cannabis.

To receive SMS alerts from CNW, text CANNABIS to 888-902-4192 (U.S. Mobile Phones Only)

For more information, please visit https://www.CannabisNewsWire.com

Please see full terms of use and disclaimers on the CannabisNewsWire website applicable to all content provided by CNW, wherever published or re-published: https://www.CannabisNewsWire.com/Disclaimer

CannabisNewsWire

Denver, CO

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.com

CannabisNewsWire is powered by IBN

by Grow Up Conference | Nov 1, 2024 | Grow Opportunity, Media Partners

The creation of North American brand Papa’s Herb began not with external voices and investors, but a foundation rooted in family values drawing from the heritage of Moroccan immigrant, Papa, who came first to Miami in 1965, and later settled in Toronto. Papa used to sell cannabis and hash out of his boardwalk ice cream shop when he needed the extra cash, treating everyone like family and delivering the best possible product at the best price.

From two 20-year-old cousins traversing the west coast – meeting with growers and discussing business development – to growing into the No. 1 vape brand in the Alberta marketplace and capitalizing off exclusive partnerships with events in the province, the brand that started within the four walls of the home is an example of one on its way to becoming a household name.

GO: What was one of the most important business decisions you made early on?

MB: One of the smartest moves we made early on was negotiating favourable terms with suppliers. Financial prudence is the cornerstone of any successful business, and as co-founders, my cousin and I managed to secure inventory on terms that allowed us to sell product first without a massive upfront investment. This approach not only conserved the initial capital coming from familial investments, but also enabled the flexibility for growth.

GO: How did travel within Canada and the United States help get your name out there?

MB: Cannabis is not an industry that stays idle – travel is an expansive necessity in the pursuit of product and business development. Meeting new people and forging strong relationships is at the heart of every successful business, especially in the nascent, culturally driven cannabis industry. The road trips taken early on were not just about the business, they were about understanding the very culture we were trying to break into.

GO: Describe what you love about the cannabis culture.

MB: The cannabis industry is built on a rich culture that values authenticity, so understanding and participating in that is an essential business tactic. Participating in events like the Calgary Stampede’s Badlands EDM show and the Great Outdoor Comedy Festival in Edmonton this summer enabled us to integrate into the community. These events, where we were fortunate to secure exclusive vape partnership rights, provided exposure and allowed us to engage directly with users where our products were already well received, while meeting new consumers and building brand affinity.

GO: How else are you marketing your products?

MB: When it comes to marketing, there’s a lot of starting and stopping in the industry where social media accounts are at risk of being taken down (like ours were at 60 and 100,000 followers, respectively). That’s why we take any opportunity we get to do more traditional marketing similar to the access provided to beverage alcohol and tobacco companies at festivals.

It’s a fine line between pushing your brand forward and facing punitive consequences. All you can really do is orient yourself towards authenticity, while leveraging activity wherever possible. The difference between the U.S. and Canadian markets is that one comes with overt rules and regulations, however in Canada, bills are being paid, whereas in America, the cannabis industry is still entrenched in a sort of lawlessness. For us, it balances out.

Every market is its own beast; it’s not for the faint of heart. But you’ve got to keep rolling the dice in order to stay in the game. With the plant’s rich culture and our family’s own heritage bolstered with the principles of hard work, integrity and community, we’re very fortunate to have been well received in North America, and we believe these principles have been instrumental in shaping our company’s ethos and success thus far.

Max Benitah is the COO & co-founder of North American cannabis brand, Papa’s Herb.

by Grow Up Conference | Nov 1, 2024 | Garden Culture Magazine, Media Partners

For city dwellers, the gentle gift of harvest is most often seen in farmers’ markets at best. Or, more likely, bound within an inch of its life in plastic at the local superstore. Raising crops in the city is difficult due to a lack of space and light. Ever-increasing awareness of food miles, the knowledge that grocery stores only stock three days of food, and the desire to eat local have brought more urbanites to grips with growing food on balconies and whatever can be grown in little shady city gardens. Interest sharpens slightly, living just north of the 45th parallel where the winter is long and the growing season is not.

Urban Growing

My urban growing adventure began in Montreal, Quebec, around 2011. As so many modern tales start, I’d received a three-minute video from a friend, filmed in a market town in Todmorden, Yorkshire, UK. This town’s people had taken its unused green spaces and had begun growing vegetables for all to share. All of the plants were donated, planted, and cared for by volunteers and were to be shared by the community.

No one had to make an application to collect from any of these gardens. It was entirely free for the community to harvest at will. And no one had abused it.

Perhaps it was seeing Mary Clear in the video saying, “Old people like a bit of mint with their new potatoes” as she stood in one of the car parks home to several herb plantings. Or maybe it was Pam Warhurst with her trademark tongue-in-cheek narration, sliding in comments like “food in your face propaganda gardening”. Or the older handyman perched on the edge of a street planter, saying he just “needed to do something meaningful”.

Community Connection

The townspeople had come together around the need to feed themselves, but more than that, they needed to be involved with each other and share. The local high school got a greenhouse. Then, the Prince of Wales visited with a royal seal of approval. Support begat support. They lined the canal that passed through the town with planters and built a meadow near the new doctor’s surgery named Pollination Street. The whole town had become a wonderland of food planting. All the work was volunteer, and all the food was for sharing between them and harvesting at will. By the time I’d heard their message, there was an international network of Incredible Edible towns throughout much of the English-speaking world, France and beyond.

They conspired in the message of their endeavour to remind me of the importance of food, community and sharing. Everything didn’t have to be bought and paid for—a modern gift culture. The idea of growing and sharing food as a community cuts through the current practice most of us endure of grocery shopping in the superstore garden to lay bare the communal aspects of our nourishment.

Incredible Edibles In Montreal, QC

It appealed greatly to my itchy green fingers. To my great surprise, in 2012, the Westmount Horticultural Society, which I had recently joined, agreed to take the idea to the City of Westmount. I showed them the video and waxed on about the benefit that local food growing has on a community. Again, to my surprise, the city agreed immediately to support the idea. However, instead of the volunteer troupe of gardeners and residents I had envisioned, the city would manage the entire project, including the planting, maintenance, and watering. I helped select the plants which they bought. The city planners worried that the residents wouldn’t like it if it began to look “too weedy”. They suggested planting up and down three blocks of the big main street and a large planting at the end of Prince Albert Avenue, where I lived.

Me? I was already walking the talk. I had transformed our little city garden into a demonstration microfood forest with six fruit trees, loads of berries and some crops on the roof sandwiched between two two-story townhouses. It also held five laying hens with a beehive on an upstairs deck.

The city enlisted a young woman named Jayme Gerbrant, newly from Winnipeg. In the first year, we planted herbs, cherry tomatoes, chard, two kinds of kale, and nasturtiums. It wasn’t crops, but it was edible, and anyone could harvest it. We posted suggested cropping techniques for the herbs and the greens. At the end of the season, some friends and I harvested what remained and brought it to the local food bank in the next borough over.

The following year, I recruited the local high school to help with the final harvest, again bringing it to the food bank. Soon after the second harvest, it became clear that my husband’s parents required help in the UK. Off we went, leaving the project in the very able hands of the city.

Jayme has been able to keep the project going since then. She added a fruit tree program for residents, including apples, pears, and sweet chestnut trees. The herb and vegetable plantings have since moved to the main parks and city hall. They’ve planted a pear orchard in the park and built a potager on the underground hockey arena. They have established a “seed lending” program at the library where residents return seeds from the next generation of plants. The end-of-the-season harvests are well supported by the community.

Widespread Interest

While I was packing my bags for the UK, the next borough over, the one with the food bank, was tooling up their version of Incredible Edibles (IE) under the umbrella of Transition NDG. The borough of Notre-Dame-de-Grace’s (NDG) version of IE was entirely volunteer, built on community participation, and truer to the original design. Churchyards were transformed into potagers, and local businesses adopted storefront planters. Front lawns turned into edible gardens. The local grocery store sponsored a planting of herbs and veg at the fire station. A large planting space was donated by a resident for shared planting of freely available produce. A couple of primary schools have begun starting seedlings for IE, tending them and watching the magic happen from tiny seed to bushy little plant. A play was written. Over ten years, NDG has built eight IE gardens, and countless citizens have converted their small front and back gardens to grow produce. All activities are organised and presented in both English and French!

Recently, NDG invited me to talk at the 10th anniversary picnic. It was a small turnout on a chilly evening, just the hardcore. And we reminisced. After the gathering, I thought it would be nice to see if it’s possible to kick some Incredible Edibles into gear in the Quebec Laurentians where I now live. It doesn’t take much, really. It is surprising how ready we all are for food that is not business as usual. It just takes a few willing hands to plant seeds and a desire to share the harvest.

Marci’s recommendations for further reading:

Incredible Edibles Todmorden: incredible-edible-todmorden.co.uk

TED.com: rebrand.ly/e47f73

Incredible Edibles Westmount: westmount.org/en/environment/incredible-edibles

Incredible Edibles NDG: IE.NDG

by Grow Up Conference | Nov 1, 2024 | Cannabis News Wire, Media Partners

The rise of marijuana multistate operators has increased concerns that independent cannabis business owners may be driven out of business by organizations that have more money, power, and influence.

Despite the negative way multistate operators are perceived, most take significant risks and work with local as well as state legislators to develop infrastructure and expand cannabis access in the U.S. By understanding the roles of multistate operators, independent businesses can use their work to their advantage.

For instance, they have helped launch legal markets in jurisdictions that may not have been possible. A good example of this is the successful legislative efforts of these operators in Missouri and Florida, made possible by the resources and time of these operators.

Their ability to speak policymaker ‘lingo’ also makes it easier to acquire licenses, launch new facilities, and set up compliant businesses in an infrastructure that makes it easier to succeed. By using the legislative groundwork and infrastructure laid by multistate operators, legacy cannabis operators have better opportunities to expand and grow.

Increasing accessibility to marijuana also grows competition in the industry which in turn drives innovation, resulting in products of higher quality and more options for customers. Competitive environments make it easier for smaller and older brands to partner with larger multistate operators to increase their product availability.

Multistate operators have also played a crucial role in the increased acceptance of marijuana across the country, with their work helping fight disinformation while informing the general public. They also oppose historically negative views that surround cannabis.

This is in addition to advocating for marijuana as a healthier alternative to alcohol through regulatory engagement and educational initiatives, helping dismantle long- established stigmas. Multistate operators have also made significant investments in marijuana R&D, which has helped develop products that maximize benefits while minimizing negative effects.

Research has also helped close knowledge gaps while allowing more individuals to better understand the plant’s different compounds. Furthermore, it has helped address issues that affect consumers and advanced scientific knowledge of this drug. All this helps elevate the marijuana industry, with insights acquired from research promoting an environment that drives innovation and growth.

From the above, we can see that relations between multistate operators and legacy marijuana operators don’t have to be negative. Operating with a united approach to advance the marijuana industry will help ensure that the industry grows while also helping preserve the grassroots values and the space’s cultural heritage.

The cannabis industry in different jurisdictions keeps evolving, and established enterprises like Canopy Growth Corp. (NASDAQ: CGC) (TSX: WEED) operating in more uniform markets can teach legacy operators in the U.S. some helpful lessons on how to adapt to changing market conditions characterized by large corporations having massive resources at their disposal.

About CannabisNewsWire

CannabisNewsWire (“CNW”) is a specialized communications platform with a focus on cannabis news and the cannabis sector. It is one of 70+ brands within the Dynamic Brand Portfolio @ IBN that delivers: (1) access to a vast network of wire solutions via InvestorWire to efficiently and effectively reach a myriad of target markets, demographics and diverse industries; (2) article and editorial syndication to 5,000+ outlets; (3) enhanced press release enhancement to ensure maximum impact; (4) social media distribution via IBN to millions of social media followers; and (5) a full array of tailored corporate communications solutions. With broad reach and a seasoned team of contributing journalists and writers, CNW is uniquely positioned to best serve private and public companies that want to reach a wide audience of investors, influencers, consumers, journalists and the general public. By cutting through the overload of information in today’s market, CNW brings its clients unparalleled recognition and brand awareness. CNW is where breaking news, insightful content and actionable information converge.

To receive SMS alerts from CNW, text CANNABIS to 888-902-4192 (U.S. Mobile Phones Only)

For more information, please visit https://www.CannabisNewsWire.com

Please see full terms of use and disclaimers on the CannabisNewsWire website applicable to all content provided by CNW, wherever published or re-published: https://www.CannabisNewsWire.com/Disclaimer

CannabisNewsWire

Denver, CO

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.com

CannabisNewsWire is powered by IBN

by Grow Up Conference | Nov 1, 2024 | Media Partners, Stratcann

Cannabis retailer sales in New Brunswick included nearly $27 million worth of cannabis in the three months ended September 29, 2024.

The figures come from Cannabis NB’s recently released Q2 2024 financial report, shared on October 30.

The provincial agency and the handful of private retailers that serve the legal cannabis market in New Brunswick sold $26.9 million worth of cannabis in the second quarter of 2024, up 6.6% from the same quarter in 2023.

Gross profit was $12.7 million, up 0.8% year over year, with net income at $6.8 million, a 1.9% increase from the same quarter in the previous year.

In addition to year-over-year increases, sales were also up from the previous quarter (Q1 2024), which was $24.7 for the three months that ended June 30, 2024. Gross profit was up $700,000 from the last quarter, while net income increased by about $900,000.

Dried flower sales were 51.7% of total sales in the most recent quarter, while concentrates were 32.9%. Edibles were 6.9% of total sales, beverages 2.8%, accessories 2.7%, extracts 2.4%, topicals 0.5% and clones 0.1%

A recent annual report from Cannabis NB shows that while dried cannabis flower continues to be the majority of sales, its market share, like in many other provincial markets, is shrinking as concentrates sales increase. New Brunswickers prefer more “convenient” cannabis products as the market continues to shift to products like vape pens, concentrates, and pre-rolls, especially infused pre-rolls, notes the report.

Dried flower sales still represented just over half (50.6%) of sales by category, down from 52.5% in 2022-2023, with concentrates and extracts at 35.2%, up from 33.5% in the previous year. Sales of edibles were the third largest product category, with 7.4% of sales by category.

The newest annual figures from the provincial cannabis agency Cannabis NB show $93.8 million in total sales for the year ended March 31, 2024, a 12.4% increase from the previous year. From this, the provincial agency generated $22.7 million in net income, a 24% increase from the previous year.

While dried cannabis sales still increased year-over-year, whole flower sales in the Picture Province were just over 30% of overall sales, while infused pre-rolls now represent 15% of total concentrate sales.

Key product sales trends for the second quarter (July 1, 2024 to September 29, 2024) compared to the second quarter last year were (July 3, 2023 to October 1, 2023):

- sales of dried flower increased 8.3%, up $1.1 million

- extracts sales increased 2.1%, up $13.1 thousand

- sales of accessories decreased 18.3%, down $0.2 million

- sales of edibles decreased 5.4%, down $0.1 million

- sales of infused beverages increased 12.6%, up $0.1 million

- sales of topicals decreased 29.7%, down $0.1 million

- concentrates sales increased 10.3%, up $0.8 million

Cannabis NB also licensed its newest cannabis FarmGate partner, Pinnacle Farms, in the most recent quarter. The Cannabis NB FarmGate program allows licensed New Brunswick cannabis producers to sell their own products onsite at their facilities.

by Grow Up Conference | Nov 1, 2024 | Media Partners, Stratcann

In compiling our November job postings, we continue to see a wide range of opportunities available in the Canadian cannabis industry. There are openings for seasoned professionals looking to make a change, as well as many entry-level positions to get your foot in the door.

Here’s our sampling of current job openings in the cannabis sector for November 2024, including StratCann’s very own posting for a remote, part-time Ad & Media Sales Representative!

Canada’s Island Grown has a few openings in Charlottetown, PE, including an Irrigation Technician and an Industrial Technician.

Muse Cannabis Store in Deep Cove, BC, is looking for a full-time sales associate.

Cheeky’s Cannabis, part of the Springs Group in Maple Ridge, BC, has an opening for a full-time budtender.

Stewart Farms in St. Stephen, NB, has several openings, including Financial Bookkeeper and Analyst, and Logistics & Operations Coordinator.

High Tide/Canna Cabana Vancouver is looking to hire a District Manager in British Columbia to expand its footprint in the province.

Under the Sun Groweries in Saskatoon, SK, has several openings, including a full-time Production Assistant Supervisor and a Cannabis Inventory Manager.

The Original Farm is looking for a customer service-focused full-time Front of House – Keyholder to join their team in Langford, BC.

Over in Delta, BC, Rubicon Organics has an opening for a Senior Manager, Planning to join their leadership team.

SNDL Inc., a private-sector liquor and cannabis retailer, has an opening for a Property Accountant to help manage their property-related financials.

Also in the field of accounting, Canopy Growth Corp. is currently recruiting for a remote position of Manager, Accounts.

Manitoba Harvest is looking to hire an on-site Supply Chain Coordinator for their Winnipeg location.

Lyonleaf Cannabis in Montreal, QC, is seeking a Cannabis Cultivation Technician to join their production team.

Skilled in social media? Weed Me Inc. has an opening for a full-time Social Media Lead at their Pickering, ON, location.

In Abbotsford, BC, Dunn Cannabis is looking to fill a full-time hybrid role for a Quality/Record Keeping Specialist.

Aqualitas is looking for a Cultivation Technician for their facility in Brooklyn, NS.

The Yukon Government has a full-time, one-year Term or Temporary Assignment for a Licensing and Compliance Officer.

DECIBEL Cannabis is currently looking for a Quality Control Technician in Calgary, AB.

Recent Comments