by Grow Up Conference | Aug 1, 2024 | Cannabis News Wire, Media Partners

Thailand’s government seems to be reconsidering its previous commitment to banning recreational cannabis, with a minister proposing a shift toward regulating the rapidly growing industry. Bhumjaithai Party leader and Interior Minister Anutin Charnvirakul stated that Srettha Thavisin, the prime minister, had decided to look into the possibility of drafting a bill to regulate cannabis sales and use instead of outright banning it.

Anutin thanked the prime minister for taking up the matter and choosing to pass legislation. His party played a significant role in the decriminalization of marijuana in 2022. He also noted that the administration will allow different political parties to submit their draft laws to parliament in addition to Bhumjaithai’s legislation.

While the details of the proposed bill remain unspecified, this move appears to delay Srettha’s contentious plan to ban cannabis, only two years after Thailand became the first southeast Asian country to legalize it.

This month, a Ministry of Public Health drug control committee approved a proposal to categorize marijuana as a narcotic. The proposal was scheduled for review by the Narcotics Control Board (ONCB), but discussions between Anutin, Somsak and Srettha preempted the meeting. Had it been approved, the ban would have started on Jan. 1, 2025.

Srettha’s contentious agenda has caused a rift within his fragile coalition government. Throughout the 2019 election campaign, Bhumjaithai — the coalition’s second-biggest party — prioritized marijuana decriminalization, with Anutin being a major driving force on the issue.

However, the decriminalization of cannabis in Thailand took place in the absence of any legal restrictions on its production or distribution. Bhumjaithai later drafted a measure for regulation, but it did not reach a vote before last year’s general election.

Decriminalization led to a booming recreational cannabis market with numerous shops offering various products, including joints and edibles. Amid a moral panic over rising drug use, especially among the youth, Srettha’s party, Pheu Thai, took a tough stance on cannabis, promising during the election campaign to reinstate controls.

Srettha ordered in May for authorities to reschedule marijuana as a category five drug, which will prohibit its production, possession or use. This change is anticipated to take effect by the start of 2025.

Anutin recently stated that he was perplexed by the return to harsh measures and promised to use his position on the ONCB to resist the recriminalization. While Bhumjaithai never completely endorsed recreational use — Anutin’s main objective was to create a business around medical marijuana — he emphasized the importance of conducting additional research before reaching snap judgments.

The recent move by the government to return to a regulated approach is intended to ease the political strain between Pheu Thai and Bhumjaithai, its main coalition partner. This change is likely to be cautiously welcomed by the country’s marijuana businesses and activists, who have been protesting daily outside Government House in Bangkok.

For companies that have their eye on the international market, such as Tilray Brands Inc. (NASDAQ: TLRY) (TSX: TLRY), the reported change of heart by the Thai government regarding the country’s marijuana policy direction could set the stage for some attractive market opportunities.

About CNW420

CNW420 spotlights the latest developments in the rapidly evolving cannabis industry through the release of an article each business day at 4:20 p.m. Eastern – a tribute to the time synonymous with cannabis culture. The concise, informative content serves as a gateway for investors interested in the legalized cannabis sector and provides updates on how regulatory developments may impact financial markets. If marijuana and the burgeoning industry surrounding it are on your radar, CNW420 is for you! Check back daily to stay up-to-date on the latest milestones in the fast -changing world of cannabis.

To receive SMS alerts from CNW, text CANNABIS to 888-902-4192 (U.S. Mobile Phones Only)

For more information, please visit https://www.CannabisNewsWire.com

Please see full terms of use and disclaimers on the CannabisNewsWire website applicable to all content provided by CNW, wherever published or re-published: https://www.CannabisNewsWire.com/Disclaimer

CannabisNewsWire

Denver, CO

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.com

CannabisNewsWire is powered by IBN

by Grow Up Conference | Aug 1, 2024 | Grow Opportunity, Media Partners

Grow Opportunity‘s fifth annual Top Grower Award has returned, and nominations are now open until September 30, 2024.

This award recognizes two winners – one from the standard licensed producer category and one from the micro producer category.

The winners will be announced in December on the cover of the Winter issue of the magazine.

This year we have also simplified the nomination form, and we would like to welcome a new judge, Alexandre Gauthier of Origine Nature, and our past 2022 award winner. Gauthier will sit with the panel of judges alongside Stacie Hollingworth, Av Singh and David Kjolberg.

A hearty thank you to our 2024 sponsors: CANNA, BIOFLORAL and GrowerIQ.

Submit your nominations for Canada’s Top Grower by Grow Opportunity here.

Read the 2023 cover story here.

Thank you & good luck!

by Grow Up Conference | Aug 1, 2024 | Garden Culture Magazine, Media Partners

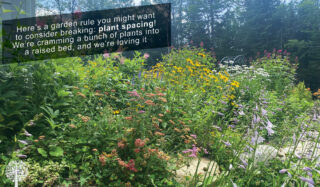

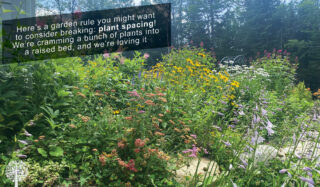

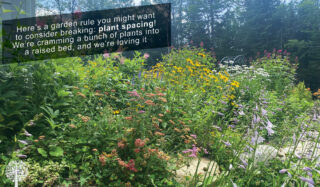

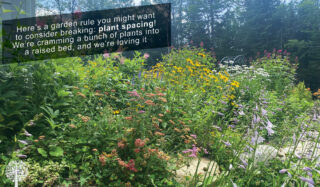

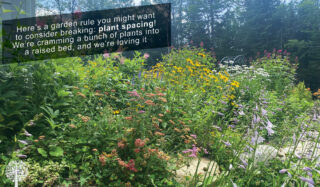

They say rules are made for breaking, so this year in my garden, I’m ignoring an essential growing ‘rule’: plant spacing. After years of following the recommended spacing on the back of seed packets, my raised beds are planted intensively this season. Tidy rows? Not in my garden. The result is a lush plant paradise that is productive, pest-free, and pleasing to the eye.

This Sounds Chaotic…

Some call it ‘chaos gardening’ or ‘horticultural disobedience,’ which implies growing plants haphazardly and allowing nature to do its thing. Nicole Johnsey Burke of Gardenary calls it ‘The Gardenary Method.’ Whatever you want to call it, it’s liberating.

After interviewing Stephanie Rose about her experiences with chaos gardening and reading Johnsey Burke’s book Kitchen Garden Revival, I was inspired to break free from the confines of proper plant spacing to maximize food production in my available space.

Hobby Growers, Rejoice!

I have six large raised beds and two smaller galvanized steel hexagons to grow in, which don’t offer much room if you follow strict spacing guidelines. In this YouTube video, Johnsey Burke talks about how the spacing recommendations on the back of seed packets are directed at farmers growing in the ground, not for home hobby growers. Goodbye, tape measure!

Taking Nature’s Lead

Rose and Johnsey Burke suggest looking at how trees, shrubs, and flowers grow in a forest or national park. There is no rhyme or reason or empty space. Plants intermingle and grow together in layers. Expect some losses; the plants that make it were always meant to survive.

How I Ignored Plant Spacing Rules

I followed the planting guide recommended by Kitchen Garden Revival. The book suggests beginning in the center of the raised beds with tall plants like tomatoes, borage, and squash, especially if you plan to stake them. At this point, place trellises, obelisks, and arches into the beds so climbers, like cucumbers and pole beans, have something to grab onto.

Next, plant the medium-sized crops on either side of the large plants. I have peppers, eggplant, bush beans, lettuce, chard, and snap peas.

Once all of my seedlings were in place, I planted seeds in bare pockets. Root veggies like garlic, beets, radishes, celery, and carrots grow wherever there’s space.

Along the outer perimeter of my garden beds, I have flowers like nasturtiums, marigolds, and zinnias, culinary herbs such as parsley, mint, oregano, sage, and medicinal plants like hyssop and lavender. The borders of my garden always look so pretty and colorful, perfect for attracting pollinators!

Planting Order for Spacing Plants

To sum up, here’s what the planting order should look like:

- Plant large plants.

- Plant medium plants.

- Plant small plants.

- Plant seeds.

- Plant borders with herbs and flowers.

The Six-Week Rule After Planting Your Garden

Johnsey Burke says six weeks after planting your garden, you shouldn’t see any bare soil anywhere. If you do, I recommend throwing some more seedlings, flowers, or seeds in there. I’ve been succession planting with radish, beans, and carrots to fill in any areas with bare soil, which leaches nutrients and water more quickly and becomes infested with pests sooner than covered earth.

The Pros Of Intensive Planting

This intensive planting method confuses pests because there’s too much to choose from, some of which they’ll hate. Gardenary says you can expect high yields, not only because you’ve crammed so much into one space but because the warmth of all the plants together boosts fruit and flower production!

Inspecting the garden is slightly more challenging with so many plants in one space (it’s chaos!), but this is a great excuse to step out into my happy place every day. I’ve been a rule follower for most of my life, but I’m so glad I finally got around to breaking this one!

by Grow Up Conference | Aug 1, 2024 | Media Partners, Psychedelic News Wire

Alcohol use disorder is a disorder characterized by an inability to stop or control one’s drinking despite adverse health, occupational or social consequences. Conventional treatments include medication, behavioral therapy, and support groups. Even with these treatments, however, many individuals find it hard to achieve lasting recovery, highlighting the need for more effective therapies.

Now, a new study has determined that psilocybin decreases the consumption of alcohol in rats by modifying certain pathways in the brain.

Psilocybin is a psychedelic compound that occurs naturally in some species of hallucinogenic mushrooms. For centuries now, it has been used in different spiritual and cultural contexts. In the last couple of years, research has determined that this psychedelic possesses therapeutic properties that may influence an individual’s cognition, perception and mood.

Early clinical trials have determined that psilocybin-assisted therapy may be effective in the treatment of a range of mental conditions, including anxiety, depression and substance-use disorders.

For this recent study, researchers used male Long-Evans rats, with the selection based on how well they could model human behaviors on alcohol consumption. During the study period, the rats had unlimited access to water and food, and were individually housed under a controlled dark/light cycle.

At first, the rats were given access to an ethanol solution for a four-week period. Once this time lapsed, they were trained to self-administer the ethanol in operant cages. This approach was used to mimic voluntary consumption of alcohol in humans and would allow investigators to measure their motivation to consume alcohol.

The investigators divided the study into several experiments to separate different variables, microinfusing psilocybin directly into the right or left nucleus accumbens in one experiment and injecting psilocybin directly into the body cavity in another. The nucleus accumbens is a region of the brain involved in reward processing.

The investigators determined that psilocybin brought on notable changes in gene expression in the nucleus accumbens. They also discovered that the psychedelic’s administration led to a significant reduction in self-administration of alcohol, noting that the rats which received the drug demonstrated a 51% decrease in total alcohol intake and a 48% drop in the number of lever presses. This suggests that the effects of psilocybin are strong and not limited to direct infusions to the brain.

In addition, the researchers observed that the psychedelic’s microinjection into the left nucleus accumbens led to a 39% drop in alcohol intake and a 38% reduction in lever presses. Further, the investigators observed that serotonin receptor pathways mediated the effects of psilocybin.

These findings suggest that psilocybin could be a useful treatment for decreasing alcohol consumption, working by reducing the rewarding properties of alcohol. However, more studies are required to confirm the drug’s effectiveness in humans.

The study’s findings were reported in the “Brain” journal.

Currently, there are plenty of startups, including atai Life Sciences N.V. (NASDAQ: ATAI), that are focusing on studying different medicinal applications of psychedelics, such as psilocybin. It is likely that diverse uses for these substances could be discovered and the field of medicine will be revolutionized.

About PsychedelicNewsWire

PsychedelicNewsWire (“PNW”) is a specialized communications platform with a focus on all aspects of psychedelics and the latest developments and advances in the psychedelics sector. It is one of 60+ brands within the Dynamic Brand Portfolio @ IBN that delivers: (1) access to a vast network of wire solutions via InvestorWire to efficiently and effectively reach a myriad of target markets, demographics and diverse industries; (2) article and editorial syndication to 5,000+ outlets; (3) enhanced press release enhancement to ensure maximum impact; (4) social media distribution via IBN to millions of social media followers; and (5) a full array of tailored corporate communications solutions. With broad reach and a seasoned team of contributing journalists and writers, PNW is uniquely positioned to best serve private and public companies that want to reach a wide audience of investors, influencers, consumers, journalists and the general public. By cutting through the overload of information in today’s market, PNW brings its clients unparalleled recognition and brand awareness. PNW is where breaking news, insightful content and actionable information converge.

To receive SMS alerts from PsychedelicNewsWire, text “Groovy” to 888-902-4192 (U.S. Mobile Phones Only)

For more information, please visit https://www.PsychedelicNewsWire.com

Please see full terms of use and disclaimers on the PsychedelicNewsWire website applicable to all content provided by PNW, wherever published or re-published: https://www.PsychedelicNewsWire.com/Disclaimer

PsychedelicNewsWire

San Francisco, CA

www.PsychedelicNewsWire.com

415.949.5050 Office

Editor@PsychedelicNewsWire.com

PsychedelicNewsWire is powered by IBN

by Grow Up Conference | Aug 1, 2024 | Media Partners, Stratcann

Want to work in the cannabis industry in Canada? There are many positions available, from entry-level to executive, from cultivation to retail, from policy to QAP; there’s a massive amount of marijuana jobs available at any given time.

Check out our July 2024 cannabis jobs roundup below for a small snapshot of the numerous positions available in Canada’s cannabis industry.

Aurora Cannabis is hiring a cultivation manager for its Pemberton, BC, facility and is hiring an applications analyst for a remote work job in Ontario and Quebec, as well as several other positions.

Medipharm Labs is hiring a patient experience associate in Vancouver.

Fika Cannabis is hiring a lead educator for one of its stores in Mississauga while SNDL is looking to hire a product management and supply chain coordinator in Edmonton and a supervisor at Value Buds in Red Deer.

Plantlife Cannabis is hiring for full-time and part-time jobs in several locations in Alberta. Tilray is also hiring for numerous positions across Canada.

Canna Cabana is hiring for several positions in BC, Alberta, Saskatchewan, Manitoba, and Ontario. Auxly is hiring a machine operator and a cultivation associate in Ontario.

Motif Labs is looking to fill several positions, including a commercial project manager in Ontario.

Organigram Inc. is hiring a cost accounting manager in New Brunswick, and Wyld is seeking a territory manager in Ontario.

Coterie Brands is hiring a brand ambassador in the Hamilton/Burlington area (part-time), and Canopy Growth is hiring for several positions, such as a regulatory affairs manager and a production assistant both in Ontario.

In Quebec, Cielo Verde Quebec Inc. is hiring a packaging coordinator and Kizos Culture is hiring a general staff member.

Cheeky’s Cannabis in Maple Ridge, BC, is seeking a full-time or part-time budtender. The Herbary in Yukon is also hiring full-time and part-time budtenders.

And, TEC Cannabis Services is hiring a cannabis trimmer/packer and a cleaner in Nova Scotia.

by Grow Up Conference | Jul 31, 2024 | Media Partners, Stratcann

Police were called after a farmer came across four plots of cannabis while working in his field.

On July 30, members from the Huronia West Community Street Crime Unit (CSCU), as well as a uniform officer attended the plots in Springwater Township, about a two-hour drive north of Toronto.

Huronia West is a detachment of the Ontario Provincial Police (OPP).

Police found 538 cannabis plants growing in four plots deep within the farmer’s land. The plants, described as “immature” were picked and destroyed.

The investigation is still ongoing.

The Huronia West OPP serves the Town of Wasaga Beach and the Townships of Springwater and Clearview.

In 2020, the township implemented a one year moratorium on cannabis production licences.

by Grow Up Conference | Jul 31, 2024 | Cannabis News Wire, Media Partners

The regulated cannabis sector has been facing a significant challenge lately: lab-tested products containing pesticides. More alarmingly, some cannabis samples sent for testing now contain a mixture of unknown compounds not previously identified in cannabis.

According to lab executives, these enigmatic substances emerge during the conversion of hemp-derived cannabinoids into delta-8 and delta-9 THC. The issue is made worse by the fact that testing for cannabinoids, heavy metals and mold is required in most jurisdictions, but testing for these byproducts is not. As such, their impact on customers is still unknown.

Cannabis naturally includes trace levels of delta-8 THC. However, most delta-8 products are synthesized by converting nonpsychoactive CBD, potentially leaving behind dubious byproducts.

According to chemist Susan Audino, who consults with biological and chemical laboratories, these are side reactions of the chemical process. “It is impossible to produce one compound without also producing others,” she added.

According to Josh Swider, CEO and cofounder of Infinite Chemical Analysis Labs in San Diego, up to 60 unknown chemicals are frequently present in many delta-8 products made via chemical procedures. Many of them remain unidentified. This suggests that previously undiscovered cannabis chemicals are being digested and introduced, according to Swider.

ACT Laboratories CEO and chief scientific officer, Bob Miller, pointed out that unethical methods used in THC-potency testing are partially to blame for the paucity of investigation into these unidentified chemicals. “Potency testing creates an opportunity for unethical interactions between labs and grower-processors,” Miller said. “Higher potencies benefit everyone except the consumer because they mean more money for the tests and higher sales prices.”

Miller highlighted that his lab in Michigan has observed an increase in delta-8 THC entering the market, posing a significant issue. “Producers often claim they have hemp and sell it across state lines. In reality, it’s a mix of delta-9 and delta-8 THC,” he said. The conversion process from CBD to delta-9 and delta-8 is often imprecise, resulting in a mix of various compounds, many of which remain unidentified due to the lack of required testing.

Certain molecules that arise from these intricate combinations in lab settings have the potential to be more psychotropic than delta-9 THC. “If we detect significant levels of any compound, we inform our clients,” Miller explained. “Some clients are eager to understand, while others just want us to test for the legally required cannabinoids.”

The tests carried out are chosen by the lab’s clients, the manufacturers of the products. “Manufacturers usually don’t request specific tests if regulations don’t demand them,” said Audino, who also pointed out that the majority of state regulators are lawyers enforcing laws rather than scientists.

Miller drew attention to the fact that the influx of these unidentified substances was unintentionally facilitated by the 2018 Farm Bill, which authorized industrial hemp. “There’s a federal movement to change regulations to eliminate unknown chemistry and stabilize the supply chain,” he said.

Swider criticized the cannabis-lab industry for moving away from science. “Labs have become more cookie-cutter, focusing only on mandated tests and ignoring other potential issues,” he said. Swider believes the industry needs a reset, urging states to establish stricter mandates. “Many labs prioritize profit over safety, and about 70%–80% of them probably shouldn’t be operational.”

Making the needed changes will require the concerted efforts of all stakeholders, including established cannabis entities such as TerrAscend Corp. (TSX: TSND) (OTCQX: TSNDF), so that only accepted compounds remain in the products that reach the market.

About CNW420

CNW420 spotlights the latest developments in the rapidly evolving cannabis industry through the release of an article each business day at 4:20 p.m. Eastern – a tribute to the time synonymous with cannabis culture. The concise, informative content serves as a gateway for investors interested in the legalized cannabis sector and provides updates on how regulatory developments may impact financial markets. If marijuana and the burgeoning industry surrounding it are on your radar, CNW420 is for you! Check back daily to stay up-to-date on the latest milestones in the fast -changing world of cannabis.

To receive SMS alerts from CNW, text CANNABIS to 888-902-4192 (U.S. Mobile Phones Only)

For more information, please visit https://www.CannabisNewsWire.com

Please see full terms of use and disclaimers on the CannabisNewsWire website applicable to all content provided by CNW, wherever published or re-published: https://www.CannabisNewsWire.com/Disclaimer

CannabisNewsWire

Denver, CO

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.com

CannabisNewsWire is powered by IBN

by Grow Up Conference | Jul 31, 2024 | Grow Opportunity, Media Partners

As climate change intensifies summer heatwaves, cannabis employers should prepare for extreme heat, and have plans in place to mitigate the risk of heat exposure and related illnesses.

“WorksafeBC data shows that workers in agriculture and manufacturing are prone to heat stress. This poses a risk for the cannabis industry because it has both indoor and outdoor workers,” says Mike Nielsen, director of prevention field services at WorkSafeBC.

During the 2021 heat dome in British Columbia, many cannabis producers had to pause operations, as they were not prepared for the elevated temperatures. However, heat stress poses a serious risk to workers even at temps well below B.C.’s 2021 record highs.

What is heat stress?

Heat stress occurs when the body’s cooling mechanisms are overwhelmed by heat. It typically occurs when the body is unable to cool itself sufficiently.

Symptoms of heat stress include excessive sweating, dizziness, heat rash, cramps and nausea. If left untreated, heat stress can escalate to severe conditions like heat exhaustion, and even fatal conditions like heat stroke.

Dehydration plays a significant role in exacerbating heat stress because adequate hydration is crucial for the body’s ability to self regulate.

“To best protect your workers, start with a risk assessment for your worksite that considers this hazard,” Neilsen says. “The best time to do this is before extreme weather arrives.”

Three key factors contribute to the risk of heat stress: the environment, the tasks and the workers themselves.

The Environment:

Workers in greenhouses or indoor settings, especially concrete buildings, face challenges related to heat and humidity. Greenhouses have fewer environmental controls, like centralized HVAC systems, while concrete buildings tend to absorb and retain heat. Further, the lack of natural ventilation can lead to stagnant air, and equipment can also elevate the temperature indoors. In addition, workers may wear protective gear or uniforms that limit airflow, heightening the risk of dehydration and overheating.

The Work:

The nature of the work itself plays a significant role in heat stress, as doing physical tasks like harvesting, pruning and processing can cause the body to generate more heat.

The Worker:

Individual factors like age, fitness level, pre-existing medical conditions or medications can affect heat tolerance. Employers should advise their workers on these risks and be supportive of workers’ personal concerns.

Reduce the risk

Once risks have been identified, employers must collaborate with workers on what measures to put in place to reduce the risks. Consider the following control measures, and determine when these controls should be put in place:

- Schedule physically demanding tasks during cooler periods, typically before 11 a.m. and after 3 p.m. This can vary in extreme heat conditions or heat dome events, as late afternoon can be the hottest part of the day.

- Implement physical modifications to facilities, equipment and processes to minimize heat exposure. Employers should consider physical modifications to buildings, especially those without HVAC systems. Shade cloths are an option for greenhouses, and whitewashing concrete buildings can reduce sun exposure.

- Monitor on-site heat and humidity conditions regularly.Establish work-rest cycles and ensure workers are not working alone in high-temperature conditions. Rotate work activities or increase person power to reduce individual exposure and allow for adequate cooling breaks. Designate cooling areas with shade and ample water supply.

- Clothing choice is also critical. While protective gear like Tyvek suits may be necessary, breathable alternatives should be explored. Educate workers and first-aid attendants on heat stress symptoms.

Employers, co-workers, and first-aid attendants play a crucial role in keeping workers safe by knowing the signs of heat stress. “You don’t know when you’re being affected by heat stress, so work in pairs, and ensure your workers and colleagues know the signs,” says Nielsen. “It’s also critical to promote a culture where prompt reporting is encouraged.”

Symptoms include excessive sweating, fatigue, dizziness, headache, nausea, muscle cramps, rapid heartbeat, pale skin and fainting. Confusion is also a symptom that is often overlooked. In addition, heat can be dangerous no matter how familiar someone is with it. Don’t assume conditions are safe for workers who are used to hot conditions.

While extreme heat events like heat domes may not occur every summer in Canada, as extreme temperatures become the new normal, the risk of heat stress is constant. Integrating risk assessment and heat stress management into regular operations is essential for protecting agricultural and manufacturing workers in cannabis.

Alexandra Skinner is the manager of government and media relations at WorkSafeBC. WorkSafeBC engages workers and employers to prevent injury, disease and disability in B.C., serving 2.7 million workers and 280,000 employers across the province.

by Grow Up Conference | Jul 31, 2024 | Grow Opportunity, Media Partners

(CNW) Calgary – High Tide Inc., the high-impact, retail-forward enterprise built to deliver real-world value across every component of cannabis, announced today that its Canna Cabana retail cannabis stores located at 20 Douglas Woods Dr SE Calgary, Alberta, 3630 Brentwood Road NW Calgary, Alberta ,1729 Walkley Rd, Ottawa, Ontario, and 94 Highway 8, Stoney Creek, Ontario, will open tomorrow, bringing the number of High Tide’s Canna Cabana branded retail locations Canada-wide to 180, including 65 stores in the province of Ontario.

Alberta

Douglasdale is a well-established and mature neighbourhood in southeast Calgary. This new Canna Cabana will open in a previous retail cannabis store with an established customer base. Co-tenants include a pharmacy, a liquor store and a gas station, amongst other businesses. This location is highly visible from a major roadway through the community and is steps away from walking paths along the Bow River while boasting over 40,000 residents within a three-kilometer radius.

Situated in the northwest end of Calgary, Brentwood is a community featuring a mix of high-density multi-family units and single-family homes. Located in a major retail shopping plaza beside the University of Calgary, this new Canna Cabana opens in a retail unit previously leased by FOUR20 Cannabis, which has filed a notice of intention to make a proposal to their creditors. Anchor tenants include a major discount retailer, a Canadian grocery chain, and several quick-service restaurants. This new store also features excellent street visibility and a population density of over 56,000 in a three-kilometer radius.

Ontario

The Walkley store opening brings the total number of Canna Cabana locations in Ottawa, Canada’s capital city, to five. Situated in a large shopping plaza along a major roadway, this brand-new Canna Cabana is anchored by a discount grocery chain, a national pharmacy retail chain, and a major Canadian discount retailer. It is also located in the densely populated southeast end of Ottawa, with minimal competition and over 180,000 residents within a five-kilometer radius.

Located in the Hamilton suburb of Stoney Creek, this new Canna Cabana opens in a major power centre surrounded by internationally recognized discount retailers, a large provincial grocery store chain, as well as a national pharmacy chain and the provincial liquor retailer, amongst many other anchor tenants. It is the first Canna Cabana in Stoney Creek and is situated along a significant thoroughfare connecting it to the surrounding suburban communities, with over 100,000 residents within a five-kilometer radius.

“I can’t think of a better way to end our third fiscal quarter than by announcing the opening of four new Canna Cabanas, bringing our ever-expanding store count to 180 across Canada and 65 in Ontario. Many of these new stores are part of our organic expansion strategy, which includes onboarding proven locations previously run by competitors through lease takeovers, resulting in minimal store buildout costs. Since January 1, we have already added 18 new Cabanas to our retail portfolio and are confident that we will meet or exceed our previously communicated goal of adding 20 to 30 new locations this year,” said Raj Grover, founder and CEO of High Tide.

“Furthermore, I am thrilled that the majority of this growth has been funded through our strong free cash flow generation from current operations. This approach will propel our future organic growth which should help us continue an upward trajectory both in terms of our store count, but also with respect to overall Canadian retail market share,” added Mr. Grover.

Debt Financing Update

Regarding the debt financing announced by the company on June 13, 2024, the company continues to work towards resolving all remaining outstanding items and drawing the initial tranche as early as this week.

Employee Stock Options Grant

In addition, High Tide announces the grant of 204,000 incentive stock options to various employees, consultants and management of the Company. Each Option is exercisable at the closing price of the company’s common shares listed on the TSX Venture Exchange based on the last trading day immediately prior to this press release, which expires three years from the date of grant, and vests over a two-year period.

Each option is exercisable to purchase one common share of the company and are being issued pursuant to the terms of the company’s Omnibus Plan, which became effective on June 2, 2022.

by Grow Up Conference | Jul 31, 2024 | Media Partners, Stratcann

Health Canada plans to share a policy consultation document about health products containing cannabidiol (CBD) this fall. The agency has been working on the proposal since 2019.

In 2022, Health Canada also released a report on health products containing cannabis. In their Forward Regulatory Plan: 2024-2026, released earlier this year, Health Canada also said it intends to create a regulatory pathway for health products containing cannabidiol that would not require practitioner oversight.

The nine-person expert panel report in 2022 included recommendations for some very limited forms of therapeutic CBD use for both humans and some dogs.

The Cannabis Health Products Coalition (CHPC) has been advocating and holding Health Canada accountable for the creation of an additional pathway for the sale of cannabis health products (CHPs) through additional sales pathways that would include pharmacies, health food stores, and other stores.

Currently, Canadians can only access CBD products through Canada’s cannabis for medical use program, which only allows online sales, or through non-medical “recreational” stores where employees cannot discuss medical effects.

Deepak Anand, an industry consultant and advisory board member at the Cannabis Health Products Coalition (CHPC), argues that over-the-counter distribution of CBD products without THC could provide better access to these health products than the current distribution modes. The organization, Anand explains, has been actively lobbying for these changes for some time.

“There has long been a need for an additional pathway for Canadians to access relatively low-risk cannabinoid products such as CBD,” says Anand. “We’ve been advocating for the government to move forward creating a pathway for these products based on the recommendations issued by the Scientific Advisory Committee (SAC) in 2022, more than two years ago.”

In the June webinar held by the CHPC Coalition, the organization noted that it has been engaging with pharmacy groups who support the calls to allow for sales through pharmacies, stating that they have experience dealing with similar health products.

Danielle O’Beirne, who is also a part of the CHPC says she’s pleased to finally see some mention of this previous commitment, and would like to see concrete plans for what the regulations will look like and a timeline for implementation.

“From a pharmacy perspective, we already have all the framework in place for natural health products and prescription drugs. No reason to recreate the wheel here for CBD products, they can be distributed through the same channels.”

Related Articles

Recent Comments